What Happened? Young Poong Paper Announces Rights Offering

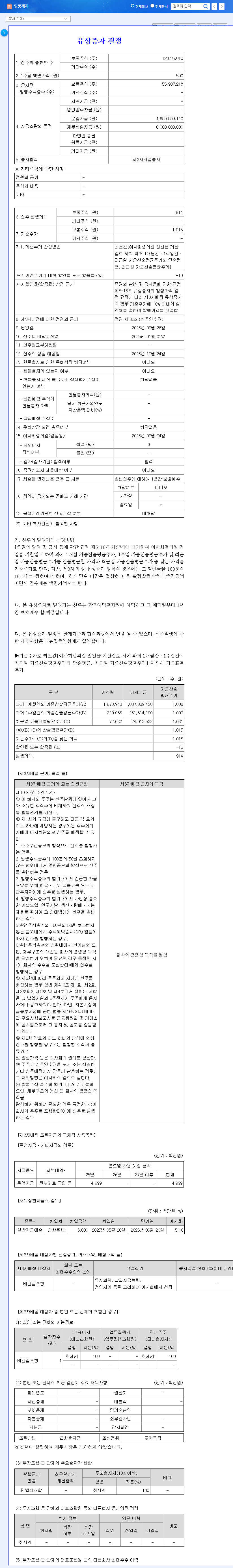

Young Poong Paper announced a third-party allocation rights offering of 12,035,010 shares (22% of total outstanding shares) on September 4, 2025. The payment date is September 26, the new share listing date is October 24, and the main investor is BNM Partnership.

What’s the Purpose and Background of the Rights Offering?

Young Poong Paper has faced challenges with declining sales and operating losses in the first half of the year. The funds secured through this rights offering are expected to be used for financial restructuring, operating funds, and investment in new drone-related businesses. This strategic decision can be seen as an attempt to secure financial stability and seek new growth engines, particularly within the paper industry’s challenging environment of rising wastepaper prices and stricter government regulations.

What are the Impacts of the Rights Offering?

- Positive Impacts: Improved financial structure, securing momentum for new business ventures.

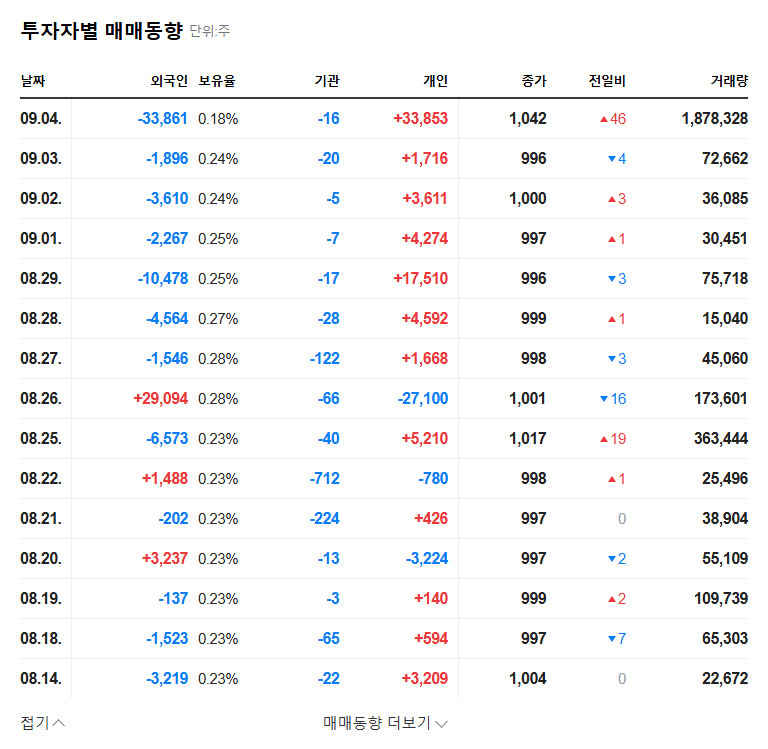

- Negative Impacts: Concerns about share dilution (offering price of 914 won, 22% offering ratio), potential negative market sentiment.

- Neutral Impacts: Changes in subsidiaries, macroeconomic variables (interest rates, exchange rates, raw material prices).

What Should Investors Do?

Investors should closely monitor the following:

- Monitoring the execution plan for the funds raised and the performance of new business investments.

- Checking future earnings announcements for sales recovery and improvement in profitability.

- Preparing for short-term stock price volatility and evaluating the long-term corporate value.

- Understanding the competitive landscape of the paper industry and the volatility of raw material prices.

In conclusion, while Young Poong Paper’s rights offering presents potential for long-term growth, caution is warranted regarding short-term stock price fluctuations. Investors should monitor the company’s subsequent announcements and market conditions to make informed investment decisions.

Frequently Asked Questions (FAQ)

What is a rights offering?

A rights offering is a way for a company to raise capital by issuing new shares. Existing shareholders and new investors can purchase these shares.

What is the purpose of Young Poong Paper’s rights offering?

This rights offering aims to raise funds for financial restructuring, secure operating funds, and invest in new businesses, specifically drone-related projects.

How does a rights offering affect stock prices?

Generally, a rights offering can lead to share dilution due to the increased number of shares, potentially causing a short-term decline in stock price.

What should investors be aware of?

Investors should carefully consider the company’s plans for utilizing the raised funds, future earnings trends, the competitive market environment, and be prepared for potential short-term stock price volatility.