Analysis of INVENI’s Shareholder Value Enhancement Policy

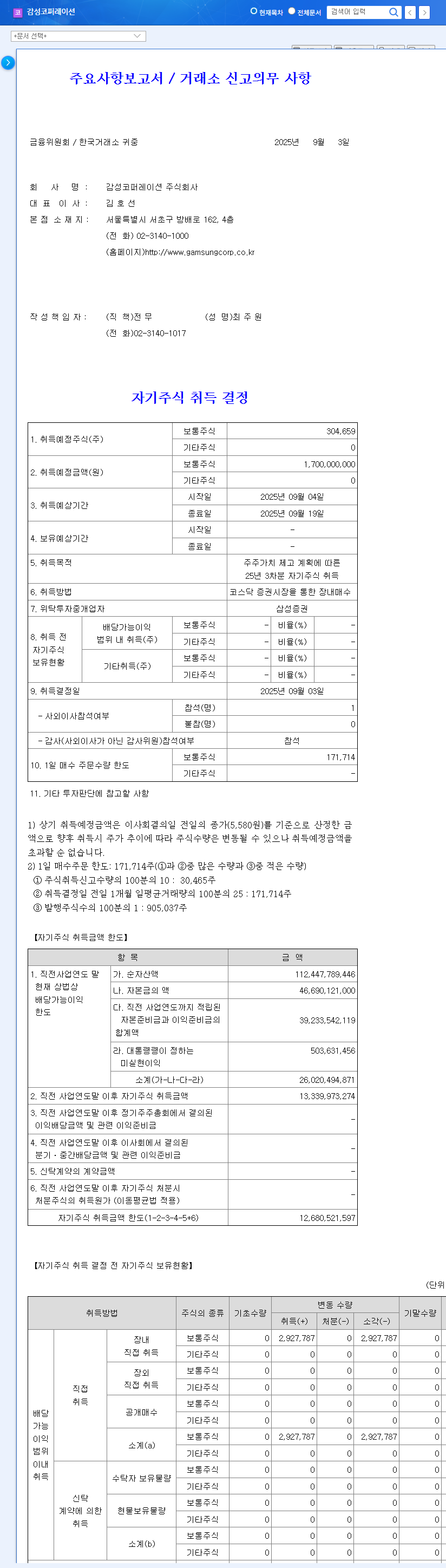

On September 3, 2025, INVENI announced its policy to enhance shareholder value. The core elements include maintaining a minimum dividend of KRW 3,000 per share for the next three years and repurchasing 5% of outstanding shares (300,000 shares, approximately KRW 19 billion) by the end of 2026.

Background and Objectives of the Shareholder Return Policy

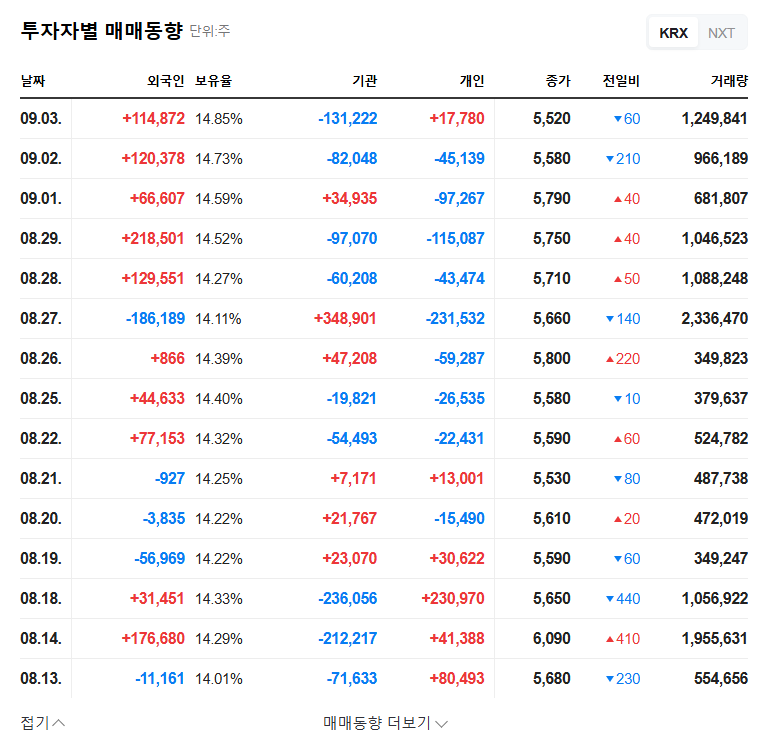

INVENI has recently faced performance challenges. The announcement of this shareholder return policy is interpreted as a strategy to address investor concerns and restore market confidence. Furthermore, the share buyback aims to improve earnings per share (EPS) and book value per share (BPS), thereby increasing the company’s value.

Potential Benefits and Risks

- Benefits: Clear shareholder return policy, potential for stock price appreciation and increased investment attractiveness, strengthened financial soundness, improved management transparency and credibility.

- Risks: Uncertainty regarding profit recovery, lack of transparency in funding the share buyback, potential changes in market conditions and the business environment.

Investor Action Plan

Investors should consider the potential for short-term stock price gains while carefully evaluating the likelihood of profit recovery and policy execution from a long-term perspective. The impact of macroeconomic variables should also be taken into account. Fluctuations in exchange rates, interest rates, oil prices, and sea freight rates, which are relevant to INVENI’s business model, could affect investment returns.

What is the scale of INVENI’s share buyback?

INVENI plans to repurchase 300,000 shares, representing 5% of its total outstanding shares.

What is INVENI’s dividend policy?

The company plans to maintain a minimum dividend of KRW 3,000 per share for the next three years.

Will INVENI’s shareholder return policy announcement positively impact its stock price?

A positive short-term stock price reaction is anticipated, but the company’s ability to improve profitability will be a crucial factor in the medium to long term.