1. What Happened?

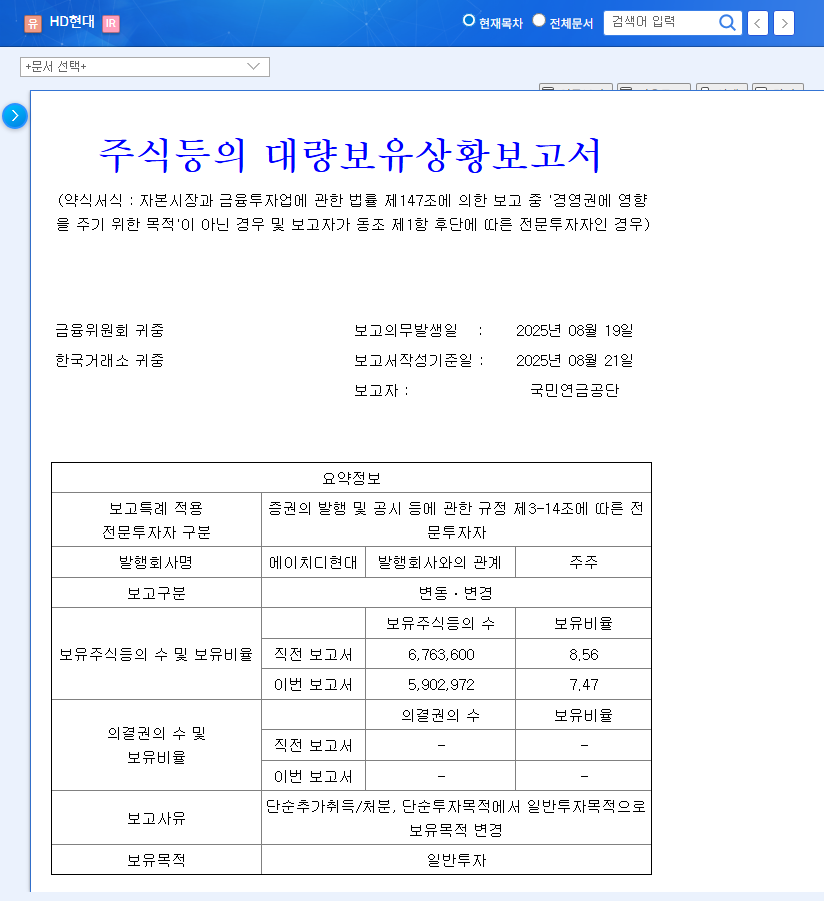

NPS reduced its stake in HD Hyundai from 8.56% to 7.47%, a 1.09% decrease. It also changed its holding purpose from simple investment to general investment. This suggests a portfolio adjustment or a shift in NPS’s investment strategy.

2. Why This Decision?

The exact reasons for NPS’s sale are undisclosed. However, typical reasons include portfolio diversification, risk management, and exploring other investment opportunities. Recent risk factors, such as HD Hyundai Oilbank’s lawsuit related to environmental law violations, might have been considered.

3. So, What’s HD Hyundai’s Future?

In the short term, the news of NPS’s sale could put downward pressure on the stock price. However, HD Hyundai maintains stable growth through a diverse business portfolio, including shipbuilding, refining, and construction equipment. It’s also actively investing in eco-friendly technologies and expanding into new businesses. Therefore, in the medium to long term, a positive outlook can be expected based on solid fundamentals and growth potential. External factors, such as the global economic slowdown, geopolitical risks, and fluctuations in exchange rates and oil prices, require continuous monitoring.

4. What Should Investors Do?

Rather than focusing solely on NPS’s stake change, investors should consider a comprehensive view of HD Hyundai’s performance in each business sector, its achievements in new businesses, and changes in macroeconomic indicators. It’s essential to make investment decisions based on the company’s fundamentals and long-term growth potential, rather than being swayed by short-term stock price fluctuations. Monitoring HD Hyundai’s future announcements, management activities, and the movements of other institutional investors is crucial for adjusting investment strategies.

Is NPS selling HD Hyundai shares a bad sign?

While it might negatively impact the stock price in the short term, HD Hyundai’s fundamentals and growth potential are more crucial in the long run.

Is it okay to invest in HD Hyundai?

HD Hyundai possesses a diverse business portfolio and growth potential. However, thorough company analysis and market research are essential before investing.

What is the outlook for HD Hyundai’s stock price?

The stock has high growth potential based on positive fundamentals, but volatility is possible due to changes in the global economy and industry environment.