1. What Happened?

On August 26, 2025, an insider at Kolon Mobility Group, ‘Jo Jin,’ reduced their stake from 78.44% to 78.41% (0.03%p) through on-market sales. The stated purpose of the sale was ‘influence on management rights.’

2. Why the Sale? What’s the Impact on Stock Price?

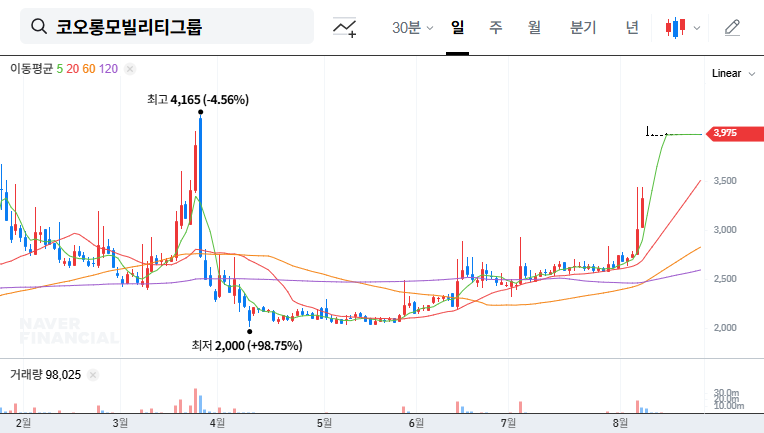

While the change in ownership is minimal, the stated purpose of ‘influence on management rights’ could raise concerns in the market. In the short term, this selling pressure could lead to a stock price decline. However, if the company’s fundamentals remain strong, the long-term impact is expected to be limited. Kolon Mobility Group reported strong H1 2025 results with consolidated revenue of KRW 1.1367 trillion (+7.2%) and operating profit of KRW 159 billion (+91.7%). The decision to cancel treasury stock also suggests a focus on shareholder value. However, investors should be mindful of declining standalone revenue, high consolidated debt-to-equity ratio, and foreign exchange volatility.

3. What Should Investors Do?

Investors should closely monitor any further share sales, the company’s explanation for the sale, and changes in fundamental indicators. Further sales without a clear explanation could negatively impact investor sentiment. The continued strength of the company’s fundamentals will be a key factor for long-term investment decisions.

Q: How will the insider share sale affect the stock price?

A: In the short term, selling pressure could lead to a price decline. However, if fundamentals remain strong, the long-term impact is expected to be limited. Monitor for further sales and company explanations.

Q: What is the current state of Kolon Mobility Group’s fundamentals?

A: The company reported strong consolidated H1 2025 results and is canceling treasury stock. However, declining standalone revenue and high consolidated debt-to-equity ratio are points of caution.

Q: What should investors watch for?

A: Investors should closely monitor further share sales, explanations from the company regarding the sale, and any changes in key fundamental indicators.