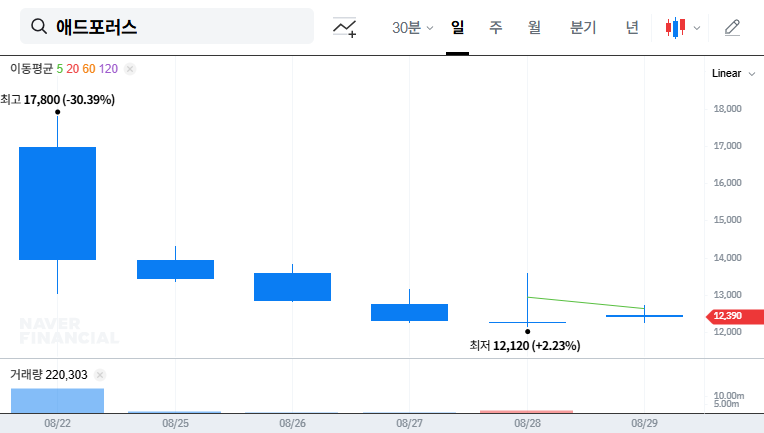

1. Shinyoung Securities Acquires 5.58% Stake: What Happened?

On August 29, 2025, Shinyoung Securities filed a large shareholding report for Adphorus. They acquired a 5.58% stake through the allocation of new shares from a merger, part of the KOSDAQ listing process.

2. Why It Matters: KOSDAQ Listing Potential and Increased Investor Interest

Shinyoung Securities’ investment is interpreted as a positive sign for Adphorus’s KOSDAQ listing. Investments from major securities firms increase the company’s credibility and attract potential investors. This can positively impact stock performance after listing.

3. About Adphorus: Core Business and Growth Strategy

- Core Business: Operating a proprietary advertising platform (84.32% of revenue). The growth of reward-based ad networks like ‘GreenFee’ is notable.

- Growth Strategy: Plans to strengthen global ad network integration and establish a full-stack mobile advertising platform by introducing OpenRTB in 2026. Securing future growth engines through the development of the AI/data-driven ‘AIDA’ platform.

- Financial Soundness: Stable financial status with a debt-to-equity ratio of approximately 23.6% and ample net cash assets as of the first half of 2025.

4. Investment Considerations: Key Risk Factor Analysis

- Risk of Slowing Revenue Growth: Revenue declined in 2024, with a slight recovery expected in 2025. Continued efforts to secure growth momentum are needed.

- High Business Segment Dependency: High reliance on the advertising platform business (84.32%), necessitating business diversification efforts.

- Intensifying Competition: Strategies are required to gain a competitive edge in the fiercely competitive ad tech market.

- Investment Losses in Related Companies: Potential investment losses from related companies like QuantumBit and Illiad.

5. Action Plan for Investors: Post-KOSDAQ Listing Outlook and Investment Strategy

While Shinyoung Securities’ investment is a positive sign, the ‘simple investment’ objective should be considered. Post-KOSDAQ listing stock performance will depend on the company’s earnings and growth potential. Investors need to carefully monitor the company’s earnings announcements, business expansion strategies, and market competition after listing.

Q: Why is Shinyoung Securities’ investment in Adphorus significant?

A: This investment is seen as a positive signal for Adphorus’s upcoming KOSDAQ listing, potentially boosting credibility and attracting more investors.

Q: What is Adphorus’s core business?

A: Adphorus operates a proprietary advertising platform connecting advertisers and media, with a focus on reward-based ad networks like ‘GreenFee’.

Q: What are the key risks to consider when investing in Adphorus?

A: Investors should consider potential risks such as slowing revenue growth, high business segment dependency, intensifying market competition, and potential losses from investments in related companies.