1. What Happened?

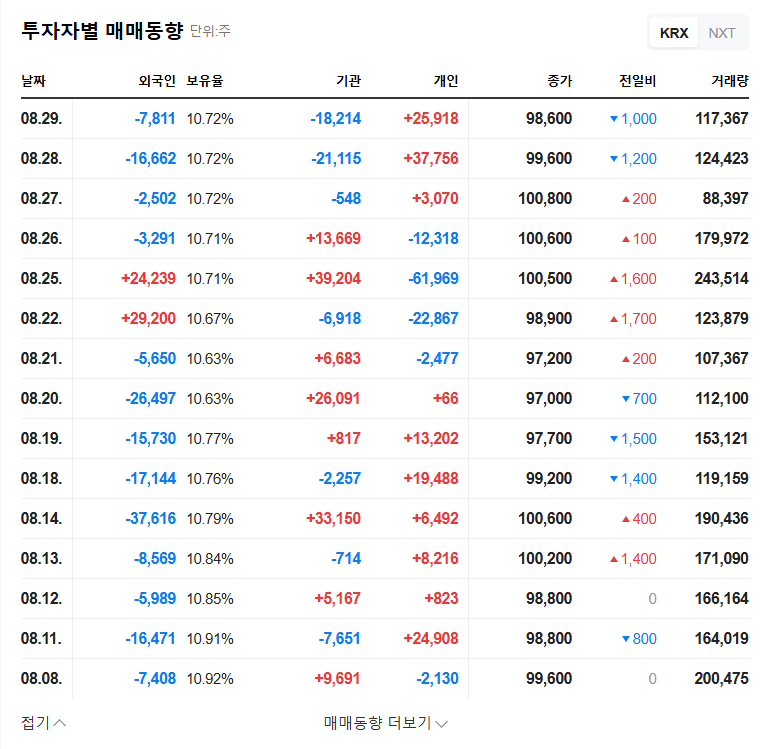

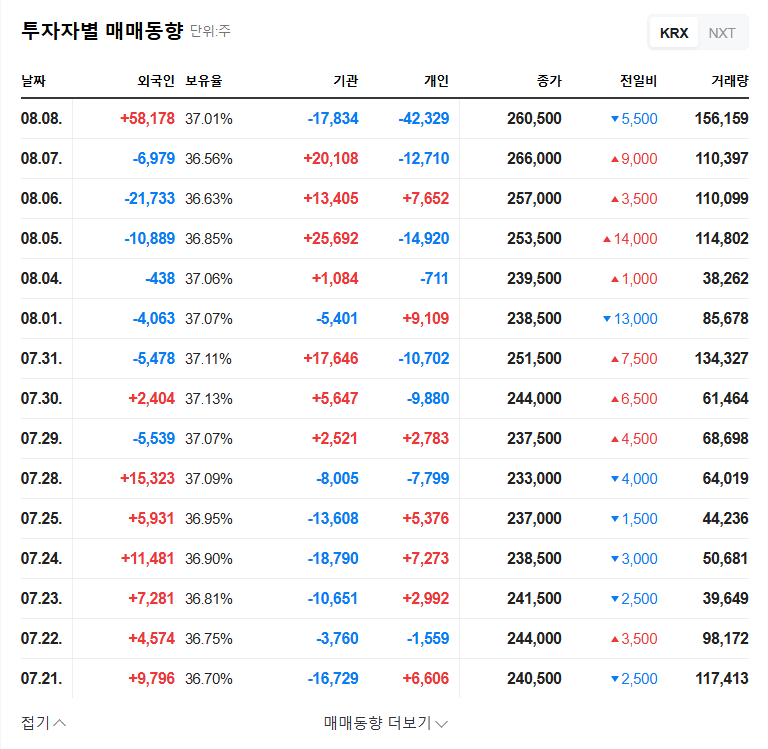

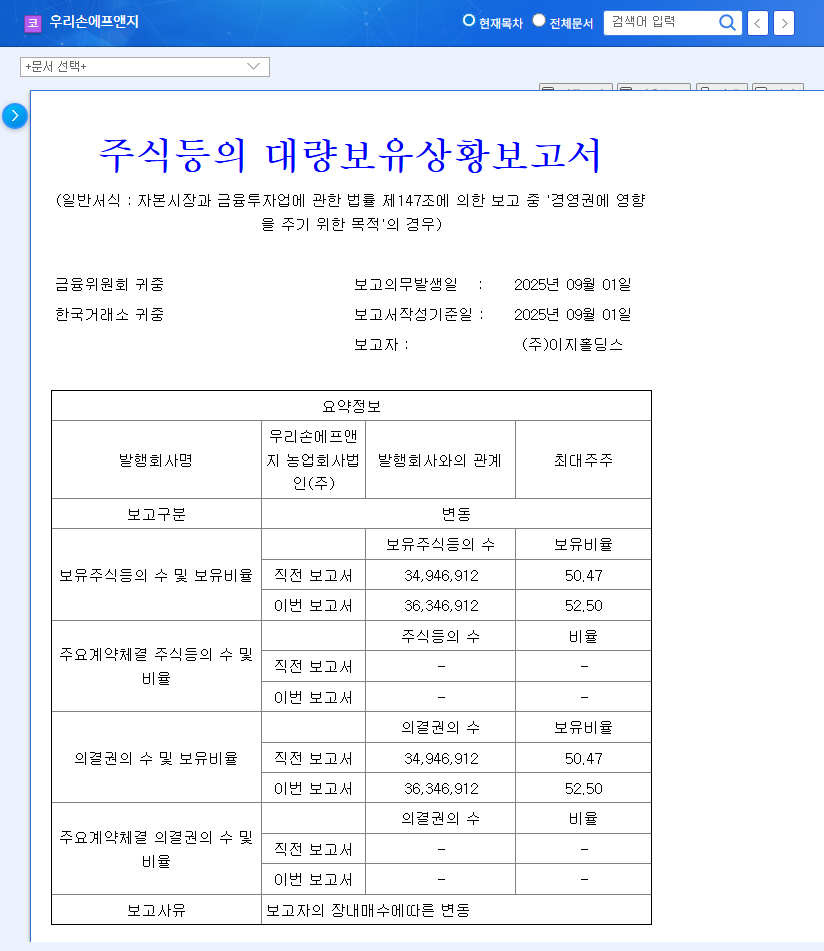

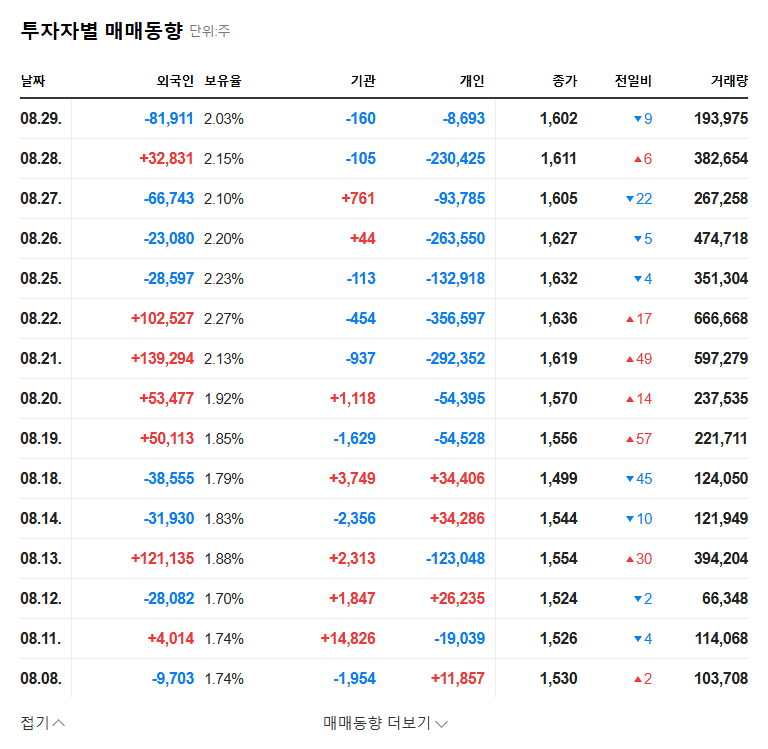

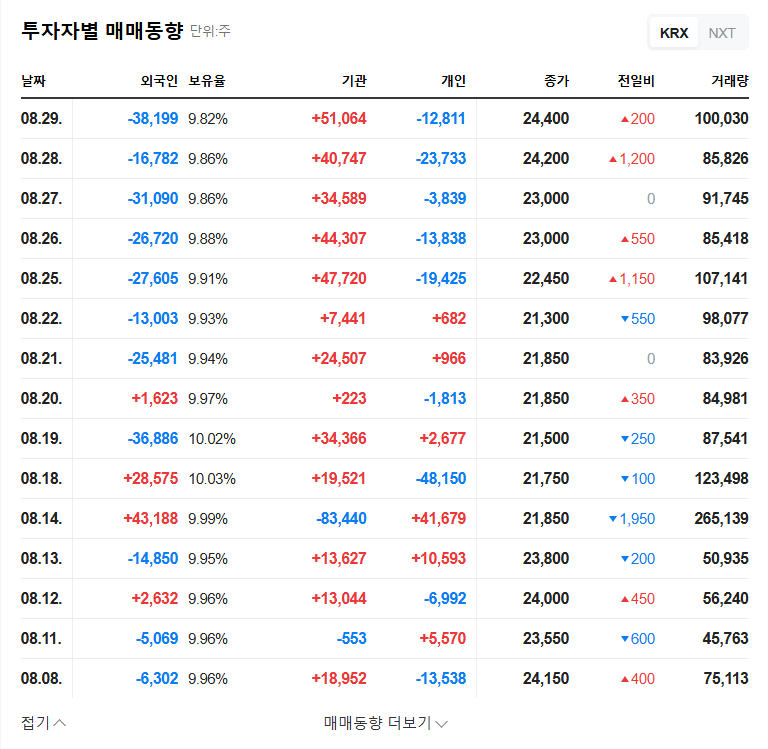

HAS’s CEO and related parties recently increased their stake to 60.72%. Through continuous purchases in the market since mid-August, they increased their stake by 0.94%p.

2. Why the Increased Stake?

This is interpreted as expressing confidence in strengthening management control and the company’s future value. Active stake purchases amid poor performance can send a positive signal to investors.

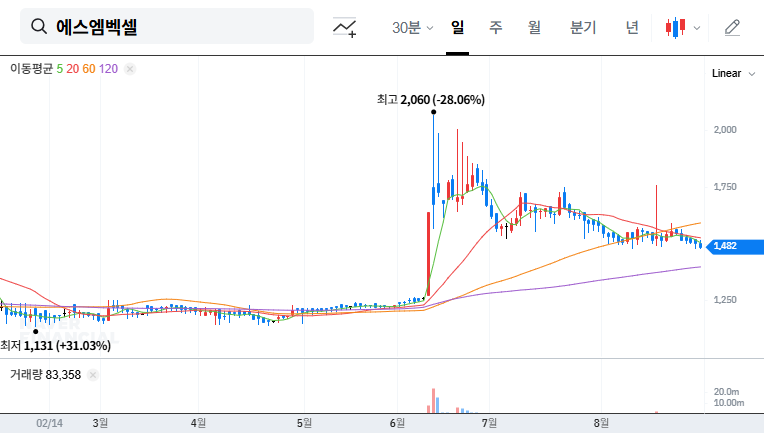

3. So, What About the Stock Price?

A positive impact can be expected in the short term. The news of the stake increase can improve investor sentiment and attract buying