1. Solid Defense CB Issuance: What Happened?

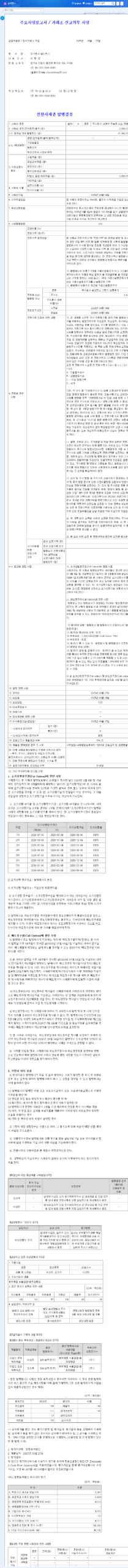

Solid Defense has decided to issue ₩2.6 billion worth of private convertible bonds. The conversion price is set at ₩838, slightly higher than the current stock price, and conversion requests can be made starting September 2028.

2. Why Issue Convertible Bonds?

The funds raised through this CB issuance will be used for Solid Defense’s operations and investments. Participating in major defense projects such as the KF-21 mission computer (MC) development, Solid Defense aims to strengthen its financial stability and secure future growth engines through this funding.

3. Impact of CB Issuance on Stock Price

- Positive Factors: With the conversion price higher than the current market price, the downward pressure on the stock price in the short term is expected to be limited. Furthermore, expectations of business expansion and improved performance through the secured funds could positively impact the stock price.

- Negative Factors: When convertible bonds are converted into stocks, there is a possibility of dilution of share value due to the increased number of outstanding shares. Also, negative corporate image due to past embezzlement and delisting issues could influence investor sentiment.

The current trading halt is a critical factor to consider for investment.

4. What Should Investors Do?

Investors considering Solid Defense should carefully review the following:

- Timing and likelihood of CB conversion

- Performance of key projects such as KF-21

- Normalization of management and ensuring transparency

- Resumption of trading

It is essential to make prudent investment decisions by comprehensively considering the overall market conditions and Solid Defense’s future business prospects.

Solid Defense CB: Frequently Asked Questions

What is Solid Defense?

Solid Defense is a company involved in the defense industry, participating in major national defense projects such as the KF-21 mission computer (MC) development.

How will the funds raised through the CB issuance be used?

The funds will be used for operating and investment purposes, contributing to strengthening financial stability and securing future growth engines.

What are the key investment considerations?

Investors should consider the past embezzlement issues and the current trading halt. The potential dilution of share value due to future CB conversion should also be taken into account.