1. What Happened with Schindler’s Divestment?

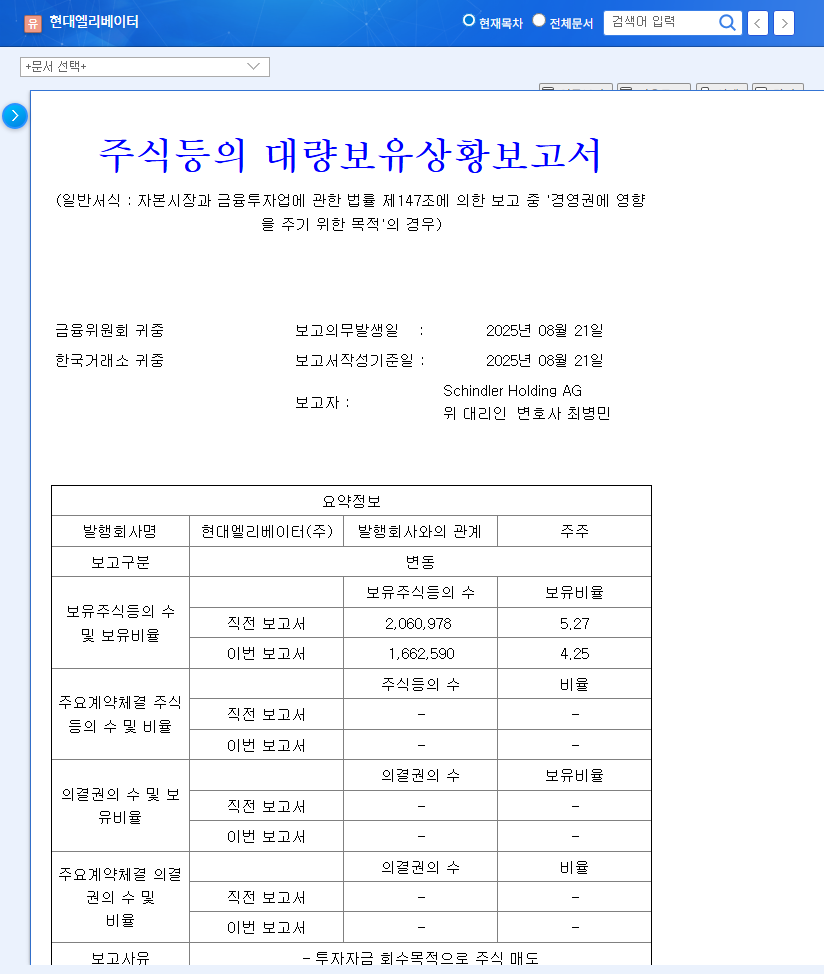

Schindler Holding AG sold 1.02%p of its stake in Hyundai Elevator for investment recovery purposes. This reduced Schindler’s stake from 5.27% to 4.25%.

2. Why Did Schindler Divest?

Schindler officially stated ‘investment recovery’ as the reason for the sale. They added that there was no intention to influence Hyundai Elevator’s management.

3. How Will This Affect the Stock Price?

3.1 Short-Term Impact:

- • Downward Pressure on Stock Price: Schindler’s divestment could put downward pressure on the stock price in the short term.

- • Supply-Demand Imbalance Concerns: The sale could create a temporary supply-demand imbalance.

3.2 Mid- to Long-Term Impact:

- • Limited Threat to Management Control: Schindler’s stake remains at 4.25%, which is not a direct threat to management control.

- • No Change in Fundamentals: The sale does not affect Hyundai Elevator’s fundamentals. It may even open the door for new investors.

- • Positive Factors: Solid performance, new business initiatives, stabilizing interest rates

- • Negative Factors: Short-term downward pressure on stock price, volatility in exchange rates and raw material prices

4. What Should Investors Do?

4.1 Short-Term Investors:

Short-term investment strategies that leverage stock price volatility can be considered. Careful monitoring of market conditions is crucial.

4.2 Mid- to Long-Term Investors:

Considering Hyundai Elevator’s growth potential, a dollar-cost averaging strategy during price declines can be considered. However, continuous monitoring of macroeconomic indicators is necessary.

What was the reason for Schindler’s divestment?

The purpose was investment recovery. There is no expected impact on Hyundai Elevator’s management.

How will this divestment affect Hyundai Elevator’s stock price?

There may be downward pressure on the stock price in the short term, but no significant impact is expected in the mid- to long term.

How should investors respond?

Short-term investors can consider strategies that utilize stock price volatility, while mid- to long-term investors can consider a dollar-cost averaging strategy.