1. What Happened? VIP Asset Management Acquires 5% Stake in Lotte Wellfood

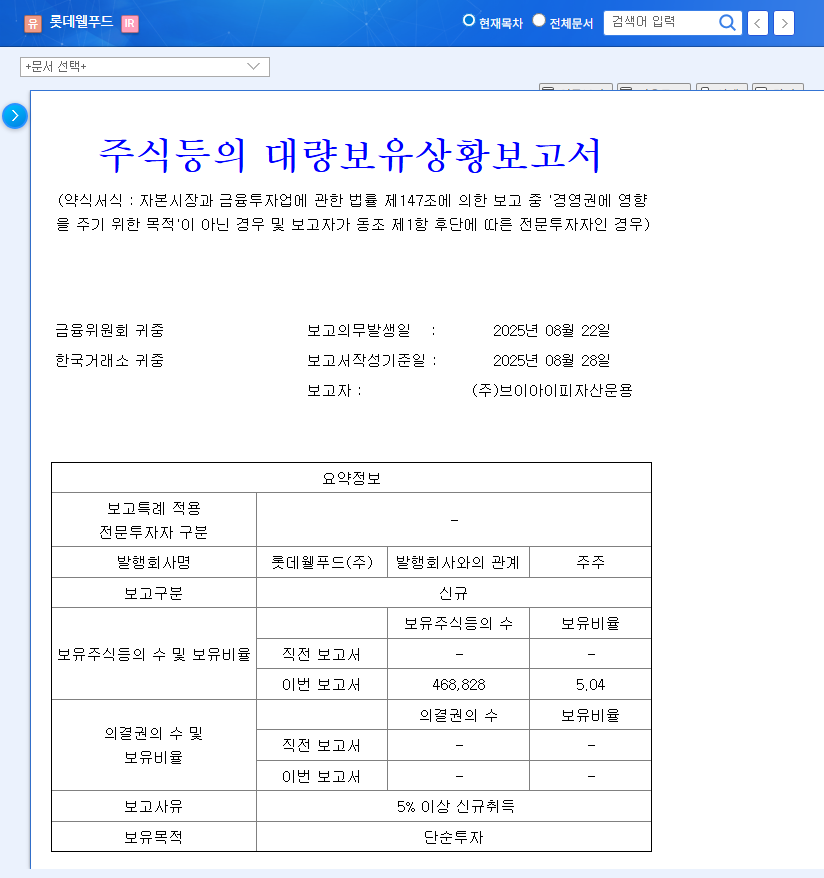

On August 29, 2025, VIP Asset Management announced the acquisition of a 5.04% stake in Lotte Wellfood. The shares were purchased on the open market between August 22 and 28, and the acquisition is for investment purposes.

2. Why Does it Matter? Lotte Wellfood at the Crossroads of Growth and Profitability

Lotte Wellfood maintains sales growth thanks to the merger effect and expansion of overseas exports, but profitability has declined due to rising raw material prices. In this context, VIP Asset Management’s investment could send a positive signal to the market. However, it’s crucial to understand that this event doesn’t directly change the company’s fundamentals.

- Positive Factors: Stable sales growth, solid capital structure, efforts to enhance shareholder value, increased R&D investment.

- Negative Factors: Decline in operating profit, cost burden due to raw material price volatility.

3. What’s Next? Short-term Momentum vs. Long-term Fundamentals

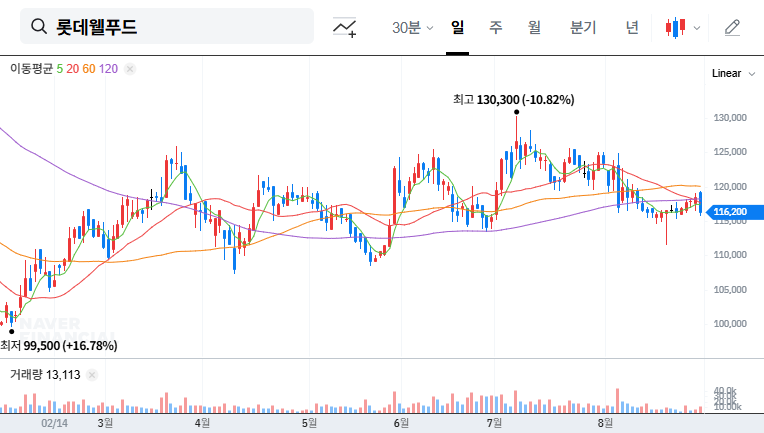

VIP Asset Management’s stake acquisition could contribute to short-term upward momentum in stock price and improved investor sentiment. However, sustained stock price growth depends on Lotte Wellfood’s ability to improve profitability. It’s also essential to closely monitor changes in the macroeconomic environment, including raw material prices, exchange rates, interest rates, and the global economy.

4. What Should Investors Do? Objective Analysis and Prudent Investment

Investors should not be swayed by short-term stock price fluctuations and should objectively analyze Lotte Wellfood’s fundamentals and growth potential. It’s crucial to closely monitor VIP Asset Management’s future investment activities, Lotte Wellfood’s efforts to improve profitability, and new product launches and R&D achievements.

Frequently Asked Questions

Is VIP Asset Management’s investment in Lotte Wellfood a positive sign?

While it can provide short-term upward momentum for the stock price, long-term growth depends on improvements in Lotte Wellfood’s fundamentals.

What should investors consider when investing in Lotte Wellfood?

It’s essential to consider factors like profitability improvements, raw material price volatility, and changes in the macroeconomic environment.

How is Lotte Wellfood’s future growth potential assessed?

While Lotte Wellfood is securing growth drivers through increased R&D investment, new business development, and expansion into overseas markets, improving profitability is key.