1. What Happened?

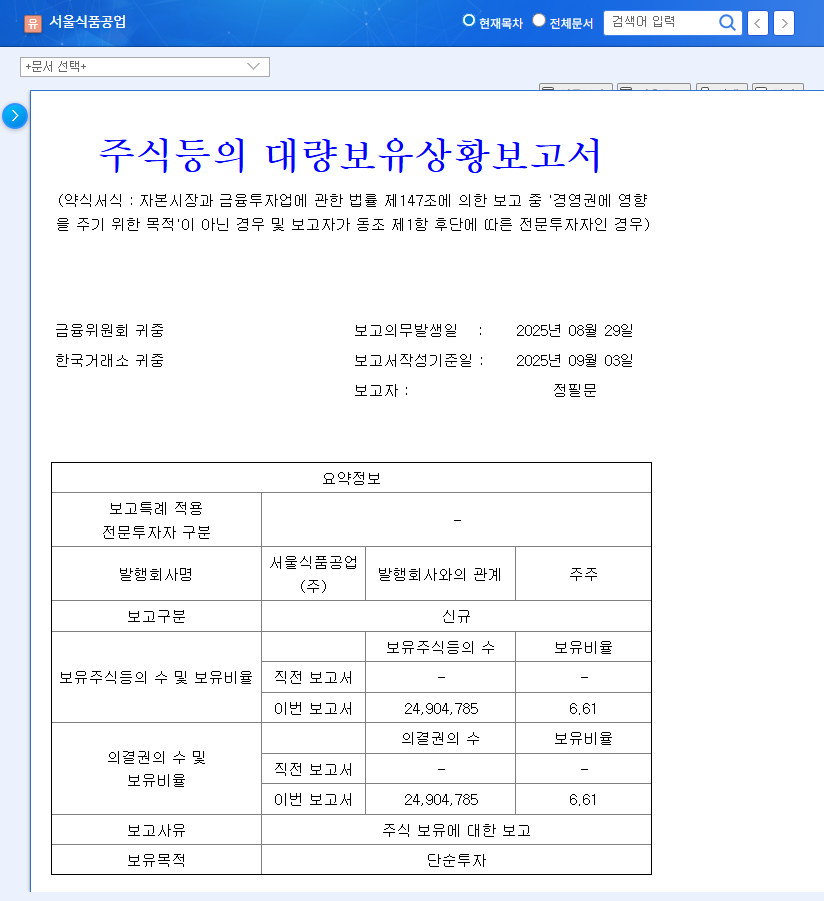

On September 3, 2025, a public announcement revealed that Seoul Food CEO Jeong Pil-moon acquired an additional 1,550,061 shares for investment purposes, securing a 6.61% stake in the company.

2. Why Does it Matter?

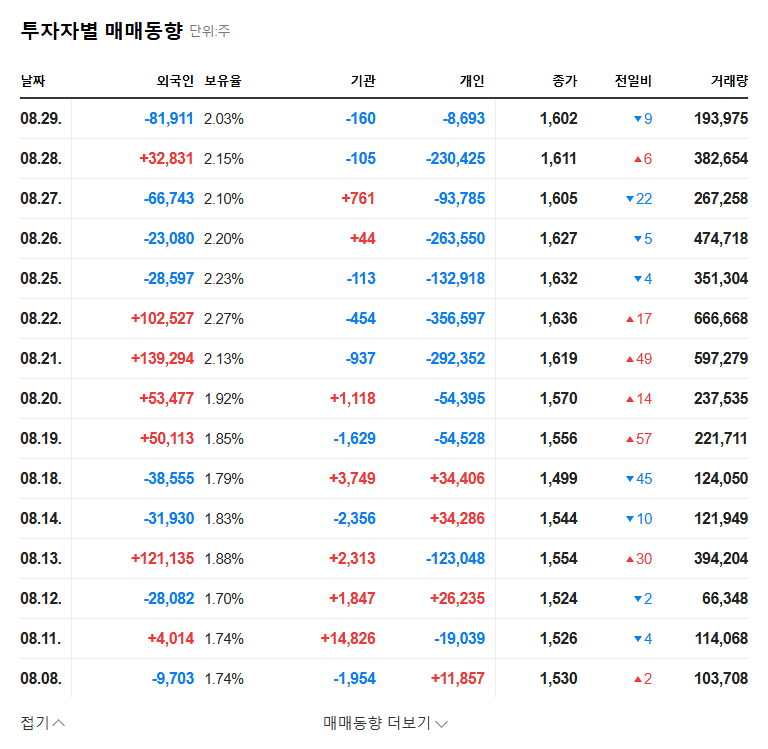

The increased stake can be interpreted as a positive signal, demonstrating the CEO’s commitment to responsible management. However, it’s crucial to acknowledge Seoul Food’s current struggles with severe underperformance. According to the 2025 semi-annual report, sales continue to decline, while operating and net losses are widening. The debt ratio is also increasing, raising concerns about potential capital impairment. External factors such as rising raw material prices, interest rate hikes, and intensifying competition also pose challenges.

3. So What Should I Do?

While CEO Jeong’s move might boost investor sentiment in the short term, sustained stock price growth is unlikely without fundamental improvement. Therefore, instead of being swayed by short-term price fluctuations, investors should carefully observe whether the company can fundamentally improve its constitution in the long run.

4. Investor Action Plan

- Keep an eye on Seoul Food’s future business plans and turnaround strategy announcements.

- Observe CEO Jeong’s management participation and actual changes.

- Monitor external factors such as fluctuations in raw material prices, exchange rates, and changes in the competitive landscape.

- Avoid being swept up in short-term market reactions and consider investments from a long-term perspective.

Will CEO Jeong’s increased stake positively impact Seoul Food’s stock price?

It could have a positive impact in the short term, but long-term stock price growth depends on fundamental improvements within the company.

What is Seoul Food’s current financial situation?

The company is facing significant challenges, including declining sales, continuous operating losses, and deteriorating financial health. There are even concerns about potential capital impairment.

What should investors be cautious about?

Investors should not be swayed by short-term stock price fluctuations and need to verify the company’s turnaround strategy and actual performance. Continuous monitoring of changes in the external environment is also necessary.