1. What Happened? : Divestiture of Ilkwang E&C

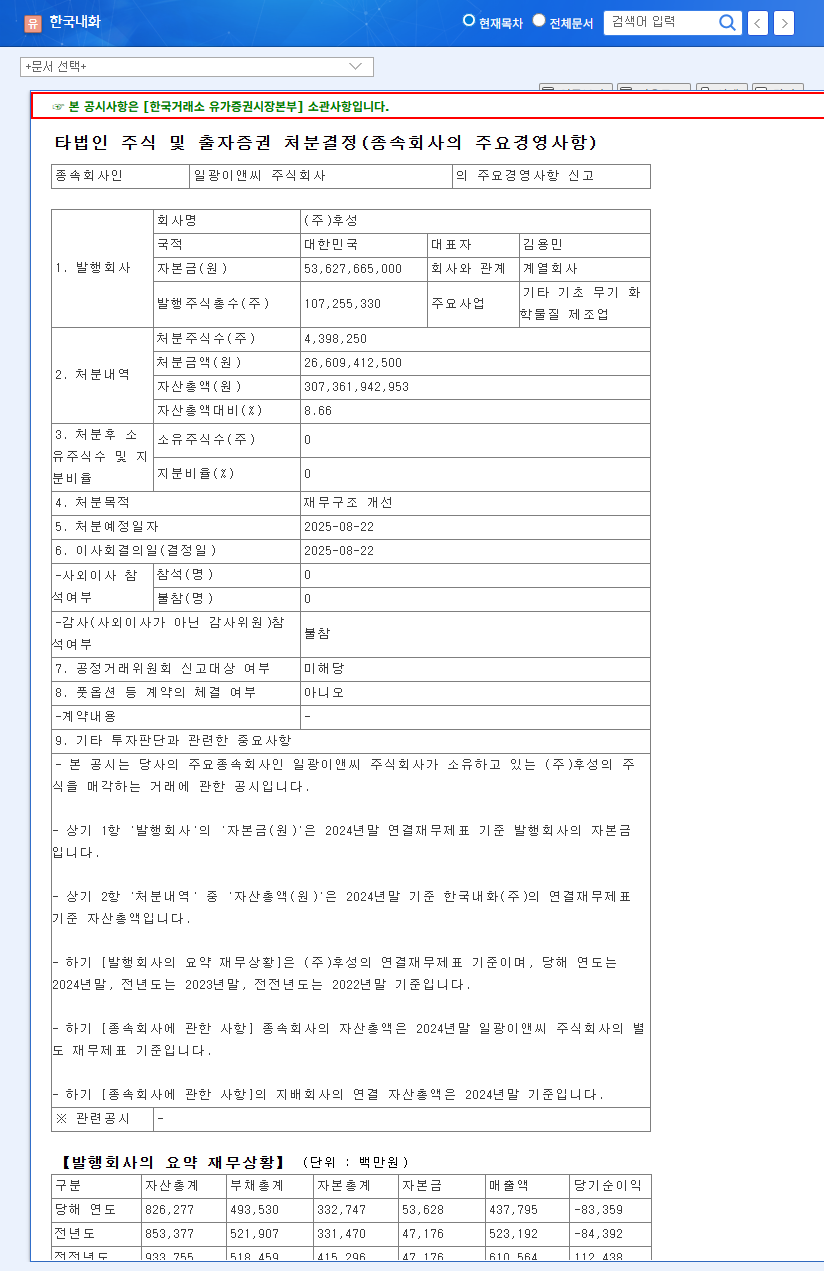

On August 25, 2025, Korea Refractories announced the sale of its 100% stake in Ilkwang E&C to Hoosung for 26.6 billion KRW. Consequently, Ilkwang E&C will be removed from Korea Refractories’ consolidated financial statements.

2. Why the Divestiture? : Strengthening Financials and Mitigating Risk

Korea Refractories has been facing financial challenges due to recent underperformance and lawsuits. Ilkwang E&C, in particular, has been a burden due to increasing losses stemming from the construction industry downturn and ongoing litigation. This divestiture is expected to improve Korea Refractories’ debt-to-equity ratio and boost liquidity. It also allows the company to shed the financial risks associated with the underperforming subsidiary and focus on its core refractories business.

3. What’s Next? : Analyzing Stock Price Implications

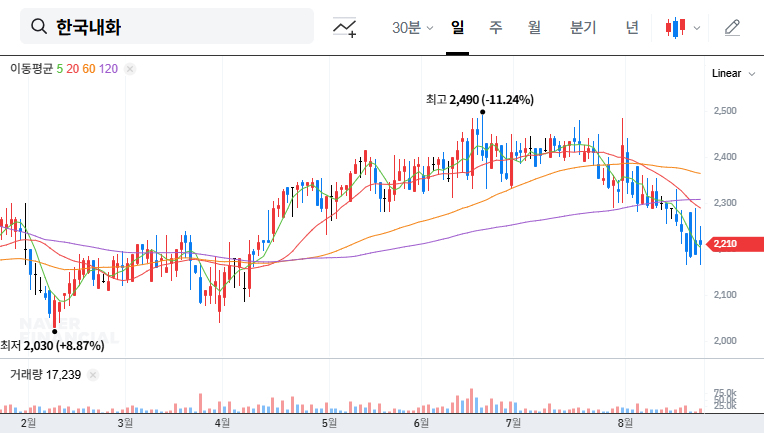

The divestiture could have both positive and negative short-term impacts on the stock price. While the anticipated financial improvements could drive the price up, concerns about revenue decline due to the loss of Ilkwang E&C’s contributions could put downward pressure on the stock. The mid-to-long-term impact will depend on how Korea Refractories utilizes the proceeds from the sale and whether its core refractories business improves. The success of its new ventures in IT and big data will also be a key factor.

4. What Should Investors Do? : Action Plan

- Short-term Investors: Can consider short-term trading strategies during periods of increased stock volatility. However, proceed with caution due to the high risk involved.

- Mid-to-Long-term Investors: Carefully monitor Korea Refractories’ performance post-divestiture, the use of proceeds, and the performance of the core refractories business and new ventures before making investment decisions.

- All Investors: Keep a close eye on macroeconomic indicators such as raw material prices and exchange rate fluctuations.

Frequently Asked Questions

Is the divestiture of Ilkwang E&C positive for Korea Refractories’ stock price?

In the short term, it could be positive due to anticipated financial improvements. However, in the long term, it could be negative due to potential revenue decline. The use of the proceeds and the performance of the core business are crucial factors.

What is the outlook for Korea Refractories?

The future of Korea Refractories hinges on strengthening its competitiveness in the refractories business and the success of its new ventures. Currently, the outlook is uncertain.

What should investors be cautious about?

Investors should consider the post-divestiture performance, the use of proceeds, and macroeconomic conditions. A cautious approach to investment is recommended.