1. What Happened? : PineMTech Acquires Vietnamese Firm

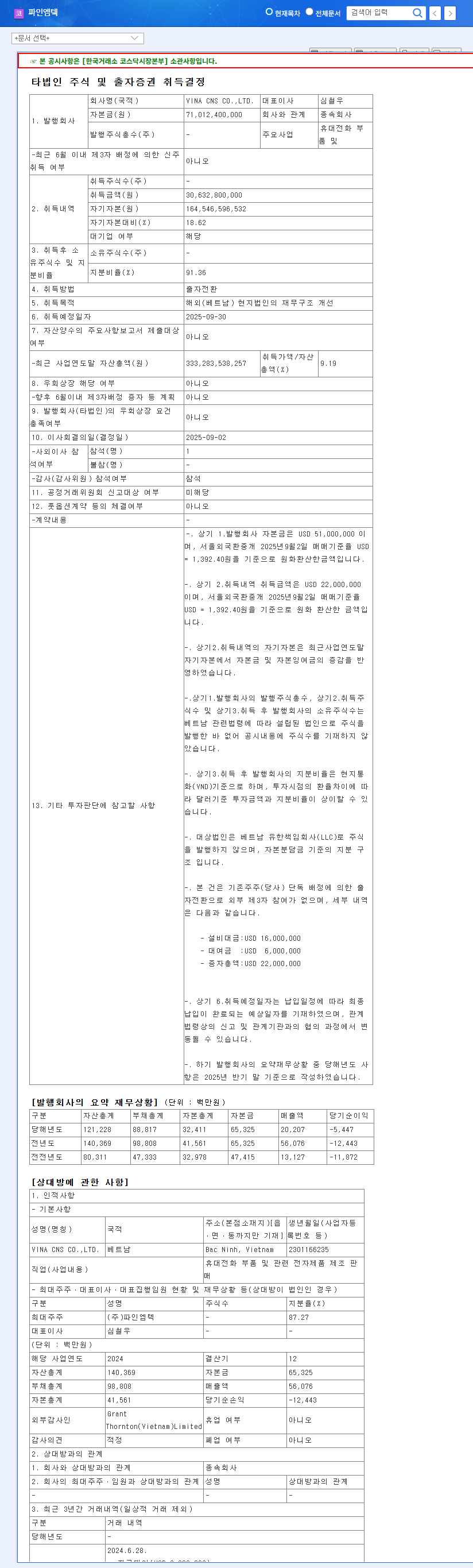

On September 2, 2025, PineMTech announced its decision to acquire a 91.36% stake in VINA CNS CO.,LTD., a Vietnamese company, for $30.6 billion. This represents 18.62% of PineMTech’s capital and will be completed through a debt-for-equity swap by September 30th. The official purpose of the acquisition is to improve the financial structure of the Vietnamese subsidiary.

2. Why the Acquisition? : Background and Hidden Implications

PineMTech’s performance in the first half of 2025 was weak due to the downturn in the foldable display component market and slowing growth in the EV/ESS component market. This acquisition can be interpreted as a strategic move to secure new growth engines. It’s likely a preemptive measure to secure an overseas base and diversify its business ahead of its entry into the U.S. medical device market in early 2026. However, the specific business of VINA CNS CO.,LTD. and its synergy with PineMTech’s existing business remain unclear, requiring further information.

3. What’s Next? : Impact on Investors

- Positive aspects: Improved financial structure of the subsidiary, potential entry into the Vietnamese market, and synergy with new businesses.

- Negative aspects: Increased financial burden, uncertainty of performance improvement, foreign exchange risk, and management risks.

4. Investor Action Plan: A Cautious Approach is Necessary

While the acquisition presents long-term growth potential, it also carries short-term financial burdens and uncertainty about performance improvement. Investors should consider the following information before making investment decisions:

- Detailed business and financial status of VINA CNS CO.,LTD.

- PineMTech’s financing plan and financial outlook.

- Connection with the medical device business.

Closely monitor the performance of VINA CNS CO.,LTD., PineMTech’s progress in the medical device business, and changes in exchange rates and macroeconomic indicators.

FAQ

What is the purpose of PineMTech’s acquisition of the Vietnamese firm?

The official purpose is to improve the financial structure of VINA CNS CO.,LTD. However, considering PineMTech’s recent underperformance, it is likely a strategic investment to secure new growth engines and diversify its business.

How will this acquisition affect PineMTech?

Positively, it can be expected to provide opportunities to enter overseas markets and create synergy with new businesses. On the other hand, negative impacts such as increased financial burden, uncertainty of performance improvement, and foreign exchange risk should also be considered.

What should investors be aware of?

Investors should carefully consider the investment after confirming additional information such as the specific business of VINA CNS CO.,LTD., its synergy with PineMTech, the financing plan, and financial soundness.