1. What Happened? Seojin System’s $94 Million Deal

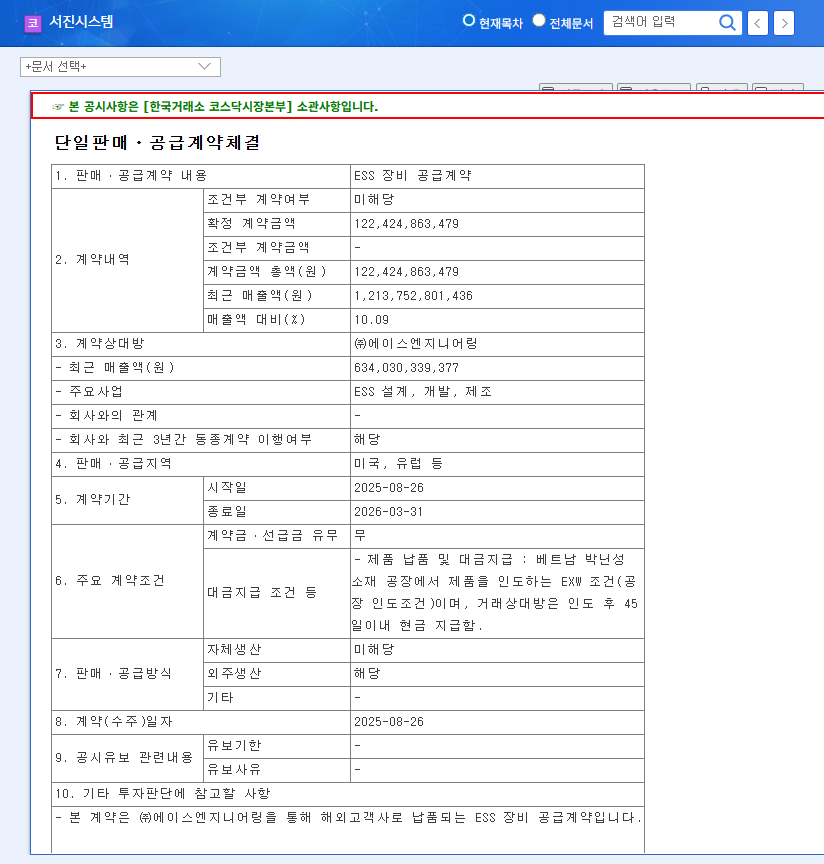

Seojin System secured a $94 million ESS equipment supply contract with Ace Engineering Co., Ltd. This represents 10.09% of Seojin System’s revenue in the first half of 2025. The contract period runs from August 26, 2025, to March 31, 2026.

2. Why Does It Matter? A Chance for a Turnaround?

Seojin System experienced a challenging first half of 2025, with revenue and operating profit declining by 55.5% and 86.3%, respectively. The ESS business segment was particularly hard hit. This substantial contract could provide a crucial catalyst for recovery. The entry into the US and European markets also offers a positive springboard for global expansion.

3. What’s the Impact? Positive Effects and Potential Risks

- Positive Effects: Revenue growth, business stabilization, global market expansion

- Potential Risks: Continued low profitability, exchange rate fluctuations, intensifying competition in the ESS market

While the contract may boost the stock price in the short term, Seojin System’s high debt ratio and low profitability remain key challenges.

4. What Should Investors Do? Maintain a Wait-and-See Approach

Investors should avoid impulsive reactions to short-term price movements and focus on a long-term perspective. Closely monitor Seojin System’s profitability improvements, potential for additional orders, and efforts to improve its financial structure. Scrutinizing the contract’s specific profitability and the company’s future business strategies is crucial.

How significant is this contract for Seojin System’s performance?

This contract, representing 10.09% of the first-half 2025 revenue, is expected to contribute to short-term performance improvement. However, the long-term impact hinges on Seojin System’s ability to enhance profitability.

What is the outlook for Seojin System’s stock price?

While a positive short-term impact is anticipated, the long-term stock performance depends on the improvement of Seojin System’s fundamentals.

What are the key investment considerations?

Investors should consider the risks posed by Seojin System’s high debt ratio, exchange rate fluctuations, and intensifying competition within the ESS market. Verifying the specific profitability of this contract is also crucial.