1. What Happened to Asia Tech? Q2 Earnings Analysis

Asia Tech recorded sales of 37 billion KRW, operating profit of 1 billion KRW, and net income of 0.6 billion KRW in Q2 2025, showing a significant decline year-on-year. Compared to Q1, sales decreased by 15.5%, operating profit plummeted by 80%, and net income fell by 84.6%.

2. Why the Earnings Slump?

The main causes of this earnings decline are sluggish domestic sales, seasonal factors, and intensified competition. The increased inventory from Q1 likely worsened due to poor sales in Q2, potentially leading to future margin contraction. External factors such as rising raw material prices also contributed to the decline in profitability.

3. What’s Next? Future Outlook

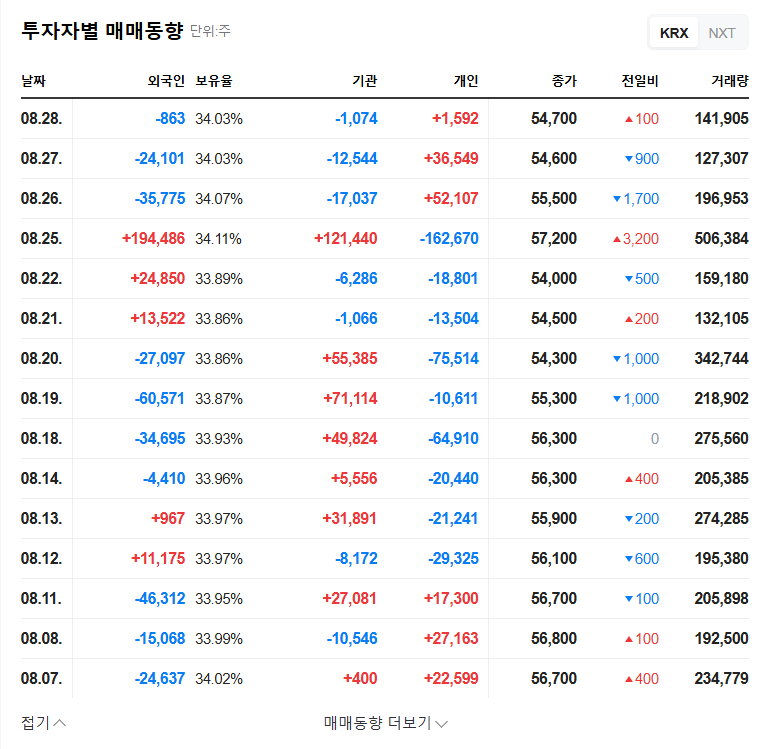

- Short-term outlook: Continued decline in sales and high inventory burden could put downward pressure on the stock price. Further stock price decline is expected if negative market sentiment intensifies.

- Mid- to long-term outlook: Successful establishment of new businesses such as smart farms, drone maintenance, and solar power generation is key to mid- to long-term growth. Recovery of the agricultural machinery market and government policy support could contribute to the improvement of existing businesses, but the current momentum is weak.

4. What Should Investors Do? Action Plan

Investors should be wary of potential stock price declines due to poor earnings in the short term. Closely monitor the performance of new businesses and improvements in inventory management efficiency. In the mid- to long term, carefully evaluate the potential success of the business diversification strategy.

What are the main reasons for Asia Tech’s poor Q2 performance?

A combination of sluggish domestic sales, seasonal factors, increased competition, rising inventory levels, and rising raw material prices contributed to the decline.

What are Asia Tech’s new business ventures?

Asia Tech is venturing into smart farms, drone maintenance, and solar power generation.

What should investors consider when investing in Asia Tech?

Investors should be mindful of short-term stock price volatility and closely monitor the performance of new businesses and improvements in inventory management efficiency.