1. What’s Happening with SK Gas?

On August 27, 2025, SK Gas announced that it is considering selling a stake worth approximately $230 million to improve liquidity. Details of the sale have yet to be finalized, with a further announcement expected within a month.

2. Why is SK Gas Pursuing a Stake Sale?

The likely drivers behind this move are the struggling LPG business and the need to secure funding for investments in new ventures. The LPG market is facing increased competition and declining demand, negatively impacting SK Gas’s performance. Simultaneously, the company requires substantial capital for investments in LNG/LPG Dual Power plants, LNG terminals, US ESS projects, and hydrogen businesses.

- Declining Financial Performance: While operating profit reached 629.1 billion KRW in 2022, it swung to a loss of 133 billion KRW in 2023 and is projected to deepen to a loss of 97 billion KRW in 2025.

- Investment Needs: Funding future growth through investments in new business ventures requires significant capital.

3. What’s the Potential Impact?

The stake sale offers potential benefits like improving SK Gas’s financial structure and securing investment funds. However, depending on the assets sold and the terms of the sale, there are potential downsides such as weakening the core business and diluting shareholder value.

- Positive Impacts: Lower debt-to-equity ratio, increased capacity for new business investments.

- Negative Impacts: Potential weakening of core business competitiveness, dilution of shareholder value.

Careful evaluation of the target assets, sale terms, and planned use of funds is crucial.

4. What Should Investors Do?

A neutral stance is recommended at this time. Investors should closely monitor the details of the stake sale revealed in the upcoming announcement, SK Gas’s performance in its new business ventures, and changes in the macroeconomic environment before making investment decisions.

Key Considerations:

- Details of the stake sale (target assets, size, and conditions)

- Planned use of funds (new investments, debt repayment, etc.)

- Performance and outlook of new business ventures

FAQ

Is the SK Gas stake sale confirmed?

No, it is currently under consideration and further details will be announced within a month.

How will the funds from the stake sale be used?

While not officially announced, the funds are expected to be used for investments in new business ventures and improving the financial structure.

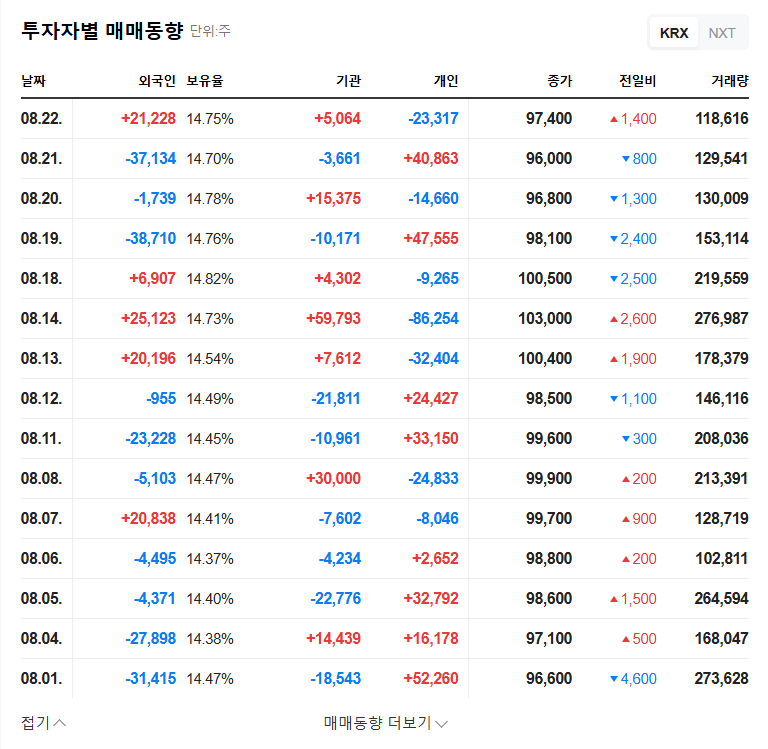

How might this impact SK Gas’s stock price?

The impact on the stock price can be positive or negative depending on market conditions and the terms of the sale. Increased volatility is possible after the announcement, so investors should proceed with caution.