1. What Happened?

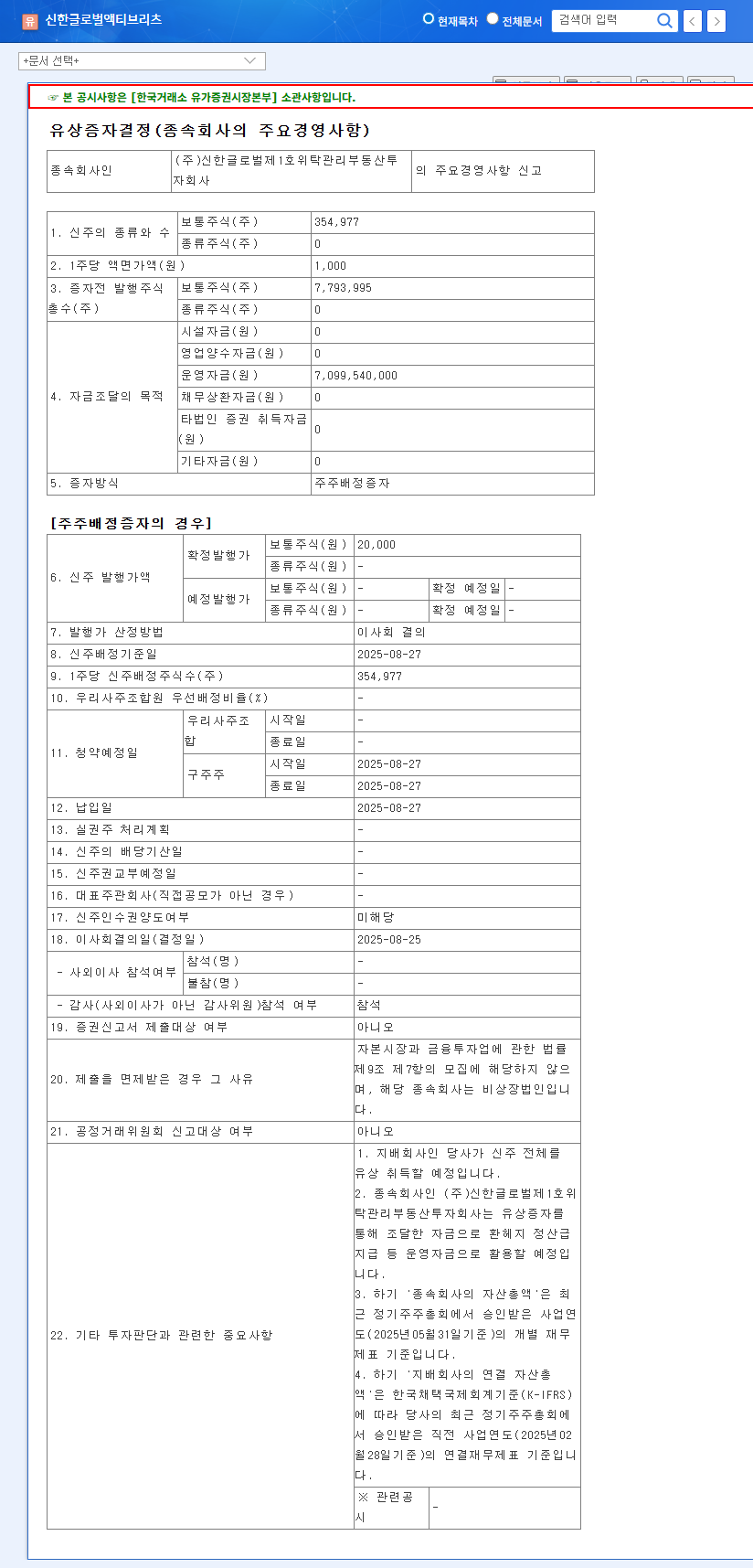

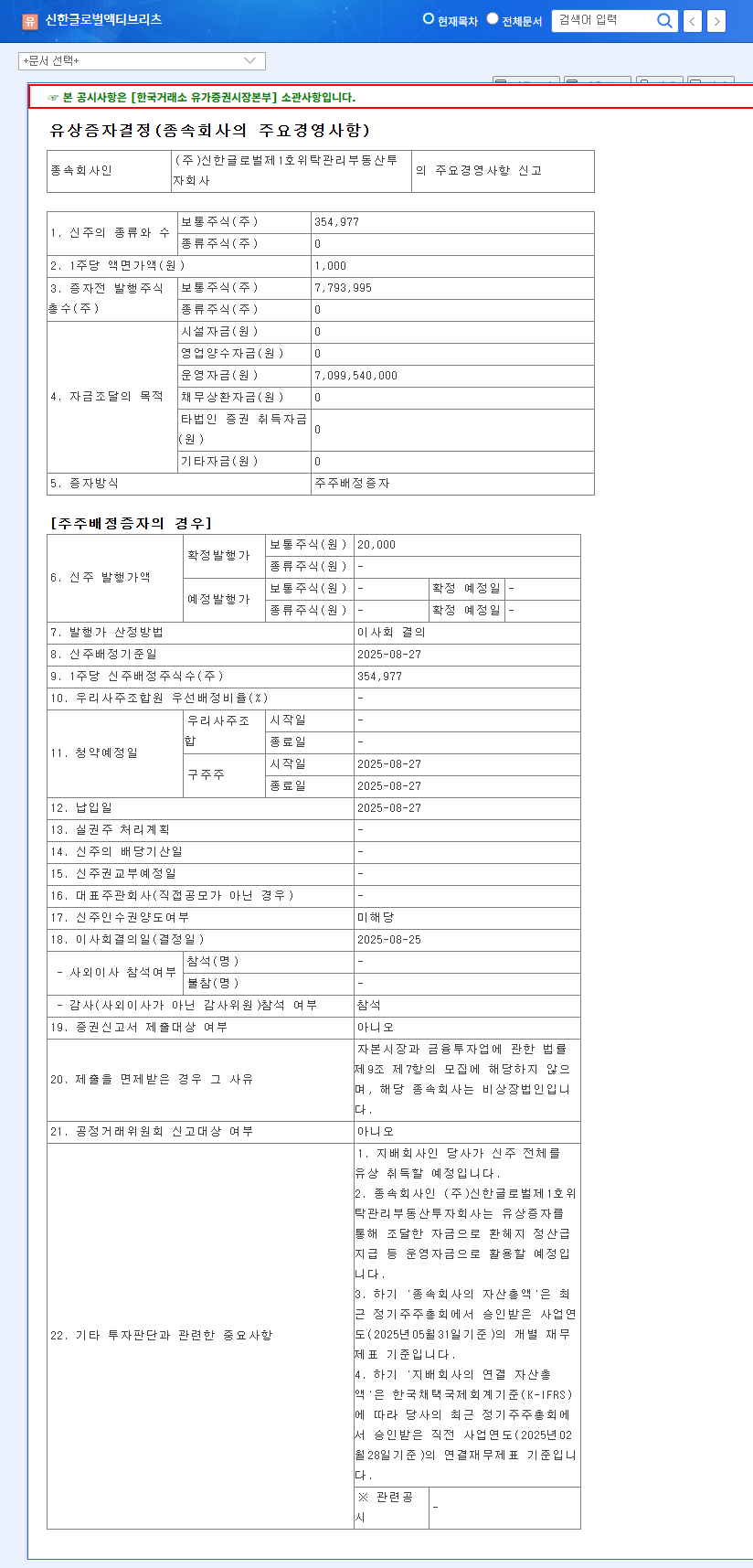

Shinhan Global Active REIT announced a rights offering on August 25, 2025. They plan to raise 7.1 billion won in operating funds through a rights offering of 0.05 shares per share.

2. Why the Rights Offering?

Shinhan Global Active REIT is experiencing significant financial difficulties due to recent losses from investments in US real estate funds. As of May 2025, they recorded a net loss of 6.8 billion won and accumulated deficit of 54.7 billion won. This rights offering is interpreted as an inevitable choice to secure short-term liquidity and improve operational stability.

3. The Impact of the Rights Offering

3.1. Short-term Impact

- Funding Secured: Securing 7.1 billion won in operating funds is expected to improve short-term liquidity.

- Share Dilution: The low offering ratio is expected to limit the share dilution effect.

- New Share Issue Price: A discounted issue price could present a buying opportunity for existing shareholders, but it could also be a factor in share price decline for non-participating shareholders.

3.2. Long-term Impact

- Fundamental Improvement?: It is uncertain whether the funds raised from the rights offering will lead to fundamental management improvements. Continuous monitoring is necessary.

- Shareholder Confidence: A rights offering in a situation of accumulated deficit could negatively affect shareholder confidence.

4. Investor Action Plan

New Investors: Extreme caution is advised. The company’s fundamentals are weak, and the long-term recovery of value is uncertain.

Existing Shareholders: Before participating in the rights offering, carefully review the company’s future prospects and the possibility of improving investment performance. Rather than making hasty decisions, it may be wiser to monitor market conditions. Keep an eye on the new share issue price, details of fund execution, and value fluctuations of US real estate funds.

FAQ

Q: Should I participate in the Shinhan Global Active REIT rights offering?

A: Existing shareholders are not obligated to participate. Carefully evaluate the company’s future prospects and the potential for improved investment performance before making a decision. It might be wiser to observe market conditions.

Q: What will happen to the share price after the rights offering?

A: The share dilution effect is expected to be limited in the short term, but the long-term share price trend will depend on whether the company’s fundamentals improve.

Q: Is Shinhan Global Active REIT a good investment?

A: Currently, extreme caution is advised for new investments due to the company’s weak fundamentals and uncertain long-term value recovery.