1. What Happened with Koramco Life Infra REIT?

Koramco Life Infra REIT disclosed investment information regarding planned new asset acquisitions on its website. This is a significant event, providing investors with insights into the company’s future investment strategy and portfolio changes.

2. Why Does it Matter?

REIT investors focus on asset value and profitability, operational performance, dividend policy, and financial soundness. New asset acquisitions directly influence these factors, making them crucial for investment decisions. Given recent concerns about Koramco Life Infra REIT’s increasing financial burden and slowing profitability, the key question is whether these investments can address these concerns and create growth momentum.

3. What are the Potential Impacts?

Positive Impacts

- Increased investor confidence through transparent information disclosure

- Heightened expectations for growth potential

- Mitigation of information asymmetry

Negative Impacts

- Potential negative investor sentiment if expectations are not met

- Possible exacerbation of existing fundamental risks

- Information overload and difficulty in interpretation

4. What Should Investors Do?

Investors should carefully analyze the disclosed investment information and assess the quality and expected returns of the new assets and their alignment with the company’s overall financial strategy. Continuous monitoring of market reactions, future performance, and changes in interest rates and the real estate market is also crucial.

Frequently Asked Questions

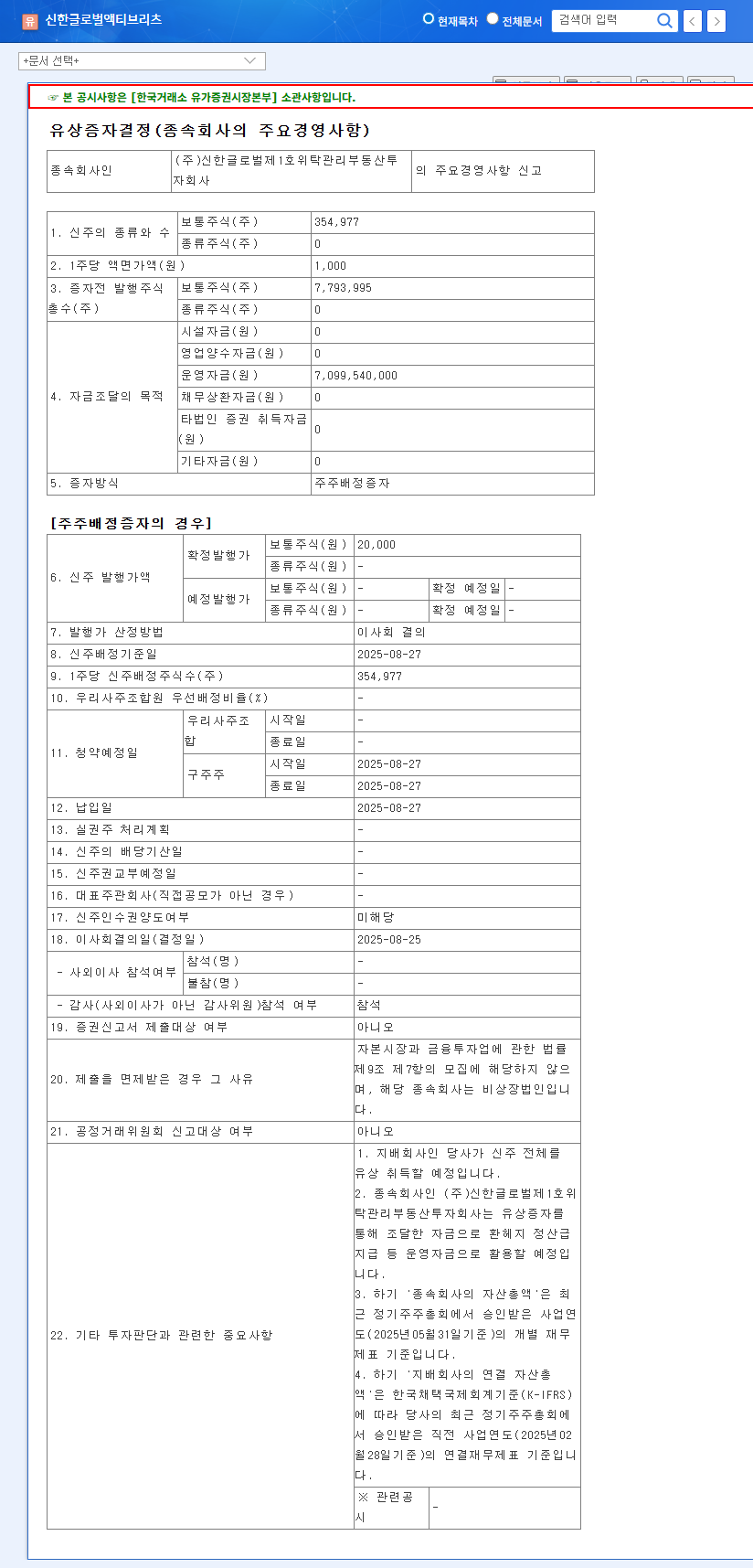

What are the new assets being acquired?

