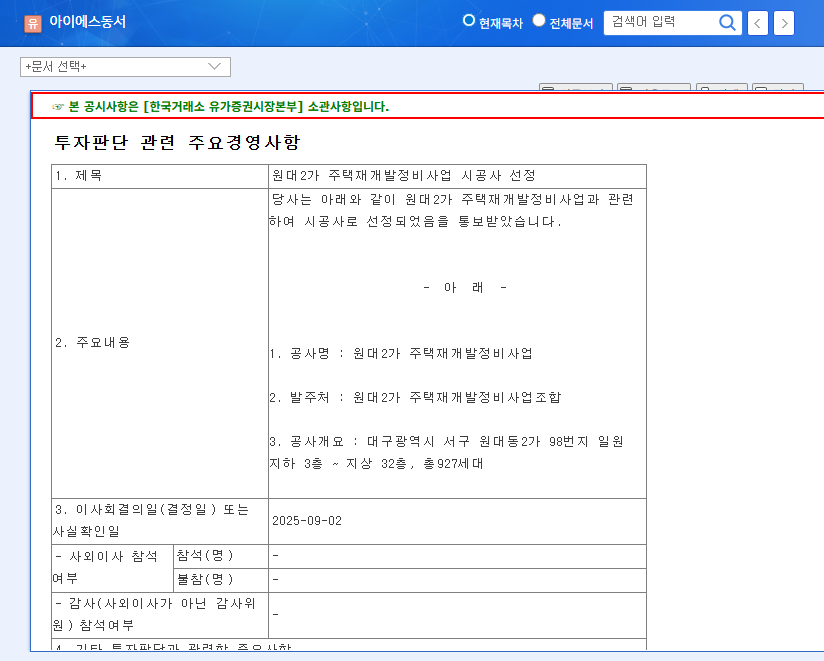

1. IS Dongseo Wins Wondae-2 Redevelopment Project: What Does It Mean?

IS Dongseo was selected as the contractor for the Wondae-2 residential redevelopment project (927 units) in Daegu on September 2nd. This contract is welcome news for IS Dongseo, which has been facing challenges due to the recent downturn in the construction market.

2. Why is it Important? – Fundamental Impact Analysis

Positive Aspects

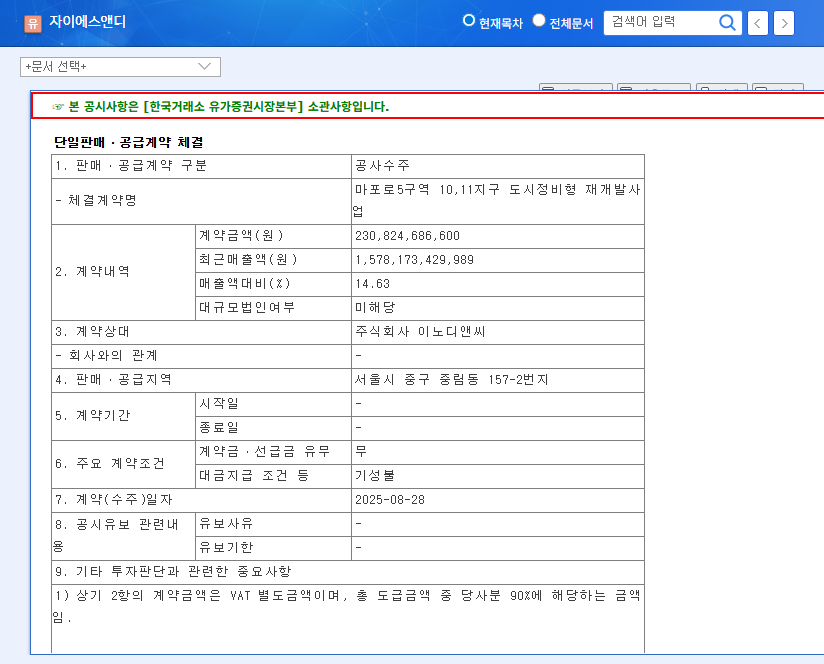

- • Expected improvement in sales and profitability through securing new orders in the construction sector

- • Potential for business expansion in the Daegu area and further order opportunities