interest. However, the mid- to long-term stock price trend depends on whether fundamentals improve. HAS is currently facing challenges such as declining sales, deteriorating profitability, and a global economic slowdown.

4. What Should Investors Do?

- Maintain a Long-Term Perspective: Focus on the company’s fundamental improvement rather than short-term stock price fluctuations.

- Monitor Performance Improvement Trends: Check for sales recovery and profitability improvement through future earnings reports.

- Keep an Eye on Macroeconomic Changes: Continuously assess the impact of macroeconomic variables such as exchange rates, interest rates, and economic slowdown.

- Cautious Approach: Despite positive signals, fundamental burdens still exist, so a conservative and cautious approach is necessary.

Q: What is the stock price forecast for HAS?

A: In the short term, it may be positively affected by management’s stake increase, but the mid- to long-term stock price will depend on whether fundamentals improve. Currently, there is high uncertainty, so careful investment is required.

Q: Is it okay to invest in HAS?

A: Investment should always be made at your own discretion and responsibility. If you are considering investing in HAS, you should comprehensively analyze the company’s fundamentals, management’s will, market conditions, etc., and make a careful decision.

Q: What is the future earnings outlook for HAS?

A: While the first half of 2025 earnings were sluggish, the company is focusing on new product development through R&D investment. Future earnings improvement will depend on the outcome of these efforts and the macroeconomic environment.