Specific details regarding the type, size, and location of the assets will be available in the investment information released by Koramco Life Infra REIT.

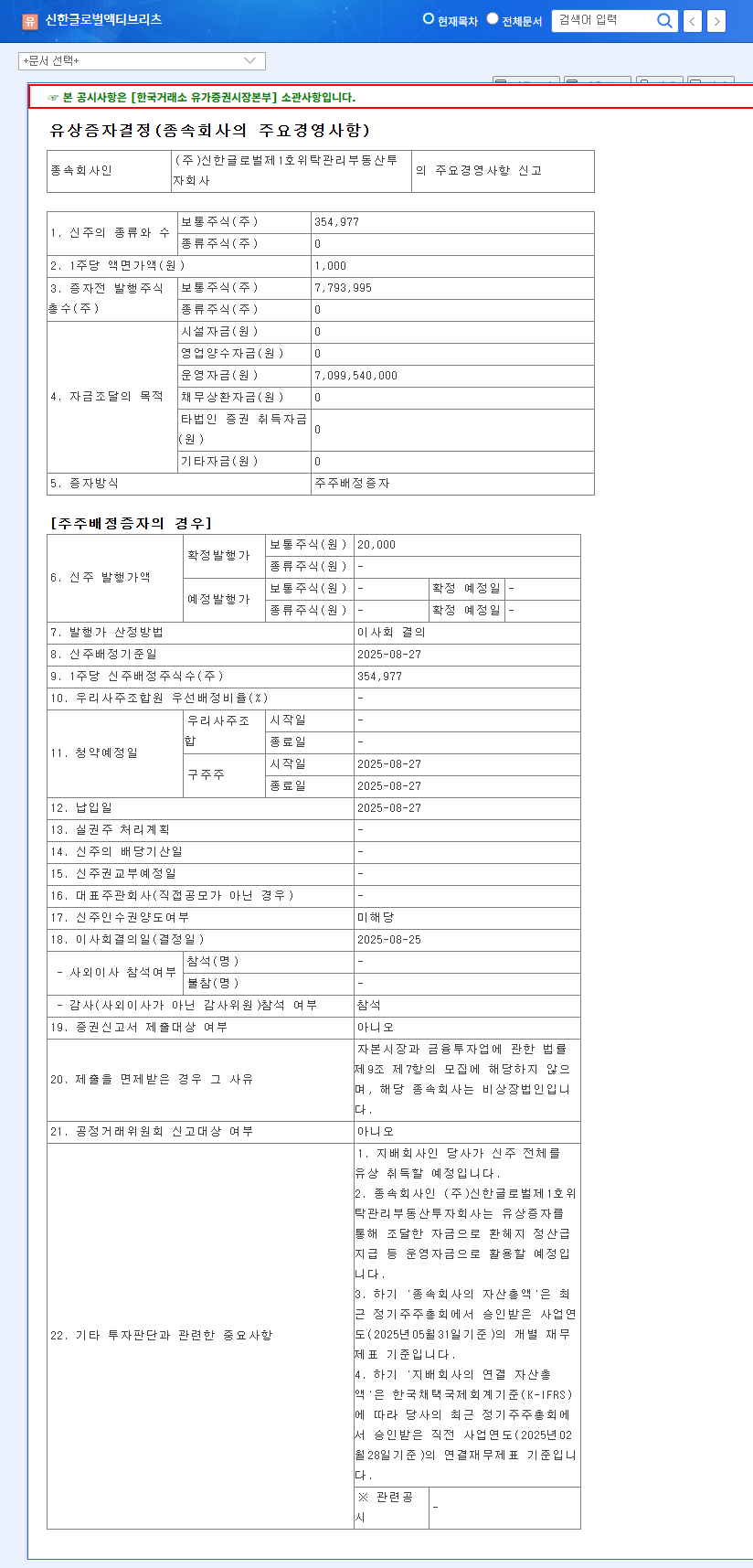

Will this investment positively impact Koramco Life Infra REIT?

The impact will depend on the profitability and stability of the new assets and their alignment with the company’s overall financial strategy.

What precautions should investors take?

Investors should carefully analyze the disclosed information, consider market conditions and the company’s fundamentals, and make prudent investment decisions.