1. What Happened at Hooseung?

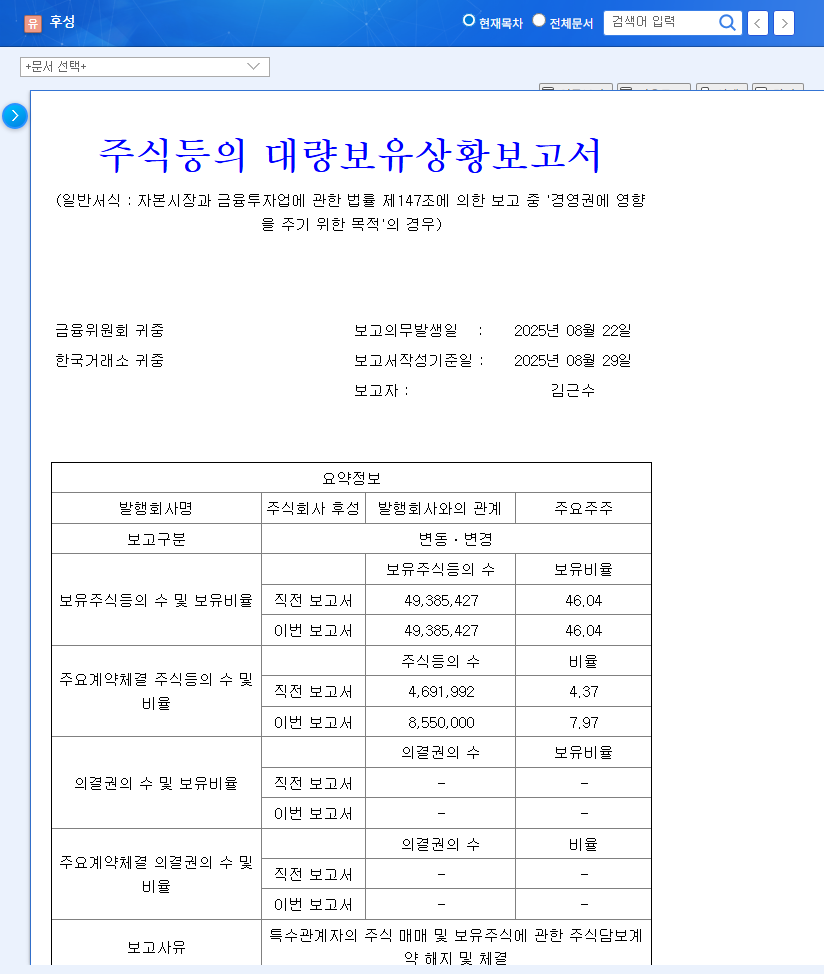

CEO Keun-Soo Kim and his related parties maintained their 46.04% stake in Hooseung. The key takeaway from the report is the stock transfer between related parties, Ilkwang E&C and Hooseung Holdings, and changes in stock pledge agreements. This suggests an internal restructuring of ownership.

2. Why Does It Matter?

The report signals management’s commitment to stability, a crucial factor for long-term investment planning and operational continuity. This is particularly important for Hooseung, given its anticipated investments in battery materials and semiconductor specialty gases.

3. What’s Next for Hooseung?

Hooseung reported Q1 2025 revenue of KRW 231.3 billion (up 4.91% YoY) and operating profit of KRW 14.6 billion (turning to profit). The strong performance in battery materials and semiconductor specialty gases drove the improvement. However, raw material prices and exchange rate volatility remain key risks. The reinforced management stability is expected to facilitate a more focused approach to managing these risks. The solid performance of the chemical equipment segment is also a positive factor.

4. What Should Investors Do?

- Maintain a long-term perspective: Considering the growth potential of the battery materials market and Hooseung’s competitive position, a long-term investment approach is recommended.

- Monitor management changes and strategies: Pay close attention to any further changes in management ownership or strategic shifts.

- Track macroeconomic factors: Continuously monitor the impact of macroeconomic variables like exchange rates and interest rates.

- Observe market expectations: Refer to analyst reports and market forecasts to inform investment decisions.

What are Hooseung’s main businesses?

Hooseung’s primary businesses are basic chemicals (including battery materials and semiconductor specialty gases) and chemical equipment.

What is the key takeaway from the large shareholding report?

CEO Keun-Soo Kim and related parties maintained their 46.04% stake, and there was a transfer of shares between related parties. This suggests a move towards greater management stability.

What is the outlook for Hooseung?

Hooseung is expected to benefit from the growth of the battery materials market and continued strong performance in the chemical equipment segment. However, investors should be mindful of risks related to raw material prices and exchange rate fluctuations.