1. What is TaeYoung Construction’s Rights Offering?

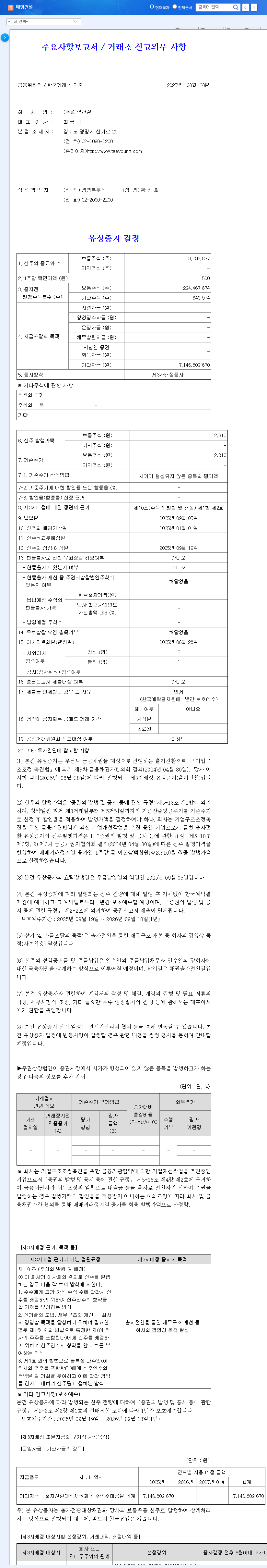

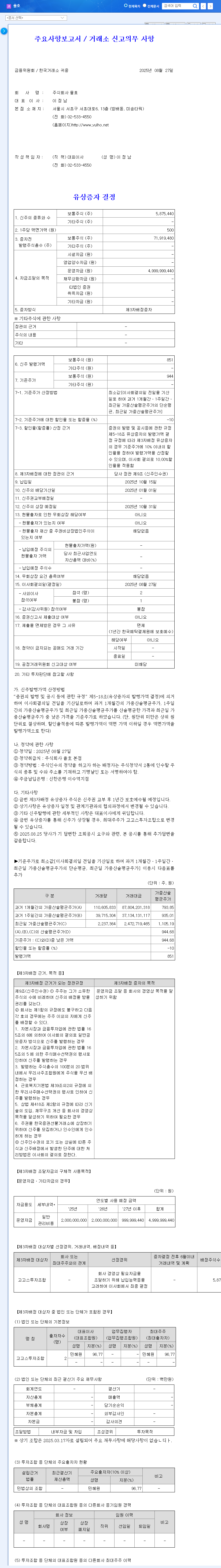

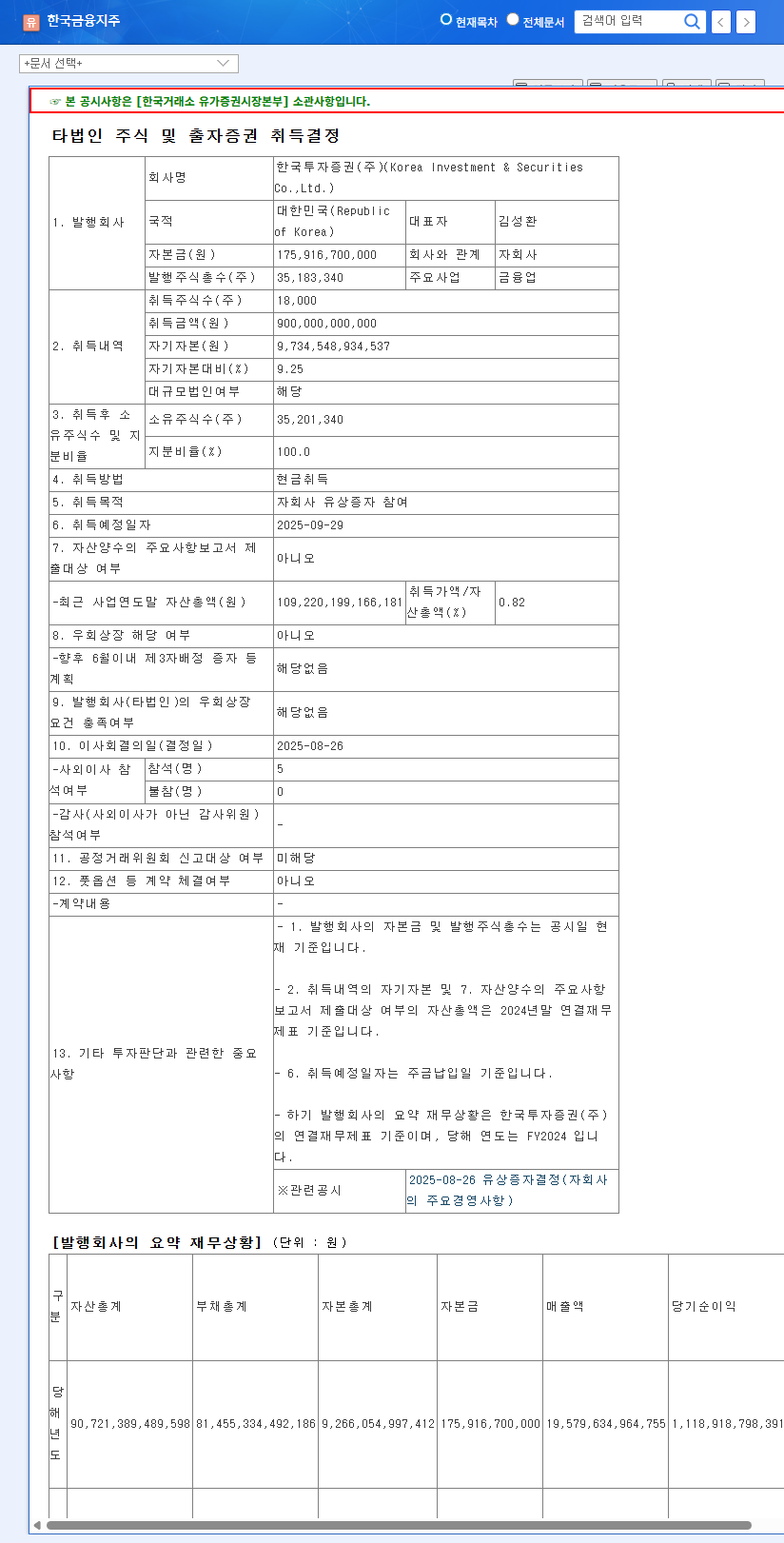

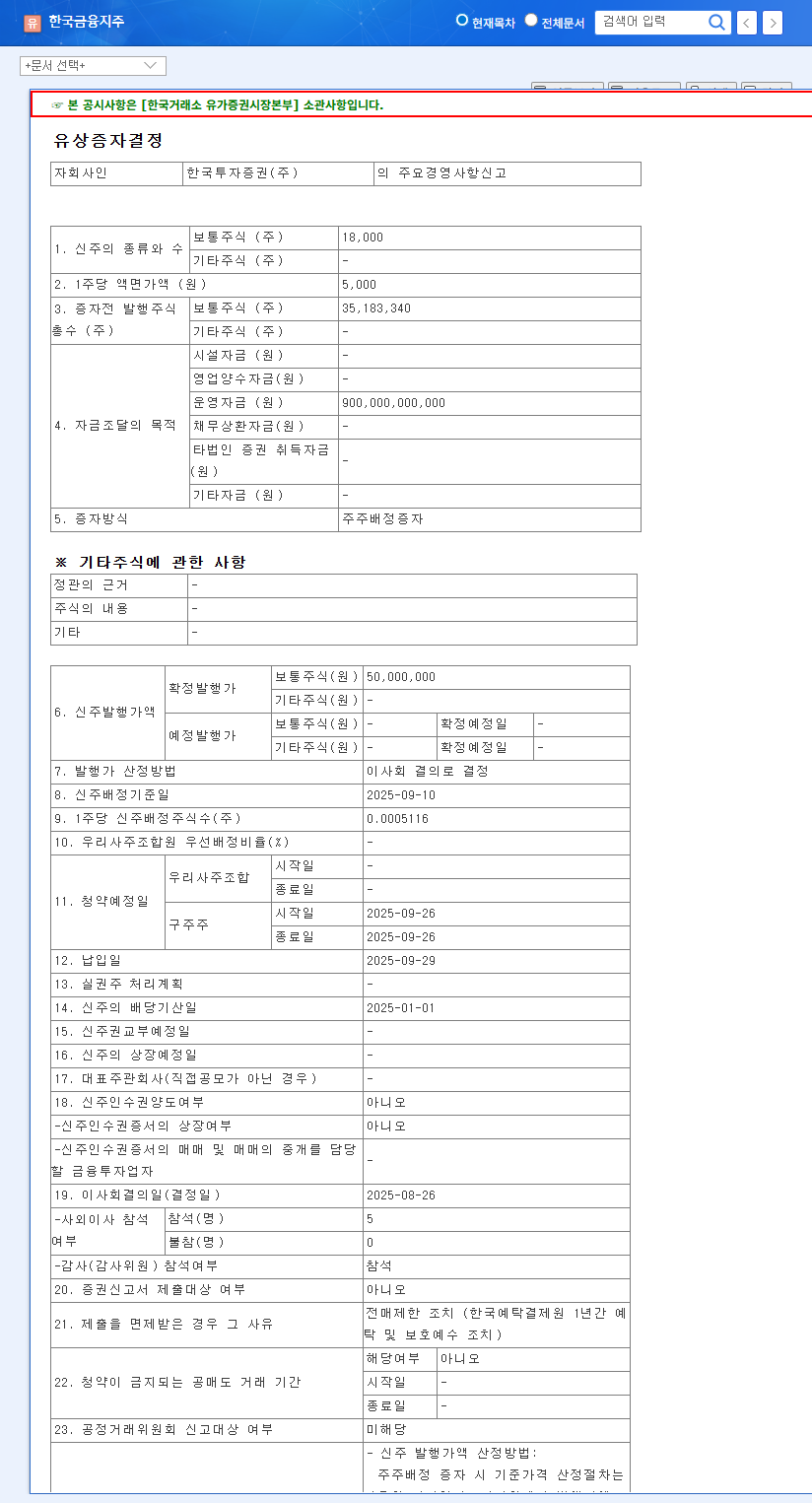

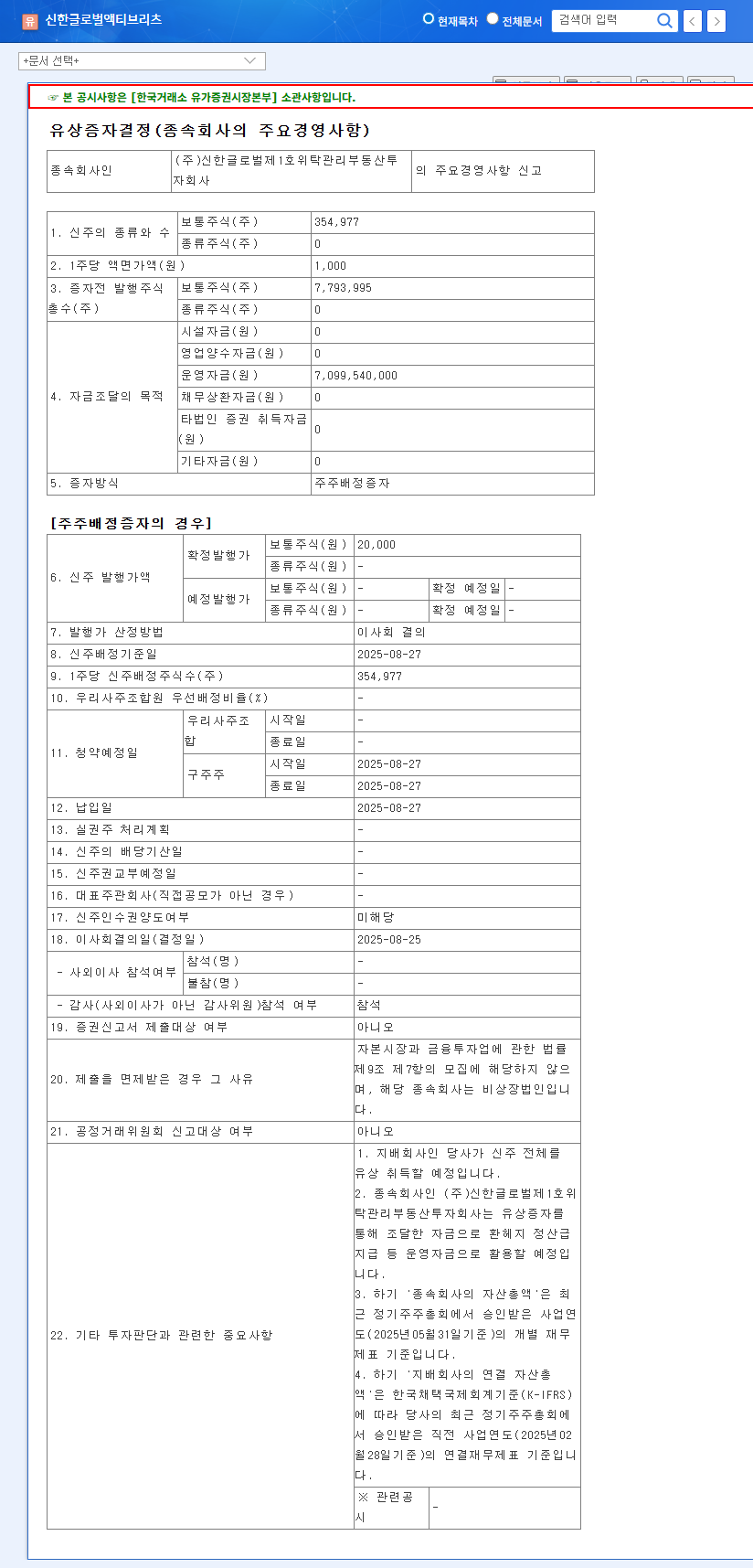

TaeYoung Construction has announced a third-party rights offering of 3,093,857 common shares, totaling approximately 7.15 billion KRW, with payment expected on September 5, 