Asia Tech Announces Cash Dividend: What Happened?

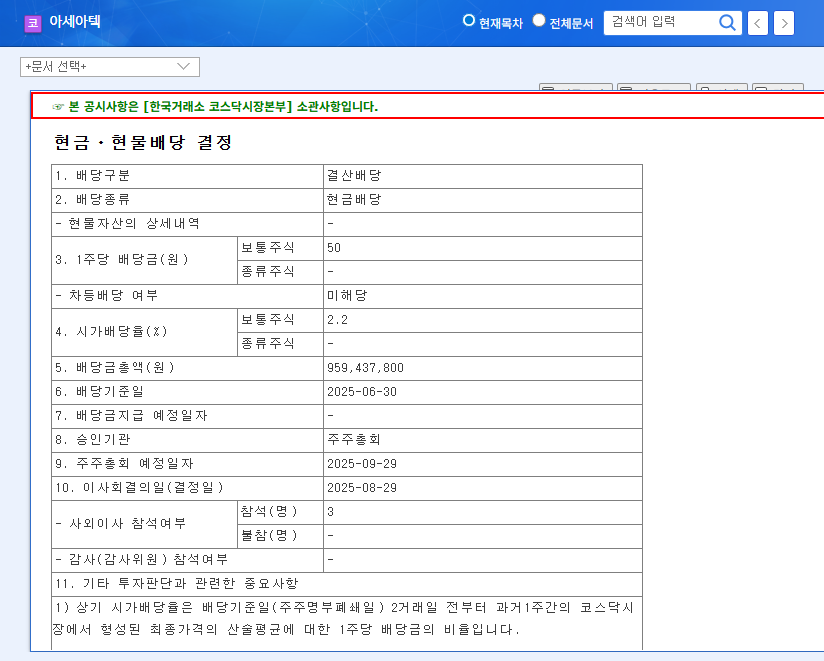

Asia Tech declared a cash dividend of 50 KRW per common share, representing a dividend yield of 2.2% based on the current stock price. This decision comes as a surprise following a weak performance in the first quarter of 2025.

Dividends Despite Underperformance: Why?

The company emphasizes that this dividend demonstrates its commitment to shareholder value, showcasing its intention to return profits to shareholders even during challenging times. However, some analysts suggest that this move might be an attempt to alleviate concerns about the company’s financial difficulties.

- Positive Interpretation: Shareholder-friendly policy, confidence in financial stability

- Negative Interpretation: Temporary measure to offset underperformance

Ultimately, the key lies in the company’s future earnings performance.

Impact of the Dividend Decision

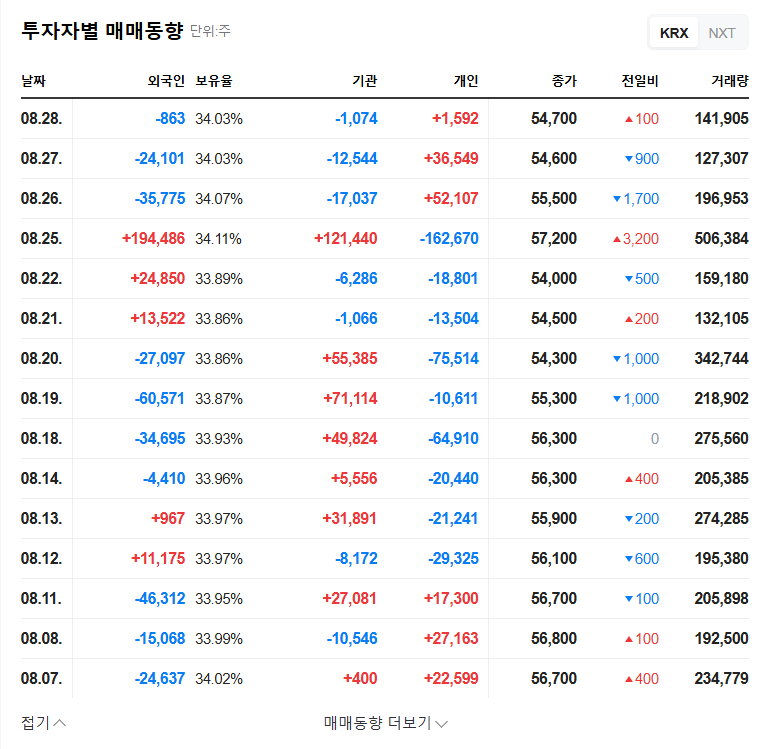

The short-term impact on the stock price is expected to be limited, given the modest dividend yield and lingering concerns about financial performance. External factors such as interest rates and exchange rates are likely to have a greater influence. In the long term, a consistent dividend policy can enhance investment appeal, but this requires sustained earnings improvement.

Investor Action Plan

1. Monitor Earnings: Closely track earnings performance from Q2 2025 onwards.

2. Track New Businesses: Monitor the progress of new businesses like smart farms and agricultural drones.

3. Monitor Macroeconomic Factors: Pay attention to changes in external factors like interest rates and exchange rates.

4. Analyze Financial Health: Thoroughly review debt and inventory management practices.

Dividends are only one factor in investment decisions. A comprehensive investment strategy should be based on thorough fundamental analysis.

How did Asia Tech perform in Q1 2025?

Asia Tech experienced a decline in revenue, operating profit, and net income compared to the same period last year, primarily due to decreased domestic sales and insufficient cost reduction measures.

What are Asia Tech’s main businesses?

Asia Tech’s primary business is the manufacturing and sale of agricultural machinery, with a focus on products like cultivators, transplanters, and SS machines. The company is also investing in new businesses like smart farms and agricultural drones.

What are the key risks to consider when investing in Asia Tech?

Investors should be aware of the company’s volatile earnings, high debt-to-equity ratio, increasing competition in the agricultural machinery market, and potential risks associated with changes in government policies.