What Happened? : Major Shareholder Divests Stake in SK Oceanplant

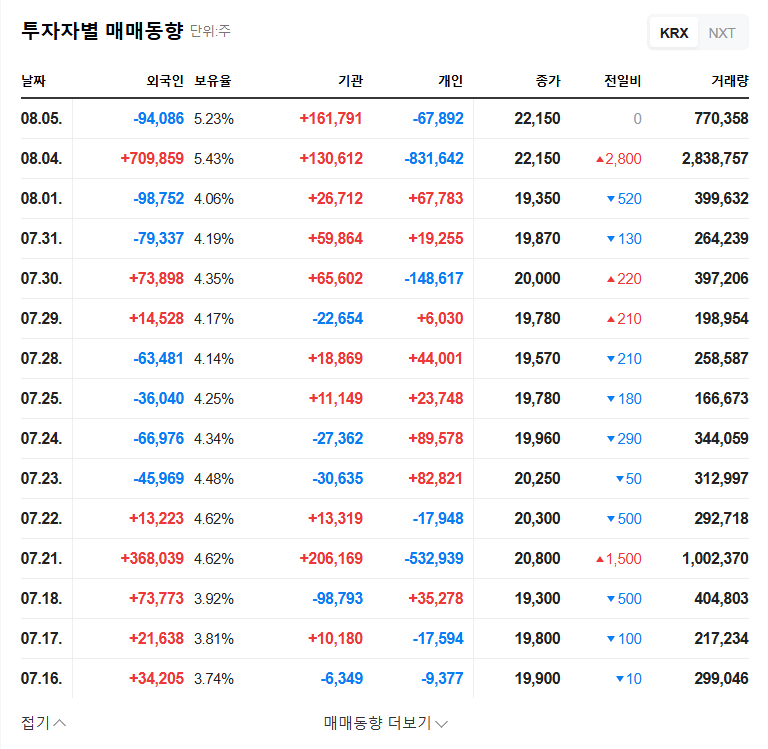

On September 8, 2025, a public announcement revealed that a major shareholder, Song Mu-seok and others, had sold a portion of their stake in SK Oceanplant. Kang Suk-hee and others sold a total of 62,819 shares on September 4th and 5th through on-market transactions. This reduced the shareholder’s stake from 20.21% to 20.10%.

Why Does It Matter? : Analyzing the Short-Term and Long-Term Impact

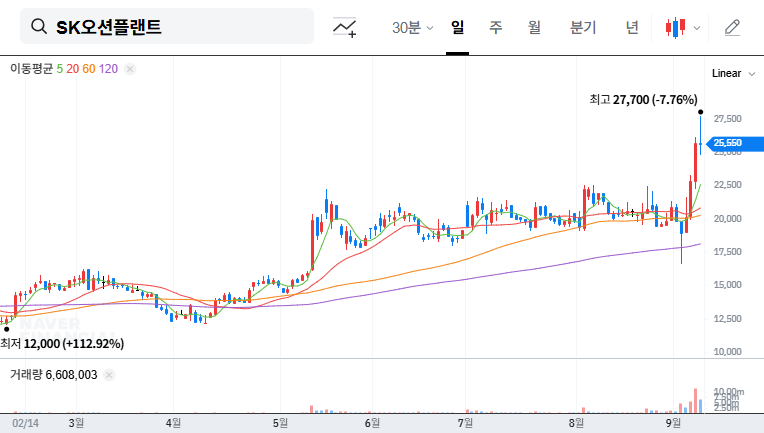

In the short term, this divestment could create downward pressure on the stock price and increase volatility. Stake changes by major shareholders, especially those with significant influence, can trigger sensitive market reactions. The long-term impact depends on the reasons behind the sale and any potential changes in the company’s management strategy. If the sale reflects negative sentiment about the company’s fundamentals, it could lead to a sustained decline in the stock price.

Understanding SK Oceanplant: Business Overview and Financial Analysis

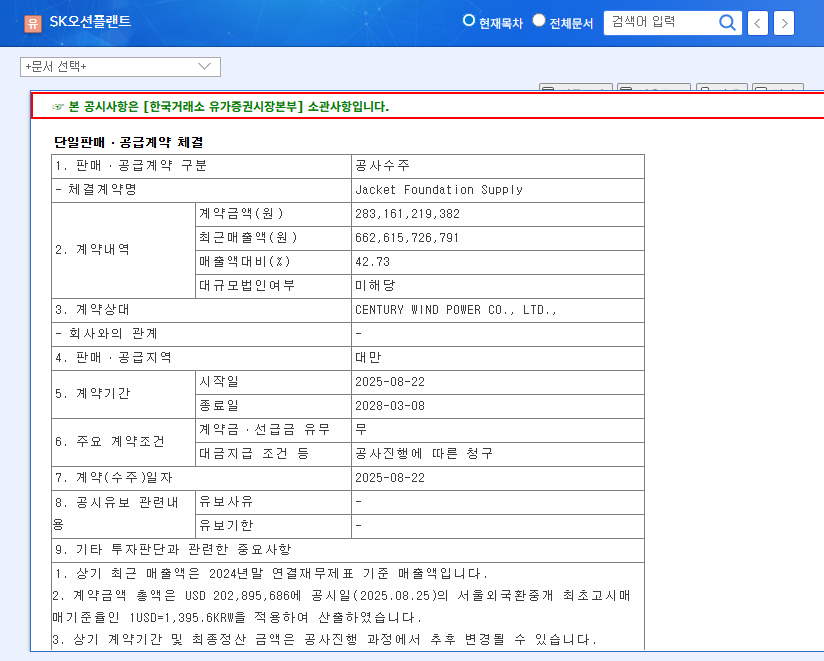

- Business Overview: SK Oceanplant has a diversified business portfolio, including offshore wind power, offshore plants, special vessels, shipbuilding, and ship repair/conversion. The offshore wind power business, in particular, holds high growth potential due to the global trend towards renewable energy policies. Recent amendments to the business report aimed to enhance transparency regarding project progress and contract details, clarifying future plans.

- Financial Status: As of 2024, both revenue and profits decreased compared to the previous year, and the debt-to-equity ratio remains high. Continuous efforts are needed to improve profitability and financial soundness.

Key Investment Considerations

- Analyze the Reasons for Divestment: Carefully assess the reasons behind the major shareholder’s sale. Determine whether it is simply for raising capital or reflects concerns about the company’s fundamentals.

- Monitor Growth Drivers: Continuously monitor the feasibility of the company’s key growth drivers, particularly the offshore wind power business.

- Assess Financial Health: Track the company’s progress in reducing its debt-to-equity ratio and improving profitability.

- Prepare for Short-Term Volatility: Be aware of the potential for increased short-term price volatility due to the sale of shares.

FAQ

How might the major shareholder’s stake sale affect the stock price?

In the short term, the sale could put downward pressure on the stock price and increase volatility. The long-term impact depends on the reasons for the sale and any changes in the company’s fundamentals.

What are SK Oceanplant’s key growth drivers?

While the company operates across various sectors, including offshore wind power, offshore plants, special vessels, shipbuilding, and ship repair/conversion, the offshore wind power business is considered to have high growth potential due to global trends in renewable energy policies.

What are the key considerations for investors in SK Oceanplant?

Investors should carefully consider the reasons for the stake sale, the feasibility of key growth drivers, improvements in financial health, and potential short-term price volatility before making investment decisions.