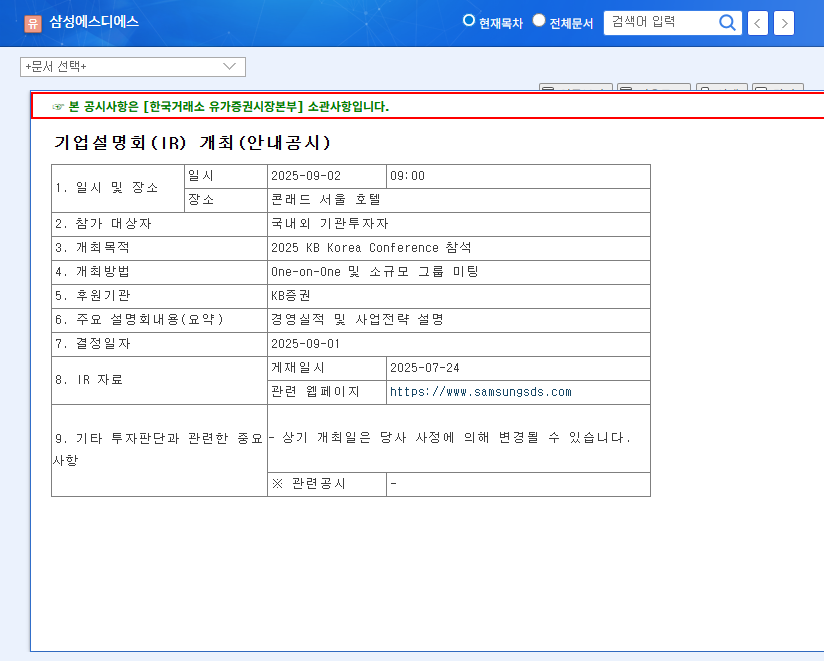

1. KB Korea Conference: What Did Samsung SDS Announce?

Samsung SDS presented its first-half 2025 business performance and future strategies at the KB Korea Conference on September 2, 2025. Key highlights included the robust growth of its IT services, increased investment in AI and cloud businesses, and efforts to improve profitability in the logistics sector.

2. Performance Analysis: IT Services Growth vs. Logistics Decline, Why?

In the first half of 2025, Samsung SDS achieved revenue of KRW 7.017 trillion (a 5.8% increase year-on-year). While the IT services sector grew by 4.4%, operating profit decreased by 11.2% to KRW 498.7 billion due to declining profitability in the logistics sector (-12.8%) and increased R&D expenses. The decline in logistics profitability is attributed to intensified competition and freight rate volatility.

3. Future Growth Strategies: AI, Cloud, and Digital Logistics Innovation. How?

Samsung SDS plans to strengthen its AI and cloud businesses within the IT services sector with FabriX, Brity Copilot, and GPUaaS. In the logistics sector, the company will focus on expanding digital forwarding services based on Cello Square and enhancing competitiveness through investment in Vizion, a US-based digital logistics startup.

4. Key Checkpoints for Investors

- Concrete achievements and future growth potential of AI and cloud businesses

- Effectiveness of logistics profitability improvement strategies

- Response strategies to global economic slowdown and exchange rate volatility

Investors should carefully analyze the future growth potential and risk factors of Samsung SDS based on information from this IR session and reflect them in their investment strategies.

Frequently Asked Questions (FAQ)

What are the main business segments of Samsung SDS?

Samsung SDS focuses on two main business segments: IT services and logistics. The IT services segment covers cloud, AI, SI, and ITO businesses, while the logistics segment provides digital logistics services based on the Cello Square platform.

What are the competitive advantages of Samsung SDS’s AI and cloud business?

Samsung SDS strengthens its competitiveness by providing customized services based on its proprietary AI platform, Brity, and cloud platform, FabriX. It also offers specialized cloud services such as GPUaaS (GPU as a Service).

What are the strategies to improve profitability in the Samsung SDS logistics division?

Samsung SDS is striving to improve competitiveness and profitability in its logistics business by expanding digital forwarding services based on the Cello Square platform and strengthening its global network. They are also focusing on acquiring external capabilities through investments in Vizion, a US-based digital logistics startup.