2025. The primary investors are financial creditors, and the funds will be used for financial restructuring.

2. Why the Rights Offering?

Currently undergoing workout procedures, TaeYoung Construction is facing significant financial challenges. This rights offering aims to secure liquidity, lower debt ratios, and improve overall financial health. The participation of financial creditors can be interpreted as a positive sign, indicating confidence in the company’s potential for recovery.

3. What are the Potential Impacts?

- Positive Impacts: Improved financial health, increased credibility

- Negative Impacts: Share dilution, potential need for further funding

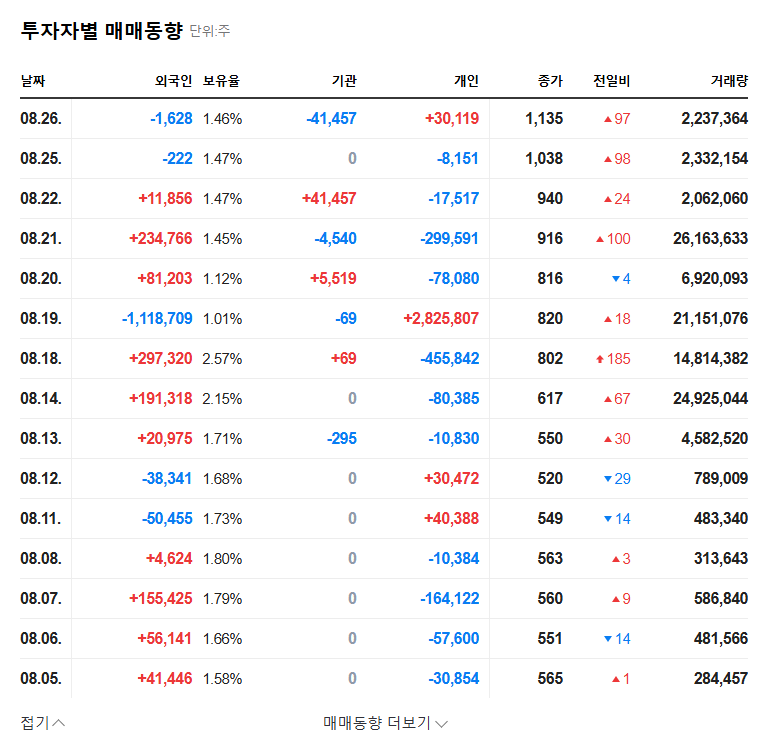

In the short term, concerns about share dilution could increase stock volatility. Long-term success hinges on the effective use of these funds to address PF contingent liabilities and achieve business normalization.

4. What Should Investors Do?

Investing in TaeYoung Construction requires extreme caution. Investors should look beyond short-term stock fluctuations and carefully monitor the efficient use of the raised capital, progress towards business normalization, and changes in the macroeconomic environment. Currently, it’s advisable to hold off on investing or proceed with extreme caution.

