1. LG Chem IR: What to Expect

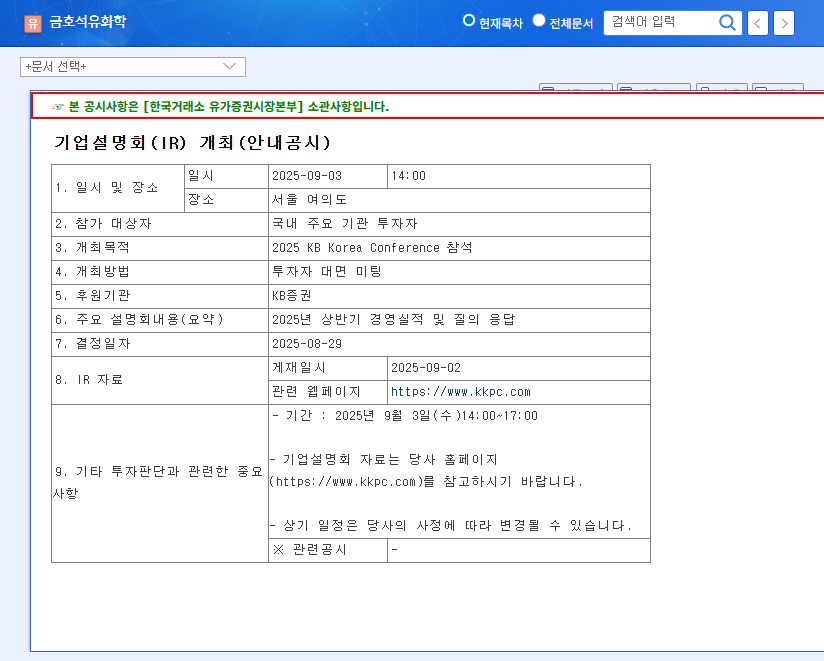

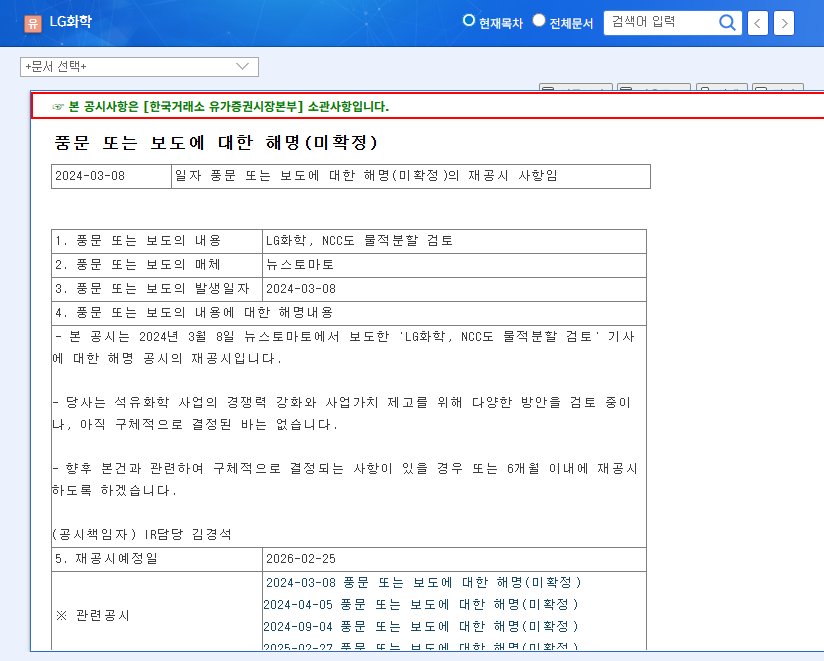

LG Chem’s IR session on September 8th will address the company’s performance, current management status, and future strategies. The market anticipates clear explanations regarding future prospects for LG Energy Solution and concrete strategies for future growth drivers like advanced materials and life sciences, especially in the context of the underperforming petrochemical sector.

2. Why is this IR Important?

This IR presents a crucial opportunity to understand the direction of LG Chem at a critical juncture. Key points to watch include turnaround strategies for the petrochemical division, the advanced materials division’s response to the IRA policy and client inventory management, and updates on the life sciences R&D pipeline. The continued growth of LG Energy Solution and the presentation of strategies to strengthen the competitiveness of LG Chem’s core businesses will also significantly influence investor sentiment.

