1. LCB97 Milestone Payment: What Happened?

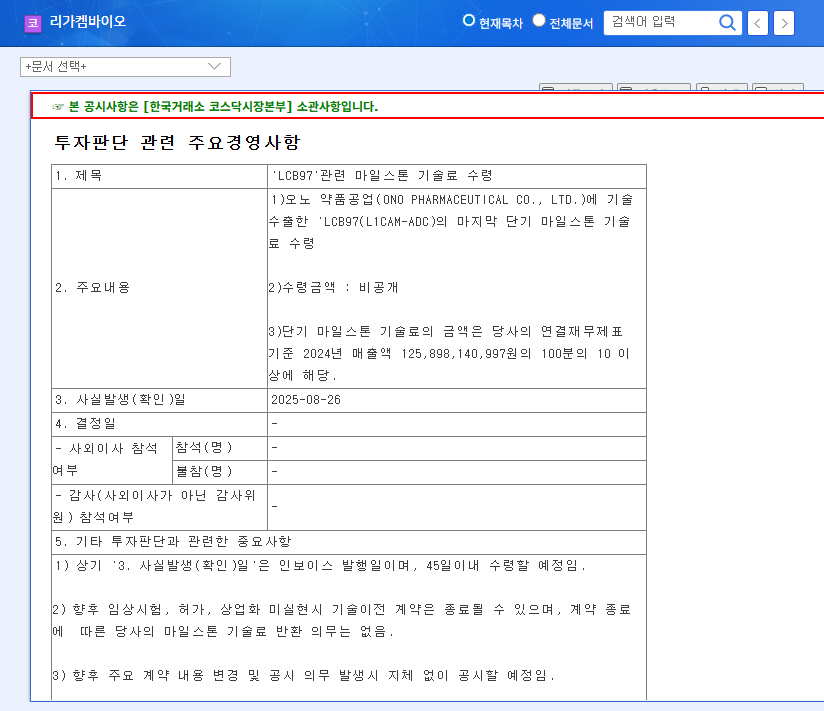

Ligand Pharmaceuticals received the final short-term milestone payment related to LCB97 (L1CAM-ADC), which was licensed to Ono Pharmaceutical. While the exact amount remains undisclosed, it is estimated to be over 10% of Ligand’s 2024 revenue.

2. Why is it Important?: Fundamental and Market Expectation Analysis

This milestone payment has a significantly positive impact on Ligand’s fundamentals. It directly contributes to increased revenue and improved profitability, while also reaffirming the value of the ADC pipeline and providing positive momentum for future licensing and negotiations. Furthermore, it is expected to strengthen financial soundness, secure R&D investment capacity, and improve investor sentiment. Considering the high growth potential of the ADC market and Ligand’s technological prowess, the market views this news positively, and based on past licensing and milestone achievements, there is a high probability of a stock price increase.

3. So What Should We Do?: Investment Implications

This milestone payment enhances the investment appeal of Ligand Pharmaceuticals. Short-term stock price momentum can be expected, and long-term growth potential is also likely to be strengthened. However, potential risks, such as the uncertainty due to the undisclosed payment amount and the need to secure continuous revenue sources, should also be considered. Therefore, investors should continuously monitor the development status and performance of other ADC pipelines besides LCB97 and make prudent investment decisions.

Q: How will the LCB97 milestone payment affect Ligand’s stock price?

A: It is highly likely to provide short-term upward momentum for the stock price. In the long term, it is expected to further strengthen the company’s growth story through the successful development and commercialization of the ADC pipeline.

Q: What is ADC, Ligand’s core technology?

A: ADC (Antibody-Drug Conjugate) is a technology that combines antibodies and drugs to target and treat cancer cells. It is attracting attention as the next-generation anticancer drug due to its high therapeutic effect and low side effects.