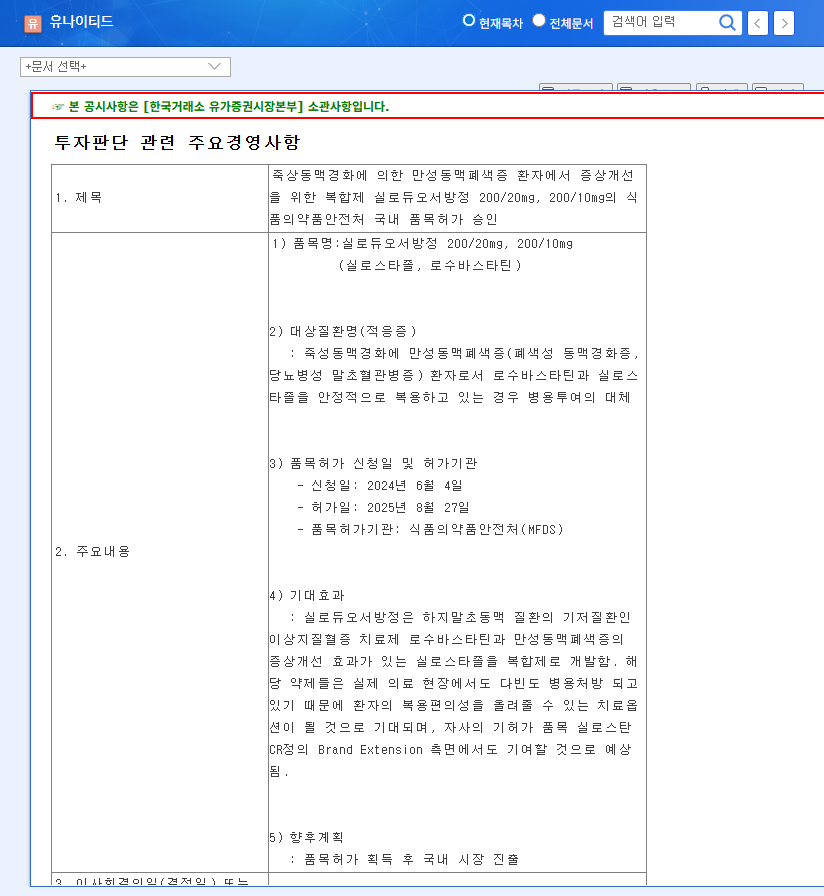

1. What Happened?

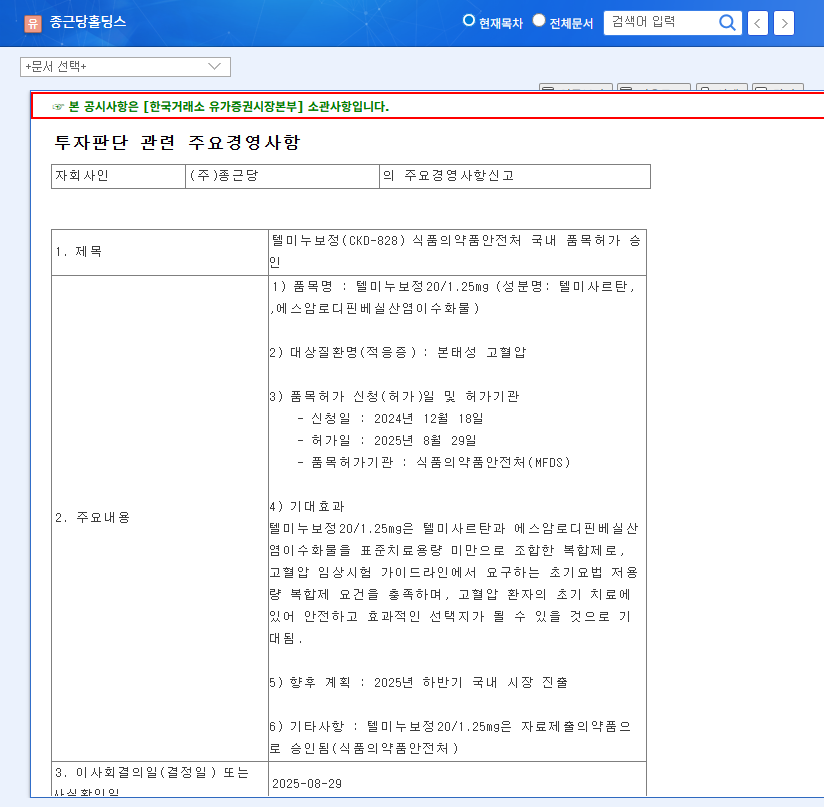

On August 29, 2025, Chong Kun Dang received domestic approval for its new hypertension combination treatment, Telminuvo. This is a significant event, strengthening Chong Kun Dang’s cardiovascular disease treatment lineup and securing a new revenue stream.

2. Why Is It Important?

Telminuvo’s approval signifies more than just a new product launch. Firstly, it can increase the corporate value of Chong Kun Dang Holdings by creating new revenue and securing a growth engine. Secondly, it demonstrates Chong Kun Dang’s R&D capabilities, raising expectations for future pipeline expansion. Thirdly, it enables the company to target the competitive hypertension treatment market with a differentiated low-dose combination therapy.

3. What’s Next?

Telminuvo is scheduled for launch in the second half of 2025. Its success will depend on various factors, including differentiation from competing products, effective marketing strategies, and pricing and insurance coverage. A key factor will be how quickly it can gain market share in the highly competitive hypertension treatment market.

