What Happened?

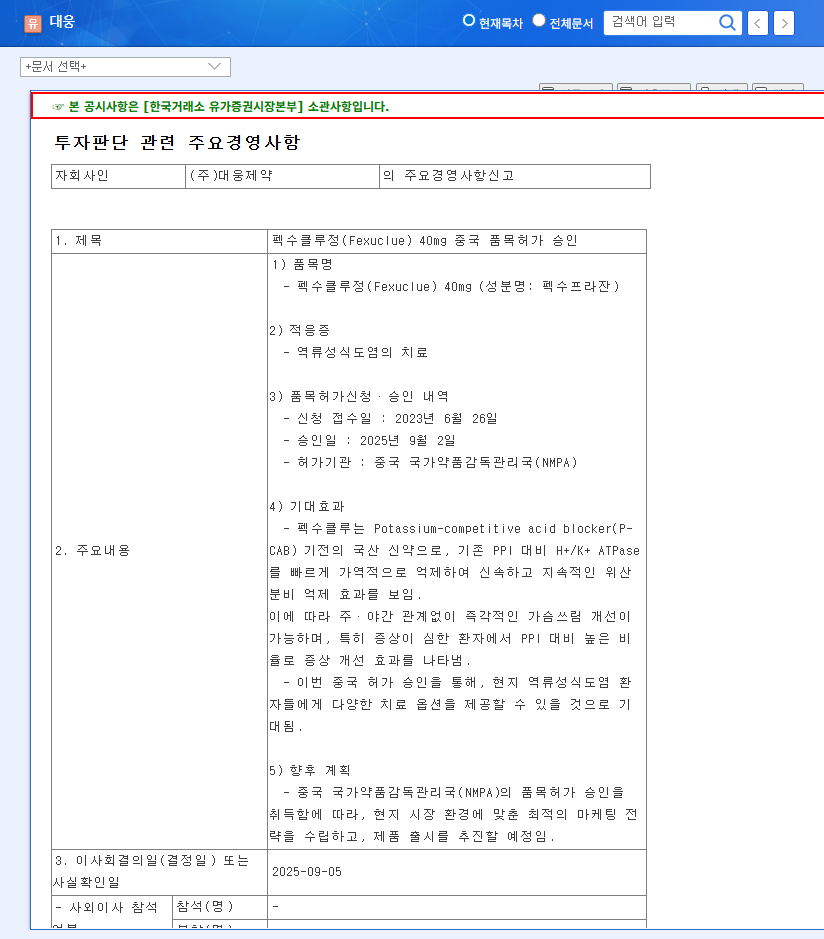

Daewoong Pharmaceutical’s ‘Fexuclue 40mg’, a treatment for gastroesophageal reflux disease (GERD), has received marketing authorization from China’s NMPA. This marks the first case of a Korean P-CAB-based new drug entering the Chinese market.

Why is it Important?

China is one of the largest pharmaceutical markets in the world. Fexuclue’s entry into China is expected to significantly contribute to Daewoong’s sales growth and profitability improvement. It will also demonstrate Daewoong’s new drug development capabilities and positively impact the company’s image.

- Sales Growth and Profitability Improvement: Expected explosive sales growth due to entry into a huge market.

- Strengthened New Drug Development Capabilities and Increased Pipeline Value: Demonstrates global competitiveness, positively impacting future drug development.

- Enhanced Corporate Image and Brand Value: Improves brand image as a successful overseas case of a domestic new drug.

What’s Next?

Daewoong is expected to focus on building local partnerships and establishing marketing strategies for successful market entry in China. A customized strategy considering the unique characteristics of the Chinese market is necessary, and efforts should be focused on securing market share through differentiation from competing products.

What Should Investors Do?

This marketing authorization is a positive signal, demonstrating Daewoong’s long-term growth potential. However, it may take time for actual sales to materialize, and there are risk factors such as market competition and regulatory changes. Therefore, it’s crucial for investors to closely monitor Daewoong’s China market entry strategy and performance trends before making investment decisions.

Frequently Asked Questions

What is Fexuclue?

Fexuclue is a new P-CAB-based drug used to treat gastroesophageal reflux disease (GERD). It shows faster onset of action and superior efficacy compared to existing PPI drugs.

What is the significance of obtaining marketing authorization in China?

China has a huge pharmaceutical market. Obtaining marketing authorization for Fexuclue in China is a significant step for Daewoong in increasing sales and expanding its global market.

What should investors be aware of?

It may take time for actual sales to materialize. It’s important to consider China’s competitive landscape and regulatory changes when making investment decisions.