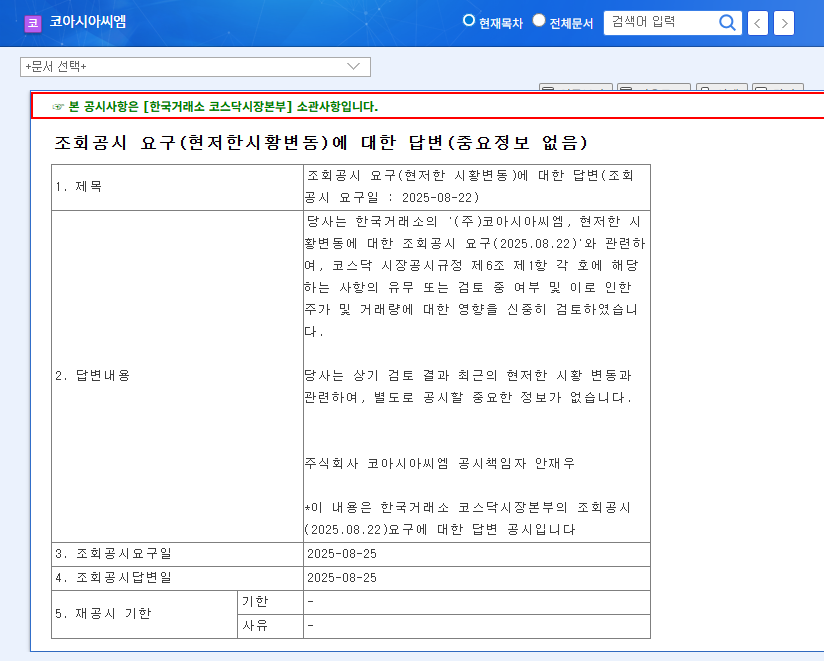

1. What Happened? Coreasia CM’s Inquiry and Response

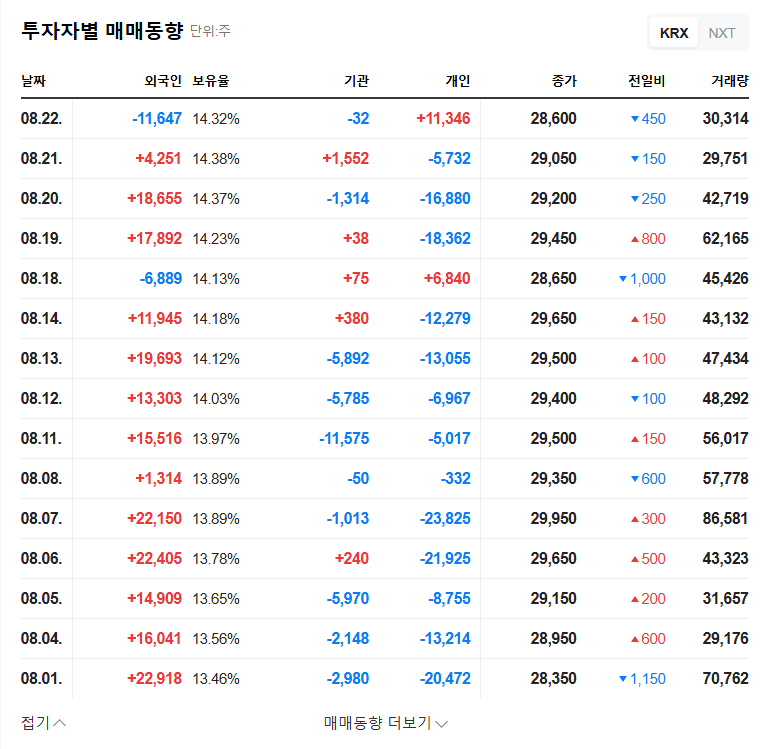

On August 22, 2025, Coreasia CM received an inquiry regarding its recent stock fluctuations. On August 25, the company responded with “No Material Information.” Contrary to market expectations, no specific information was disclosed, raising questions among investors.

2. Why the Stock Fluctuations? Fundamental Analysis

Coreasia CM’s 2025 semi-annual report reveals both positive aspects and challenges.

- Positive Aspects: Revenue growth and return to profitability, investment in new technologies, recovery of the smartphone market, decrease in inventory.

- Challenges: Low production capacity utilization, convertible bond burden, foreign exchange and interest rate risks, decreasing R&D expenditure trend, related party transactions.

These factors likely contributed to the stock’s volatility.

3. What’s Next? Investment Outlook

While the inquiry response itself doesn’t directly impact fundamentals, the return to profitability is a positive sign. However, low production capacity utilization and convertible bond burdens remain key challenges.

4. What Should Investors Do? Action Plan

Investors should consider the following:

- Monitor plans and results for improving production efficiency.

- Understand the company’s strategy regarding convertible bond maturity and potential conversion.

- Track the performance and revenue contribution of new businesses.

- Assess whether R&D investment is increasing.

- Analyze the impact of changes in the macroeconomic environment.

Frequently Asked Questions (FAQ)

What was Coreasia CM’s response to the inquiry?

“No Material Information.”

How was Coreasia CM’s performance in the first half of 2025?

The company achieved revenue growth and returned to profitability, but faces challenges such as low production capacity utilization.

What should investors consider when investing in Coreasia CM?

Investors should carefully monitor improvements in production efficiency, convertible bond risk management, and the performance of new businesses.