- • Contribution to long-term financial stability

- • Improved investor sentiment and potential stock price momentum

- • Expected synergy with the battery recycling business

Negative/Limited Aspects

- • Limited impact on short-term earnings

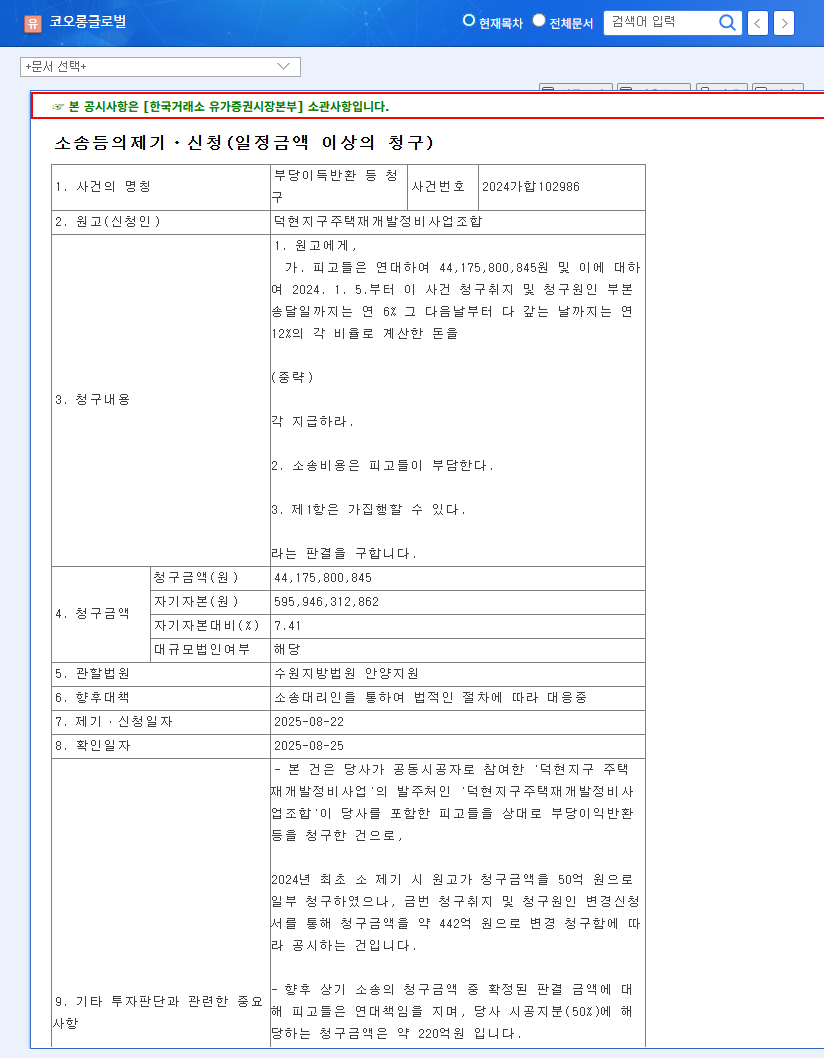

- • Continued downturn in the construction market and PF risks

- • Difficulty in securing profitability due to intensified competition in the construction industry

3. So, What Should We Do? – Investment Strategy

Short-term Investment

New orders can have a positive impact on stock prices in the short term, but it may take time for earnings to improve. Short-term investors should be mindful of market sentiment and stock price volatility.

Mid- to Long-term Investment

IS Dongseo’s mid- to long-term investment value depends on the growth of the battery recycling business, the recovery of the construction sector’s profitability, and its ability to manage financial risks. While this contract is a positive sign, continuous monitoring is necessary.

Key Monitoring Points

- • Trends in additional construction project orders

- • Performance and profitability of the battery recycling business

- • Interest rate fluctuations and PF risk management

- • Changes in the macroeconomic environment (interest rates, exchange rates)

FAQ: Investing in IS Dongseo – What are your questions?

Q: What are IS Dongseo’s main businesses?

A: IS Dongseo engages in construction, concrete, environment, and battery recycling businesses. Recently, they have been focusing on investments in the battery recycling business as a future growth engine.

Q: How will this redevelopment project contract affect IS Dongseo’s stock price?

A: In the short term, there is a possibility of improved investor sentiment and a rise in stock price. However, the long-term impact depends on the recovery of the construction market and the growth of the battery recycling business.

Q: What are the key points to watch out for when investing in IS Dongseo?

A: The downturn in the construction market, high debt levels, and PF-related risks are investment risk factors. It is also essential to continuously monitor the performance and profitability improvement trend of the battery recycling business.