1. JEIL E&S Invests in Hanul Sojae Science – What Happened?

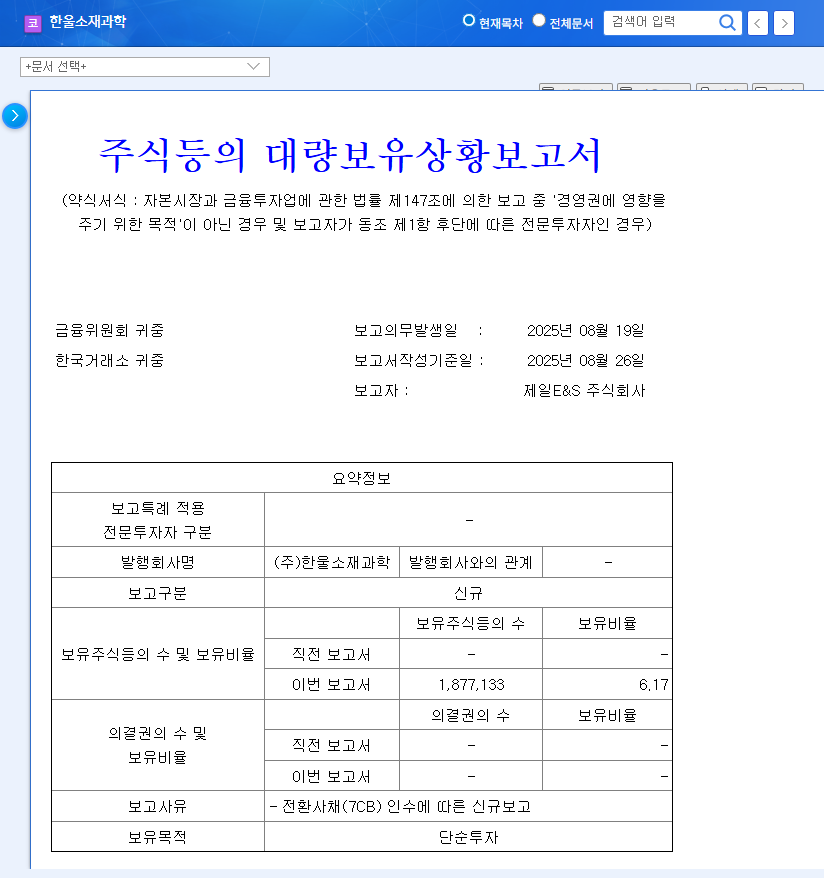

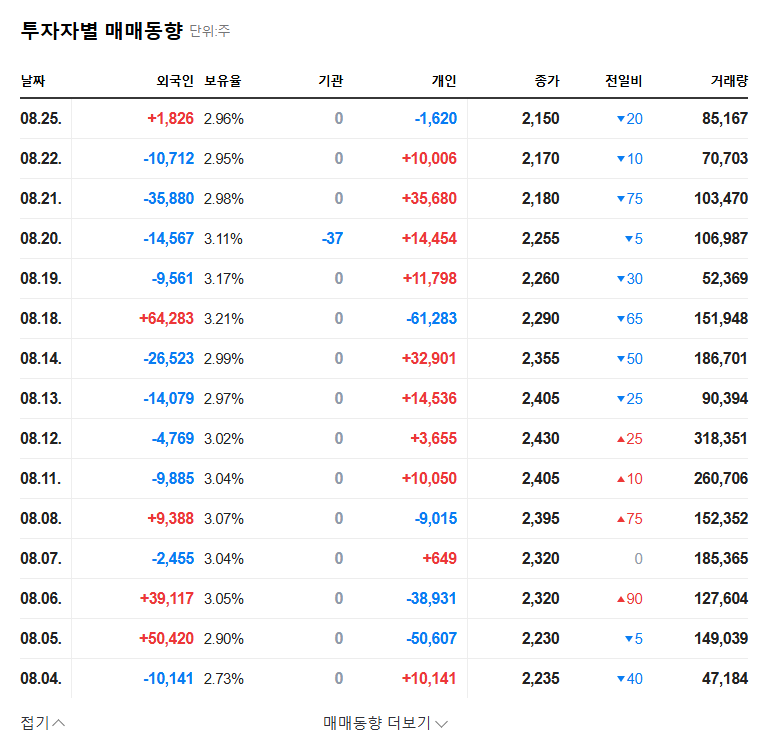

On August 26, 2025, JEIL E&S acquired convertible bonds (7CB) of Hanul Sojae Science, securing a 6.17% stake. While stated as a simple investment, the possibility of future management participation cannot be ruled out.

2. Why the Investment? – Background and Implications

The exact reasons behind JEIL E&S’s investment remain unclear, but it’s speculated that they see potential in Hanul Sojae Science’s new businesses (semiconductor materials, GFRP reinforcing bars). However, Hanul Sojae Science is currently facing financial difficulties, urging investors to approach this investment with caution.

3. Impact of the Investment – Opportunities and Risks

- Positive Impacts:

- Potential improvement in financial structure upon conversion of convertible bonds

- Expectation of increased corporate value due to new investment

- Negative Impacts:

- Concerns about equity dilution upon conversion of bonds

- Incurrence of interest expenses on convertible bonds

- Possibility of JEIL E&S’s management intervention

4. Investment Strategy – What to Consider

Investors considering Hanul Sojae Science should carefully evaluate the following:

- Performance and profitability of new businesses

- Improvement in financial structure

- JEIL E&S’s investment objectives and future management strategy

- Impact of macroeconomic variables (interest rates, exchange rates, raw material prices)

In conclusion, investing in Hanul Sojae Science carries high risks, requiring a cautious approach.

Frequently Asked Questions

What is the purpose of JEIL E&S’s investment?

Officially, it’s stated as a simple investment, but the possibility of future management participation cannot be ruled out.

What is Hanul Sojae Science’s financial situation?

The company is facing financial difficulties due to investments in new businesses and sluggish performance of existing businesses.

What is the most important factor to consider when investing?

Investors should consider the performance of new businesses, improvement in financial structure, JEIL E&S’s future strategy, and the impact of macroeconomic factors comprehensively.