What Happened at Corentec?

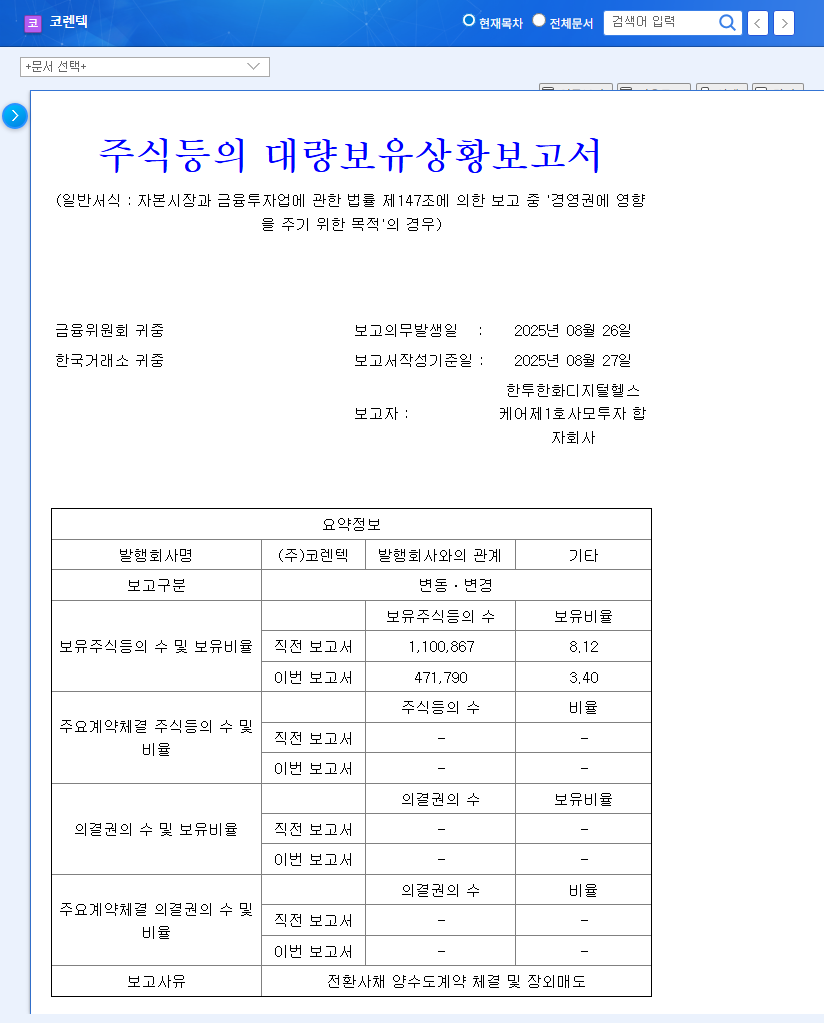

Hanwha Digital Healthcare Private Equity Fund No. 1 decreased its stake in Corentec from 8.12% to 3.40% through the transfer and over-the-counter sale of convertible bonds. This could put downward pressure on the stock price in the short term.

Why Does the Divestment Matter?

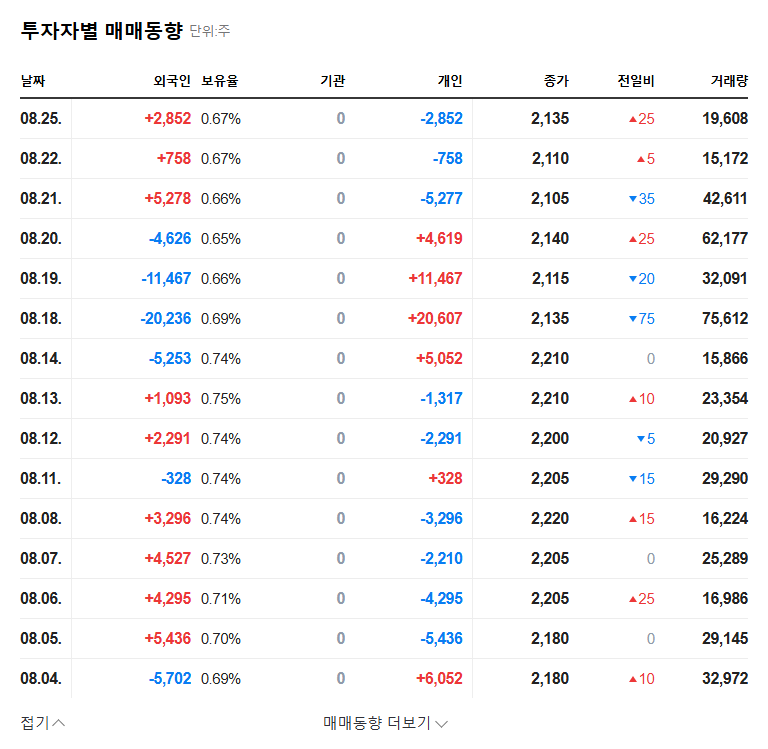

Changes in major shareholder stakes significantly influence investor sentiment. A substantial decrease like this triggers heightened sensitivity to the reasons behind it and the future outlook, potentially increasing stock volatility.

Corentec’s Present and Future

- Positive Factors: FDA approval, efforts to improve financial structure, and continued R&D investment could serve as long-term growth momentum.

- Negative Factors: Weak performance in the first half of 2025, exchange rate and interest rate volatility, and macroeconomic uncertainties pose short-term risks.

What Should Investors Do?

Short-term investors should be wary of stock volatility. Carefully consider investment decisions while closely monitoring the possibility of further stake changes and market conditions. Long-term investors can focus on Corentec’s growth potential. However, it’s advisable to consider a dollar-cost averaging strategy while continuously monitoring key points such as changes in the macroeconomic environment and performance in overseas markets.

Frequently Asked Questions

What is Corentec’s main business?

Corentec specializes in artificial joints, developing and selling products like artificial hip and knee joints.

How will this divestment affect the stock price?

In the short term, it may put downward pressure on the price due to the potential for more shares to be sold. However, the long-term impact depends on the company’s fundamentals and market conditions.

What should investors consider before investing in Corentec?

Carefully monitor macroeconomic changes, exchange rate and interest rate fluctuations, and the company’s financial performance. Investment decisions should be made cautiously, considering individual investment goals and risk tolerance.