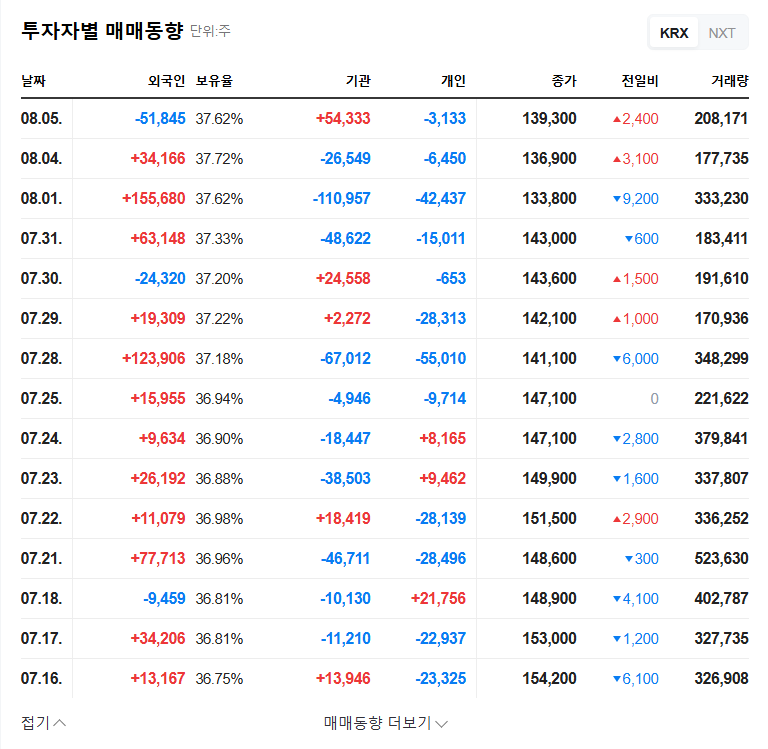

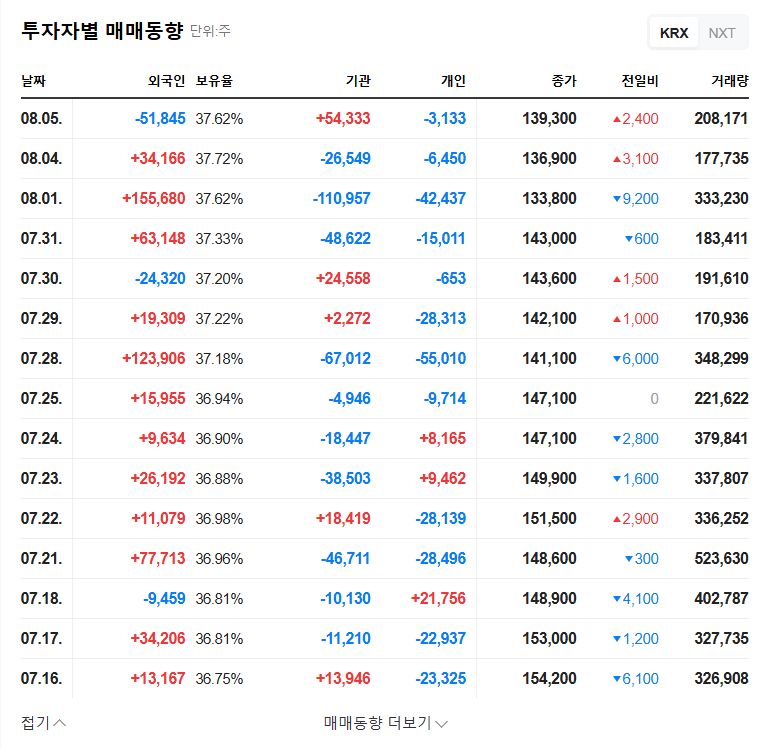

How will the rights offering affect TaeYoung Construction’s stock price?

In the short term, the increase in the number of shares could lead to share dilution. However, in the long term, improved financial health could create momentum for stock price appreciation.

How will the funds from the rights offering be used?

The funds will be used for financial restructuring, particularly for debt repayment and securing liquidity.

Should I invest in TaeYoung Construction?

Investing in a company undergoing workout procedures requires extreme caution. Carefully consider the company’s potential for business normalization and its efforts to improve its financial structure before making any investment decisions.