1. DariusN Divests 0.2% Stake in Shinwon: What Happened?

DariusN disposed of 215,700 common shares of Shinwon Corp. through on-market sales on August 22, 2025, following the conclusion of convertible bond transactions. This reduced DariusN’s stake in Shinwon from 5.85% to 5.65%, a decrease of 0.2%.

2. Impact of the Divestiture on Shinwon Corp.

This divestiture is not expected to have a direct impact on Shinwon Corp.’s fundamentals. No significant changes are anticipated in its business model, financial status, or management control. However, changes in major shareholder stakes can have a short-term impact on investor sentiment. Given the small size of the sale and its relation to convertible bonds, the impact is expected to be limited.

3. Key Investment Points: What Should Investors Do?

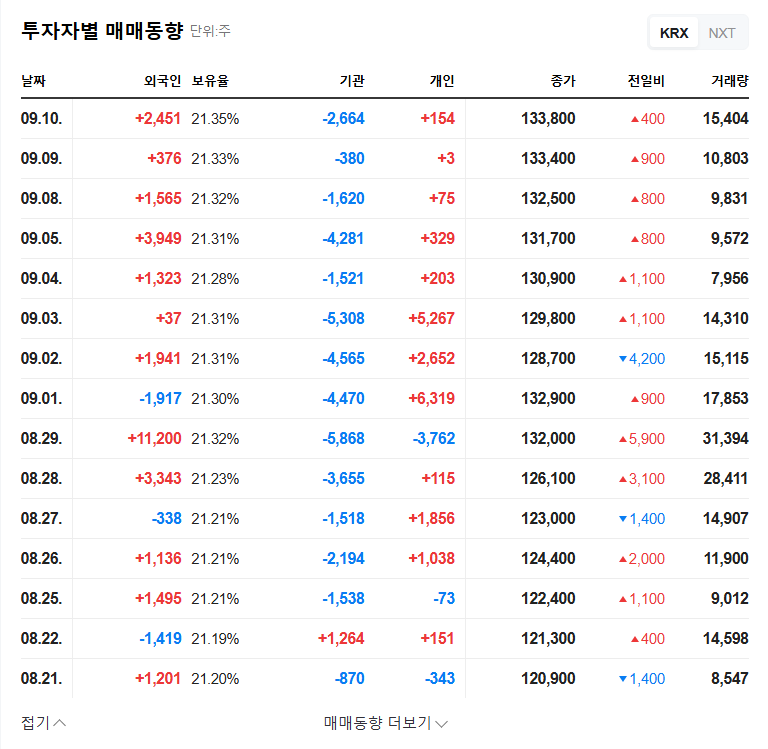

- Short-term Impact: Potential for dampened investor sentiment, but limited impact expected.

- Long-term Perspective: Focus on Shinwon’s core business competencies, including global fashion market demand, OEM/ODM business competitiveness, brand portfolio, and new market development capabilities.

- Key Investment Indicators: Monitor trends in macroeconomic indicators such as exchange rates, raw material prices, and shipping indices.

Rather than reacting emotionally to this announcement, it is crucial for investors to make investment decisions based on a comprehensive analysis of Shinwon’s fundamental business competitiveness and macroeconomic indicators.

FAQ

What is the reason for DariusN’s stake sale?

The sale was due to the conclusion of convertible bond transactions related to the designation of an exerciser of call options.

Will this divestiture affect Shinwon Corp.’s management control?

The sale is not expected to directly impact management control due to its small size.

Should I invest in Shinwon Corp. stock now?

It is recommended to make investment decisions based on an analysis of the company’s fundamentals and macroeconomic indicators, rather than short-term stock price fluctuations.