1. Lotte Chilsung Beverage IR: What’s it about?

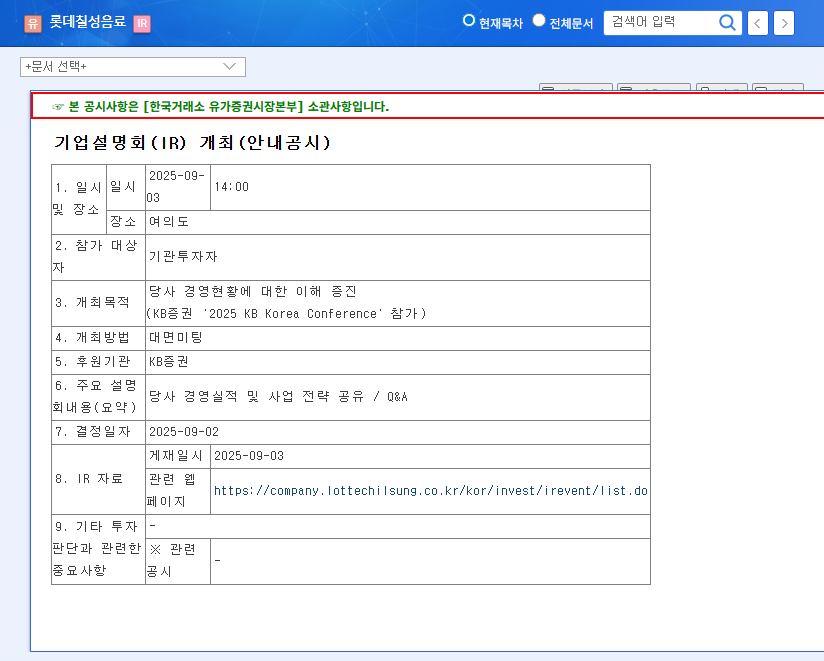

Lotte Chilsung Beverage will announce its current business status and future strategies at the KB Securities ‘2025 KB Korea Conference’ on September 3, 2025. Key topics are expected to include strengthening the zero-calorie and zero-sugar product lineup in line with the healthy pleasure trend, overseas expansion strategies, and ESG management activities.

2. Why is Lotte Chilsung Beverage holding this IR?

This IR is a crucial opportunity to emphasize growth momentum and address investor concerns following the first-half earnings announcement. With sluggish profit improvement due to rising raw material prices and intensifying competition, it’s vital for the company to clearly present its future growth strategies and profitability improvement plans to improve investor sentiment. Participating in the KB Securities conference also provides exposure to a wider investor base.

3. Post-IR Stock Outlook: What can we expect?

The IR has the potential to improve investor sentiment and positively impact the stock price. However, if the delivered message falls short of market expectations, there is a risk of a price decline. The medium to long-term stock performance will ultimately depend on the execution of the presented business strategies and the company’s ability to adapt to changes in the macroeconomic environment.

4. Investor Action Plan: What should you do?

- Review the IR results: Carefully analyze the information presented and the market’s reaction.

- Analyze earnings forecasts: Examine the guidance for the second half and full year to assess growth and profitability improvement.

- Monitor macroeconomic factors: Keep track of trends in exchange rates and raw material prices.

FAQ

When is the Lotte Chilsung Beverage IR?

It’s scheduled for 2 PM on September 3, 2025, at the KB Securities ‘2025 KB Korea Conference’.

What are the key topics of the IR?

The agenda includes the announcement of business performance, sharing of future business strategies, and a Q&A session with investors.

What is the expected impact of the IR on Lotte Chilsung’s stock price?

Positive messages could lead to a price increase, while failing to meet market expectations might cause a decline. The long-term performance will depend on the execution of strategies and the macroeconomic environment.