4. What Should Investors Do?

Telminuvo’s approval offers positive investment momentum, but risks also exist. Careful consideration should be given to intensifying competition, drug pricing policies, and past issues related to Kyungbo Pharmaceutical. Before making investment decisions, it’s crucial to closely monitor Telminuvo’s market launch performance, insurance coverage decisions, and market share acquisition strategies compared to competitors.

What is Telminuvo?

Telminuvo is a combination drug for treating hypertension, developed by Chong Kun Dang. It consists of telmisartan and amlodipine besylate dihydrate and meets the requirements for a low-dose combination therapy for initial treatment.

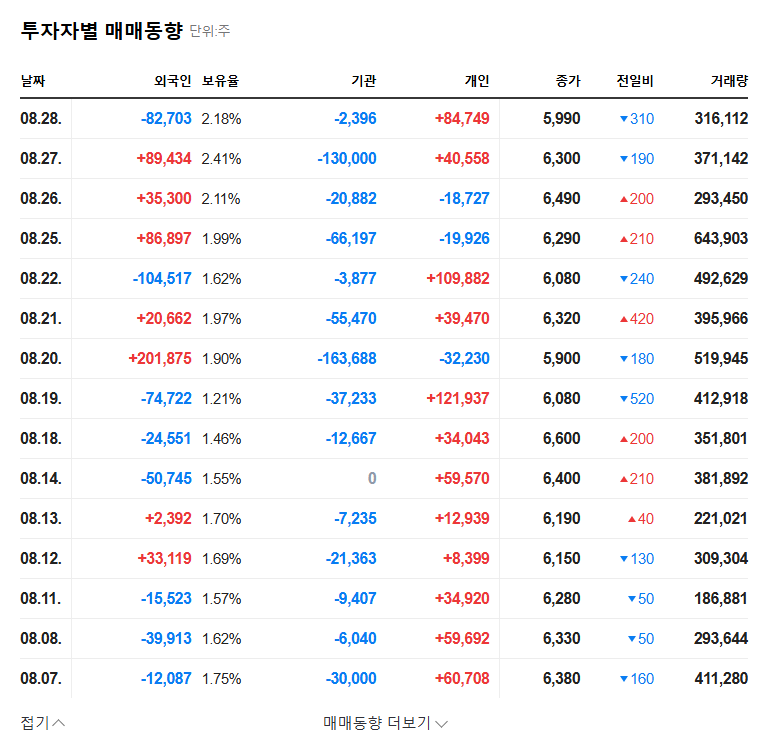

How will Telminuvo’s approval affect Chong Kun Dang Holdings’ stock price?

It is likely to act as a positive momentum in the short term, but the long-term impact will depend on actual sales contributions and market response.

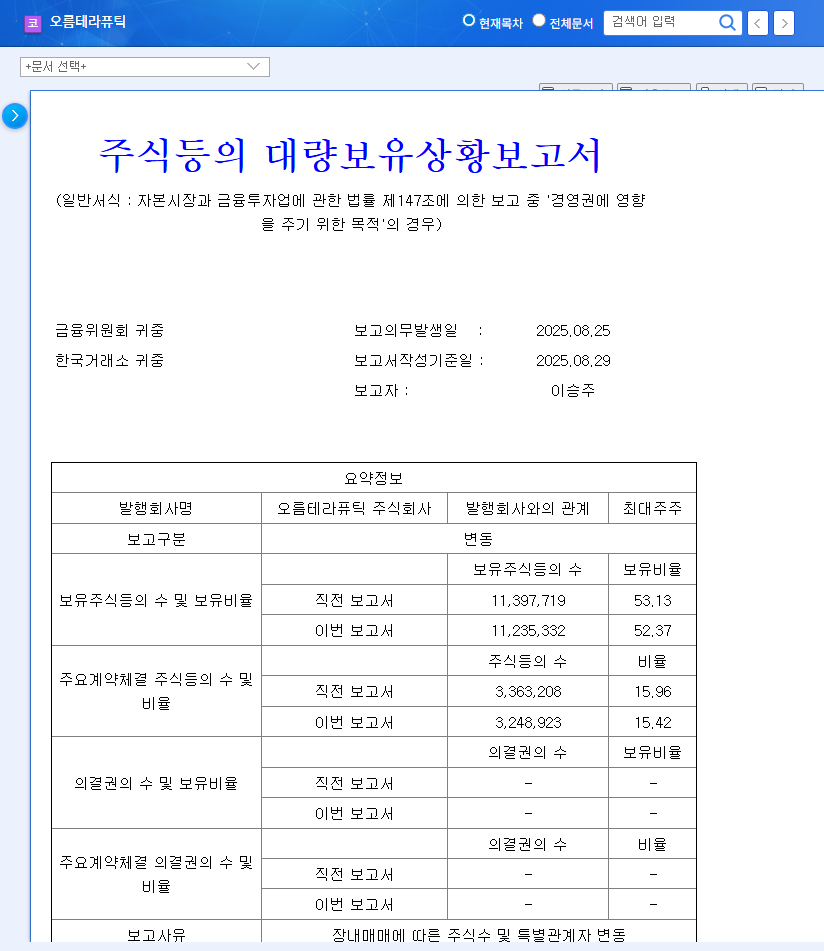

What are the key considerations for investors?

Investors should consider the intensifying competition in the hypertension treatment market, drug pricing policy variables, and past issues related to Kyungbo Pharmaceutical. Continuous monitoring of market share, insurance coverage, and other factors after launch is crucial.