3. Key IR Analysis and Investor Action Plan

- Petrochemicals: Focus on concrete implementation plans and expected outcomes of the turnaround strategy. The progress of transitioning to high-value-added products and sustainable businesses, along with strategies for managing external risks such as fluctuations in international oil prices and exchange rates, are crucial.

- Advanced Materials: Pay attention to the continued growth potential of the EV and IT industries, and LG Chem’s strategies for navigating short-term volatility stemming from the IRA policy changes and client inventory management. The strategy of strengthening the portfolio with high-value-added products and its results will be key.

- Life Sciences: Look for updates on the progress of the innovative drug development pipeline and the sustainable growth potential of key products.

- LG Energy Solution: Examine the continued growth potential of the EV and ESS markets, and strategies to address increasing competition.

- Financial Status: Analyze the company’s financial risk factors, including the continued deficit in the petrochemical division, increasing debt, and expansion of investments, and understand LG Chem’s financial soundness management plan. The impact of macroeconomic variables such as exchange rates, interest rates, and oil prices, as well as the company’s risk management strategy, are also critical factors.

4. Short-term/Mid-to-Long-term Investment Strategies

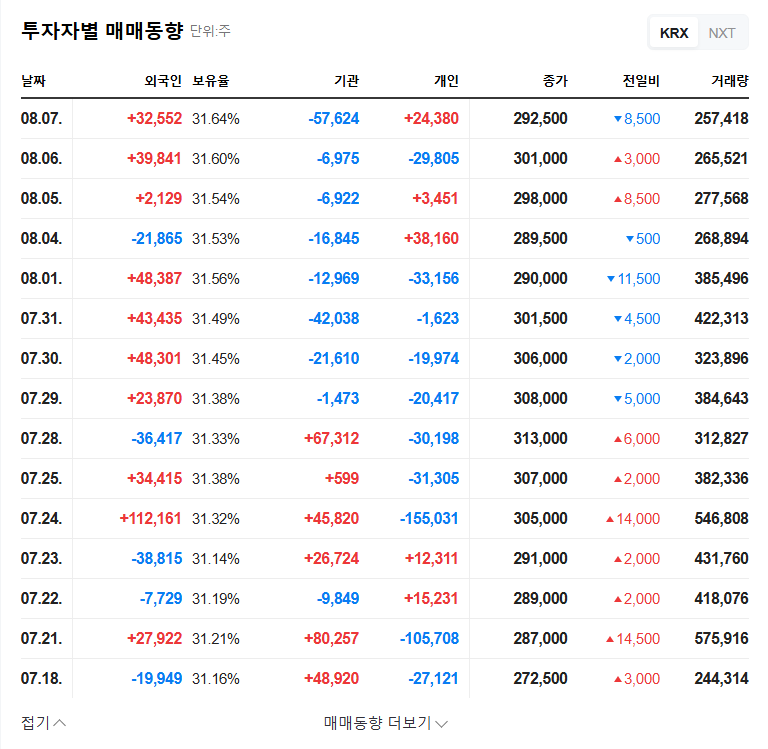

- Short-Term: Carefully analyze the IR announcements and market reactions to adjust investment strategies. Positive announcements could create upward momentum for the stock price, but the possibility of a decline should also be considered if the announcements fall short of expectations.

- Mid-to-Long-Term: Continuously monitor the continued growth of LG Energy Solution, profitability improvements in petrochemicals and advanced materials, and R&D achievements in life sciences. Macroeconomic variables and the company’s risk management capabilities are also important investment criteria.

FAQ

What are the key takeaways to watch for in LG Chem’s IR?

Key areas of focus include the petrochemical turnaround strategy, growth strategies for advanced materials and life sciences, the outlook for LG Energy Solution, and financial status and risk management plans.

What is the expected impact on LG Chem’s stock price?

Short-term volatility is expected depending on the content of the IR. In the mid-to-long term, factors like profitability improvement in petrochemicals and advanced materials, R&D achievements in life sciences, and the growth of LG Energy Solution will influence the stock price.

What precautions should investors take?

Investors should carefully analyze the IR content and establish short-term/mid-to-long-term investment strategies. Consider macroeconomic variables and the company’s risk management capabilities.