What’s happening? Hanmi Semiconductor IR Scheduled

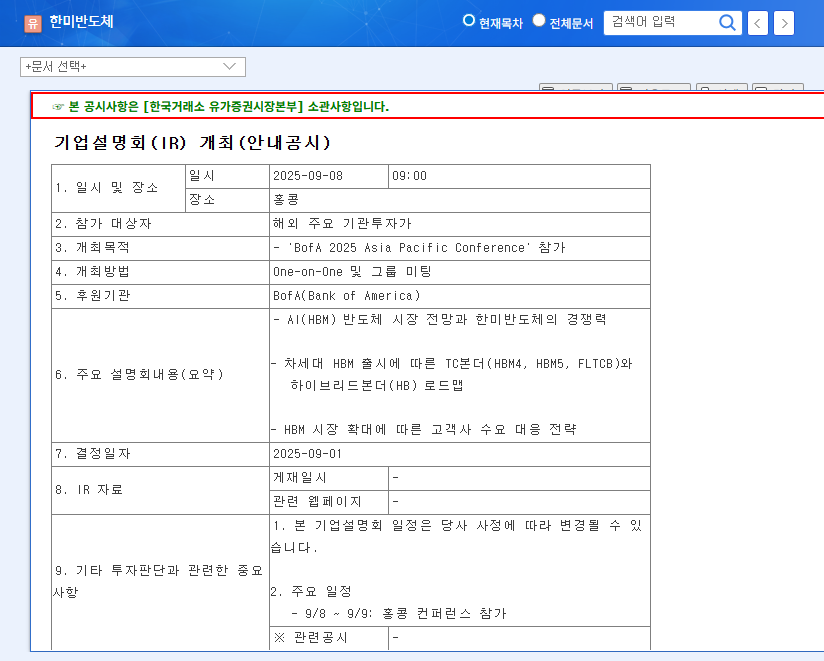

Hanmi Semiconductor will host an IR session at the ‘CGSI Tech Tour’ on September 22nd. The session will cover AI semiconductor market forecasts, Hanmi Semiconductor’s competitive edge, the launch of next-generation HBM (HBM4, HBM5, FLTCB) and Hybrid Bonder (HB) roadmap, and their strategy for expanding demand into the broader memory semiconductor market.

Why is it important? The growth of the AI semiconductor market and Hanmi’s Key Role

The AI semiconductor market is growing rapidly, and HBM is a core component. Hanmi Semiconductor, a supplier of essential equipment for HBM production, is directly linked to the growth of this market. Their strong performance in the first half of 2025 (revenue of KRW 327.4 billion, a 63.1% YoY increase) proves this.

Key IR takeaways and impact on investors?

- Positive Impacts:

- Reinforced technological leadership through the disclosure of next-generation HBM technology roadmap

- Presentation of an expansion strategy into the overall memory semiconductor market

- Reaffirmation of solid fundamentals and high profitability

- Expected improvement in investor sentiment and potential upward momentum for stock price

- Potential Risk Factors:

- Possibility of not meeting market expectations

- Intensifying competition

- Decrease in operating cash flow

- Exchange rate volatility

What should investors do? Key Checkpoints

- Check the specific technological roadmap and commercialization plan related to HBM4, HBM5, and Hybrid Bonder.

- Review the feasibility of the strategy to expand demand into the memory semiconductor market.

- Check the sustainability of profitability and financial soundness.

FAQ

What is Hanmi Semiconductor’s main business?

Hanmi Semiconductor develops and sells semiconductor manufacturing equipment such as essential equipment for HBM production (DUAL TC BONDER, 6-SIDE INSPECTION), micro SAW&VISION PLACEMENT equipment, and EMI Shield equipment.

What are the key announcements expected during this IR?

The IR will cover AI (HBM) semiconductor market outlook, Hanmi Semiconductor’s competitive edge, next-generation HBM (HBM4, HBM5, FLTCB) launch and Hybrid Bonder roadmap, and their strategy for expanding demand across the broader memory semiconductor market.

What are the key considerations for investors?

Investors should consider factors such as whether market expectations are met, the potential for increased competition, changes in operating cash flow, and exchange rate fluctuations.