Buhwang Pharmaceutical Poised to Unveil 1H 2025 Performance and R&D Status

On July 16, 2025, Buhwang Pharmaceutical announced the upcoming Investor Relations (IR) event for the presentation of its 2025 first-half financial results and R&D progress. The briefing is scheduled for July 22, 2025, at 3:30 PM. This IR event is anticipated to have a significant impact on the stock price and fundamental outlook of Buhwang Pharmaceutical, a company with a market capitalization of approximately KRW 242.3 billion.

Will First-Half Results Continue the Q1 Momentum?

According to the recently released Q1 2025 report, Buhwang Pharmaceutical achieved positive results with increased revenue and a turnaround in operating profit. However, the continued net loss remains a challenge to be addressed. High research and development expenses and the sluggish performance of some subsidiaries are factors contributing to concerns about long-term growth.

The 2025 first-half results to be announced at this IR will provide crucial insights into how these trends continue:

- Sustainability of revenue growth

- Expansion of operating profit surplus

- Potential for resolving net loss

New Drug Pipelines: The Key to Success

It is no exaggeration to say that Buhwang Pharmaceutical’s long-term growth engine relies on its new drug development pipelines. While the successful launch of Latuda is a positive short-term factor, the success of other new drug development pipelines will ultimately determine its true growth potential.

The following R&D-related information will be of key interest to the market during the IR:

- Specific progress of research and development pipelines (e.g., JM-010, CP-012)

- Announcement of clinical trial results for new drug pipelines

- Possibility of major pipeline development stages being ahead of schedule

This information will shape market expectations and directly influence stock price movements.

Subsidiary Performance: Strengthening the Overall Fundamentals

The performance improvement of Buhwang Pharmaceutical’s subsidiaries is also a crucial analysis point. News of improved subsidiary performance can strengthen Buhwang Pharmaceutical’s overall fundamentals, enhance market credibility, and positively impact the stock price. Conversely, worsening subsidiary performance can heighten concerns about financial soundness and lead to a stock price decline.

Anticipated Impacts by IR Announcement Content

The following positive or negative impacts can be anticipated based on the IR presentation:

Positive Impacts:

- Improved Half-Year Performance: If the positive trend from Q1 extends throughout the first half, leading to revenue growth and a return to net profit, a stock price increase can be expected.

- Positive R&D Progress: Favorable announcement of clinical trial results for new drug pipelines or earlier-than-expected progression of major pipeline development stages is likely to boost market expectations and lead to a stock price rise.

- Improved Subsidiary Performance: News of improved performance from subsidiaries will strengthen Buhwang Pharmaceutical’s overall fundamentals, enhance market credibility, and positively affect the stock price.

Negative Impacts:

- Continued Weak Performance: If results similar to or worse than Q1 are announced, a stock price decline is anticipated. A continued or widening net loss would have a significant negative impact.

- R&D Failure News: Announcements of clinical trial failures or development delays for new drug pipelines will significantly lower market expectations and trigger a stock price drop.

- Worsening Subsidiary Performance: Further deterioration in subsidiary performance or the occurrence of additional losses will increase concerns about Buhwang Pharmaceutical’s financial health and lead to a stock price decline.

External Factor Analysis: Exchange Rates, Interest Rates, Commodity Prices, Global Economy

External factors that could influence Buhwang Pharmaceutical’s performance and stock price include:

- Exchange Rates: The recent trend shows a slight decline in the KRW/USD exchange rate, while the KRW/EUR exchange rate is on an upward trend. This could have a mixed impact on imported raw material costs and the performance of overseas subsidiaries.

- Interest Rates: US benchmark interest rates remain high, while Korean benchmark interest rates have been slightly lowered. These interest rate differentials can affect Buhwang Pharmaceutical’s financing costs and investment decisions.

- Commodity Prices: Crude oil prices have been volatile recently, while gold prices have remained relatively stable. An increase in crude oil prices could lead to higher production costs and reduced profitability.

- Global Economy: A decline in the China Containerized Freight Index suggests a potential global economic slowdown, which could lead to reduced demand for pharmaceuticals and negatively impact Buhwang Pharmaceutical’s revenue growth.

