1. What Happened?: NPS Increases Stake and Changes Investment Objective in Hanwha Aerospace

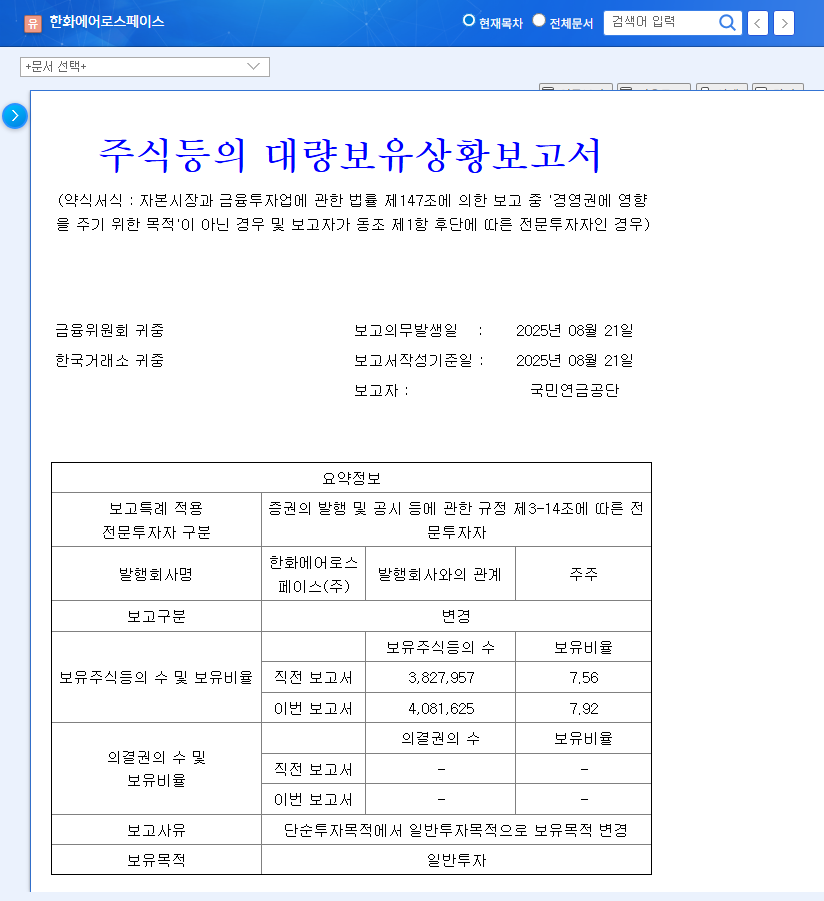

On August 27, 2024, the NPS increased its stake in Hanwha Aerospace from 7.56% to 7.92% and changed its investment objective from ‘passive investment’ to ‘general investment’.

2. Why?: The Background of NPS’s Decision

This move by the NPS is interpreted as a positive assessment of Hanwha Aerospace’s growth potential. Its robust marine/defense business, a substantial order backlog of KRW 133.66 trillion, and the future growth engine of the aerospace business are likely factors that influenced NPS’s investment decision.

3. So What?: Improved Investor Sentiment and Expected Stock Price Increase

NPS’s stake increase can act as a positive signal to investors, improving investor sentiment and providing momentum for a stock price increase. Furthermore, the shift to general investment suggests the NPS’s potential for more active participation in enhancing corporate value as a shareholder, raising expectations for long-term growth.

- Positive Aspects: Improved investor sentiment, efforts to enhance corporate value, increased trust from institutional investors

- Points to Consider: Potential conflicts due to management participation, short-term stock price volatility, exchange rate and interest rate fluctuation risks

4. Investor Action Plan: Thorough Analysis and Prudent Investment

While there is a possibility of a short-term stock price increase, thorough company analysis is essential before making investment decisions. It is important to make prudent investment decisions by monitoring changes in the macroeconomic environment, the company’s fundamentals, and the future actions of the NPS. Especially, the high debt ratio needs continuous monitoring.

Frequently Asked Questions

What does the NPS’s shift to ‘general investment’ mean?

It means they can exercise more active shareholder rights than with passive investment. It increases the possibility of contributing to enhancing corporate value through participation in management and shareholder proposals.

What is the future stock price outlook for Hanwha Aerospace?

While the NPS’s investment is a positive sign, the stock price can fluctuate depending on various factors such as macroeconomic conditions, company fundamentals, and management strategies. Careful analysis is needed.

What are the precautions for investment?

Investors should carefully check the risk factors the company has, such as high debt ratio, exchange rate and interest rate volatility, before making investment decisions.