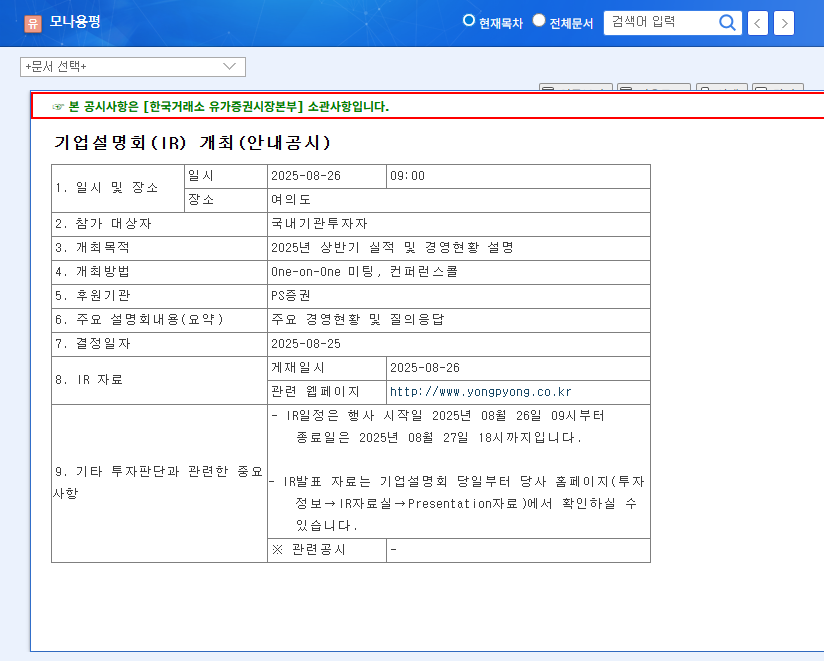

IR Key Takeaways: What Happened?

Yongpyong Resort offset declining operating revenue with increased sales revenue in the first half of 2025. They officially announced their entry into the senior residence market, adding ‘senior housing and leisure welfare facilities operation’ as a new business objective. Updates were also provided on new projects like the Rusongchae Condo, Gangneung ‘Pressier’ Ocean Condo, and Gochang Theme Park.

Senior Residences: Why Should Investors Care?

The aging population suggests high growth potential for the senior residence market. Yongpyong Resort’s existing leisure business experience is expected to provide a competitive edge through differentiated services. Diversification could mitigate risks associated with the seasonality of the resort business and external environmental changes, contributing to a more stable revenue structure.

Investment Strategy: What Should You Do?

While Yongpyong’s new business venture is positive, the high debt-to-equity ratio of 162.51% requires caution. Short-term stock price volatility is possible depending on the specifics of the business plan and growth potential revealed during the IR. Long-term value will hinge on the success of the senior residence business and improvements in the company’s financial structure.

Action Plan for Investors

- Carefully review the IR materials and management’s explanations.

- Analyze the growth potential and competitive landscape of the senior residence market.

- Monitor financial health indicators and risk management plans.

- Consider macroeconomic factors and real estate market trends in your investment strategy.

Frequently Asked Questions

What is Yongpyong Resort’s new business venture?

Yongpyong Resort is entering the senior housing and leisure welfare facilities operation market, also known as senior residences.

What is the outlook for the senior residence market?

The aging population presents a high growth potential for this market. Yongpyong’s existing leisure business could provide a competitive advantage.

What are the key investment considerations for Yongpyong?

The high debt-to-equity ratio raises concerns about financial health. Investors should also consider the new business’s success and the company’s ability to manage risks related to macroeconomic changes.