Investment Strategy: A Prudent Approach Post-IR

Buhwang Pharmaceutical’s IR event will serve to confirm market expectations regarding its 2025 first-half results and R&D progress, significantly influencing its stock price. It is crucial to make investment decisions prudently, considering the positive and negative aspects highlighted in the Q1 report, subsidiary performance, new drug development status, and external environmental factors.

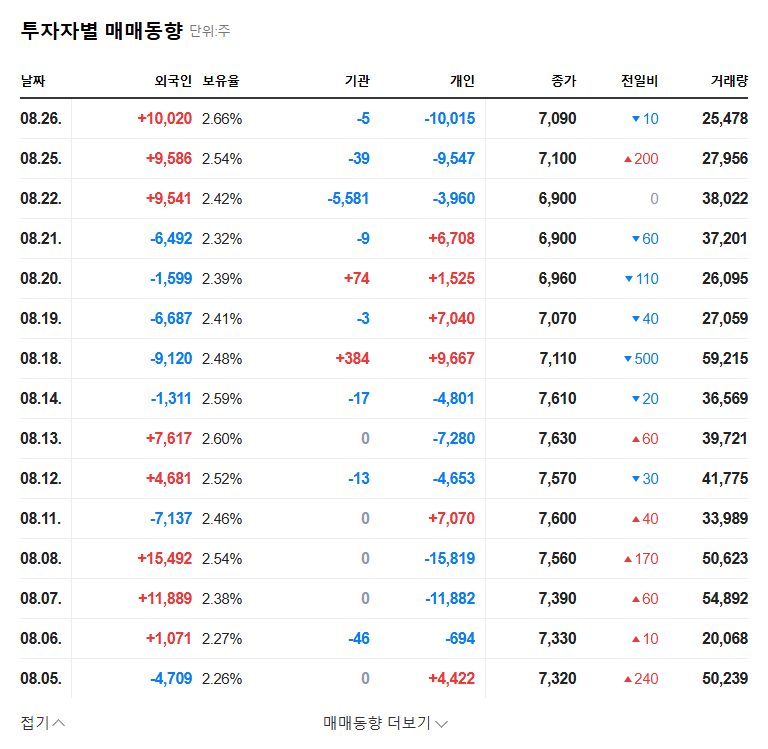

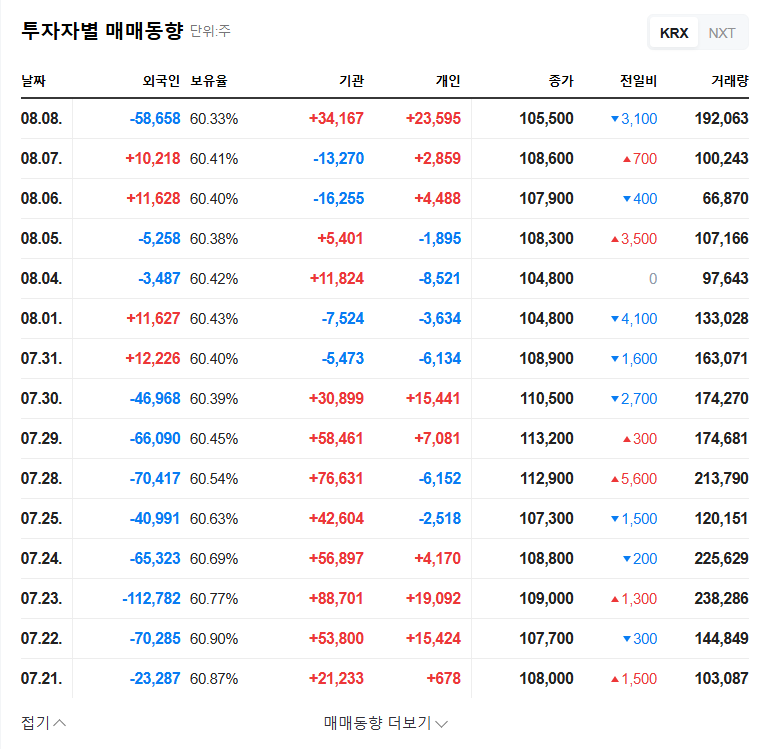

The provided stock price chart includes long-term data, limiting its predictive power for short-term price fluctuations. It is advisable to modify your investment strategy based on further analysis after the IR. Additionally, analyzing recent stock price movements and trading volume data alongside will provide more accurate insights.