1. Maeil Holdings Stock Buyback: What Happened?

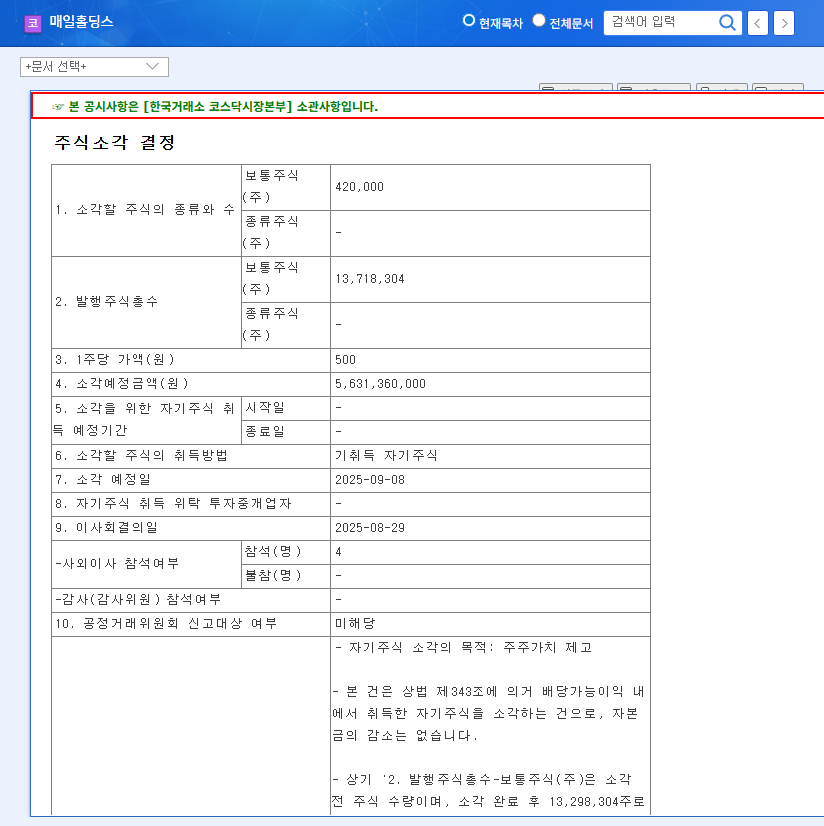

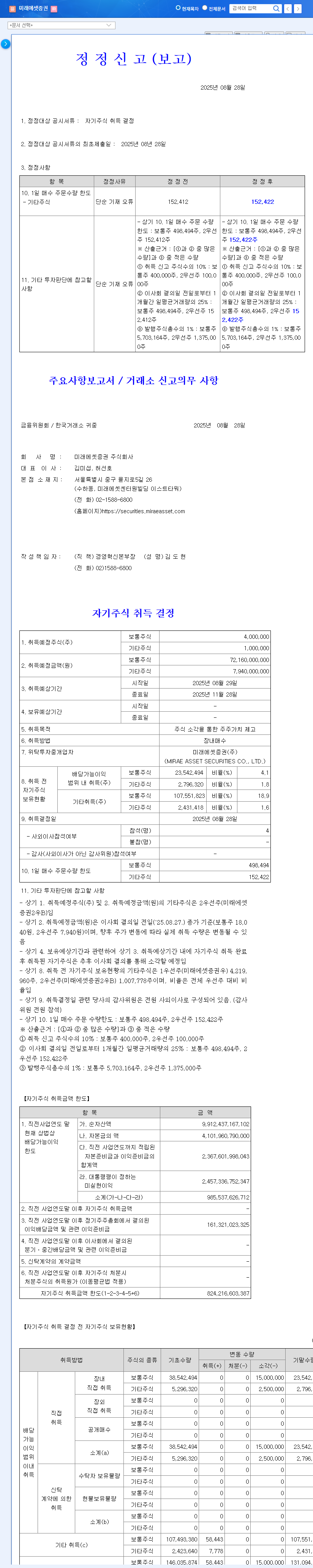

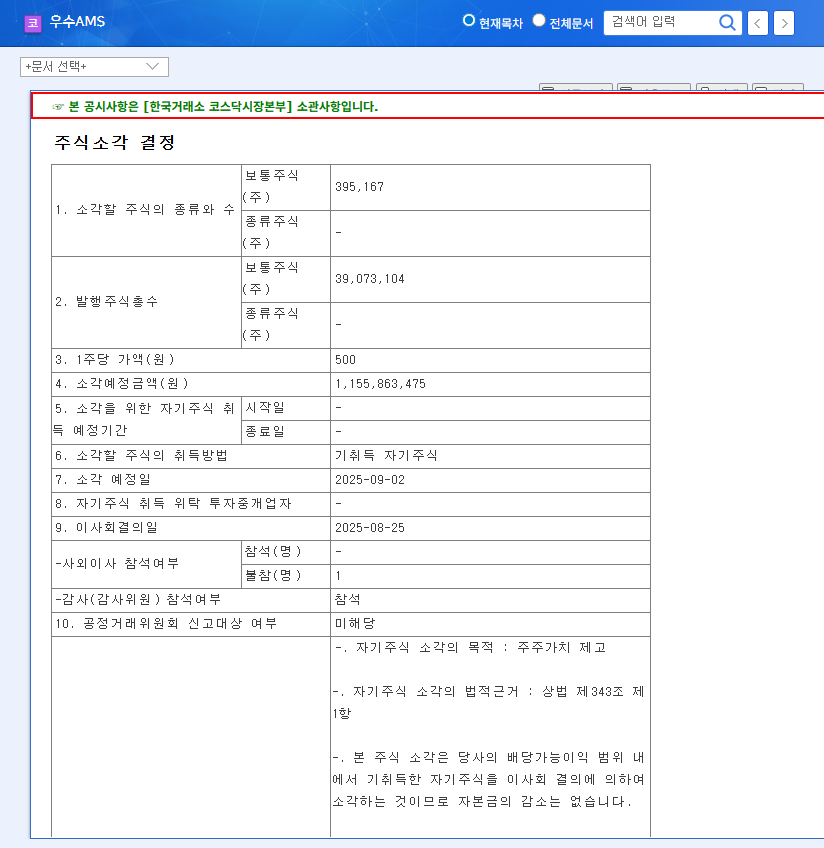

On August 29, 2025, Maeil Holdings announced a decision to buy back and retire 420,000 common shares (approximately 3.66% of the market capitalization). The cancellation date is scheduled for September 8th.

2. Why the Buyback Decision?

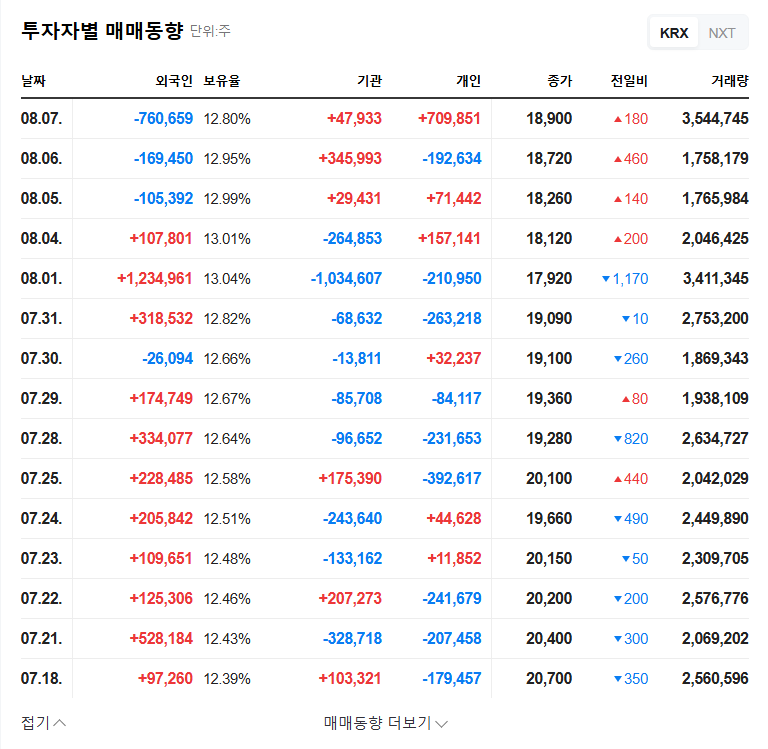

Maeil Holdings has recently experienced a slowdown in profitability. In this situation, the stock buyback is interpreted as an effort to enhance shareholder value. It is analyzed as an attempt to increase the value per share and improve investor sentiment.

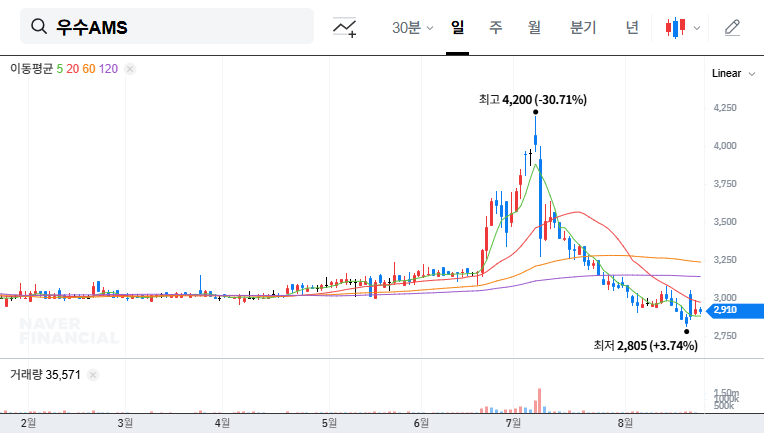

3. Stock Price Outlook and Investment Strategies?

Positive Aspects:

- ➡️ Expected increase in Earnings Per Share (EPS) and Book Value Per Share (BPS), leading to a potential rise in stock price.

- ➡️ Possibility of improved investor sentiment due to strengthened shareholder return policy.

Negative Aspects:

- ➡️ Short-term cash outflow.

- ➡️ No fundamental change in the company’s fundamentals.

Investment Strategies:

- ➡️ Potential for short-term stock price increase, but requires careful monitoring of fundamental improvements.

- ➡️ In the mid-to-long term, the company’s response to changes in the dairy/restaurant market and improvement in subsidiaries’ performance are crucial.

4. Investor Action Plan

While the stock buyback can act as a short-term positive catalyst, fundamental improvements are essential for sustained stock price growth. Investors should closely monitor Maeil Holdings’ future performance and industry trends.

Frequently Asked Questions

What is a stock buyback?

It refers to a company repurchasing its own shares and then retiring them. This reduces the number of outstanding shares, leading to an increase in the value per share.

Should I invest in Maeil Holdings stock now?

While there is a possibility of a short-term stock price increase, mid-to-long-term investment requires careful consideration of the company’s fundamental improvements.

What is the future outlook for Maeil Holdings?

The company faces challenges such as intensifying competition and declining profitability in the dairy and restaurant markets. The improvement in subsidiaries’ performance and strengthening of business competitiveness are key variables.