What Happened at Shinstill?

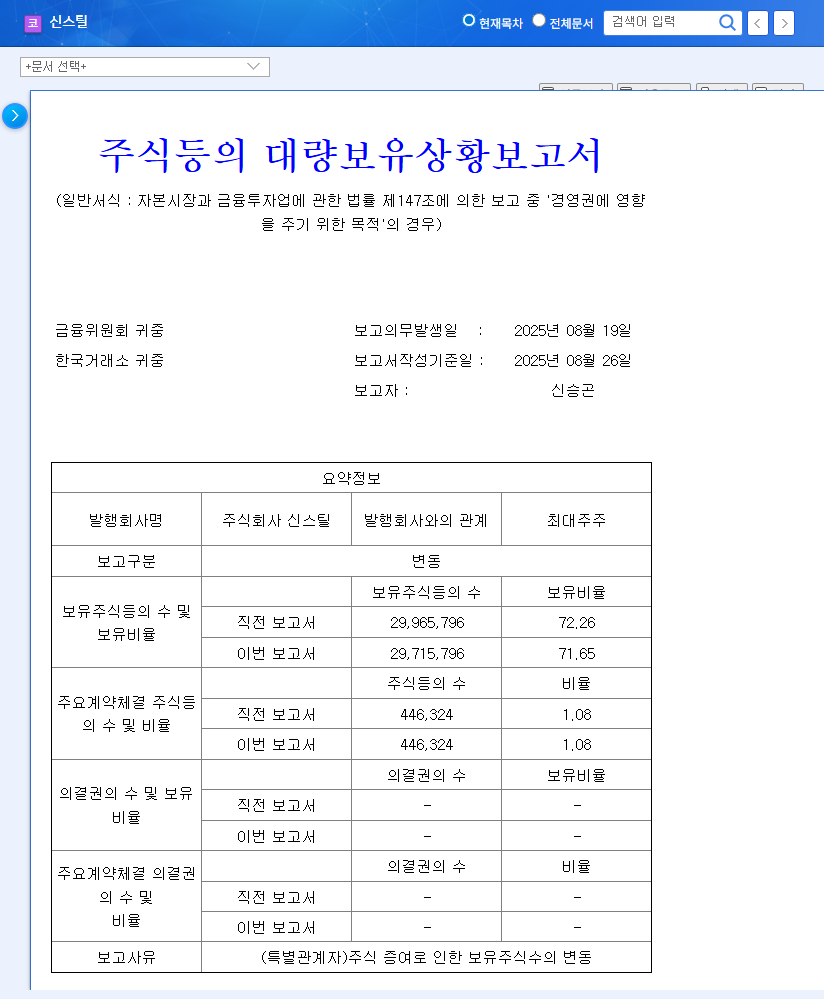

Shinstill’s CEO Shin Seung-gon and related parties gifted 250,000 common shares to Mr. Seok Jin-gwang, resulting in a change in shareholding ratio. This decreased the total shareholding from 72.26% to 71.65%. This information was disclosed on August 19, 2025.

Why Did This Happen?

The specific purpose of the gift hasn’t been disclosed, but generally, there can be various reasons such as share diversification, inheritance planning, or management succession. Currently, the stock gift itself doesn’t directly impact the company’s fundamentals. However, it’s necessary to closely monitor potential changes in shareholder composition and management strategies.

The Gift’s Impact on Shinstill’s Future

Short-term Impact:

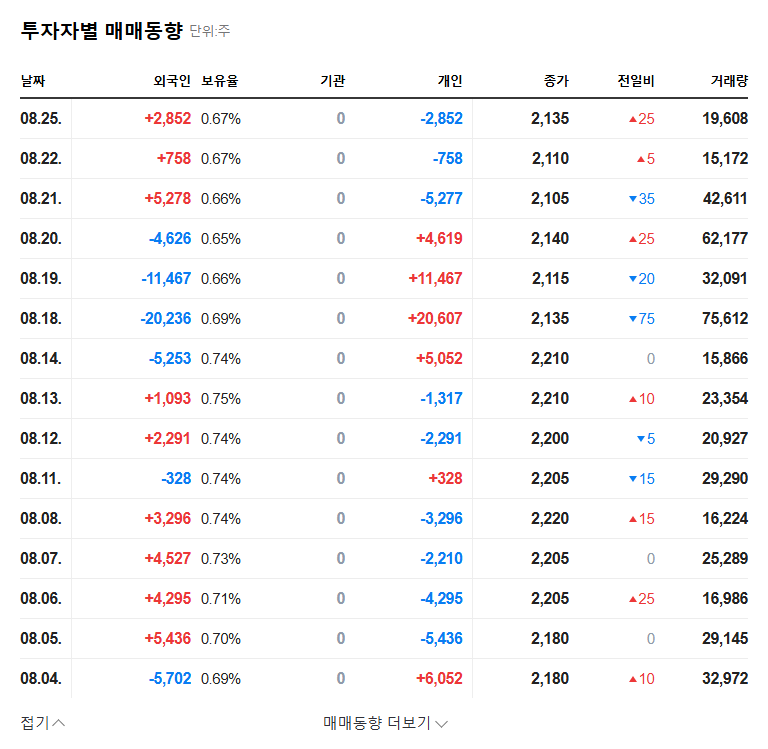

- Potential for Increased Stock Volatility: Share changes can influence investor sentiment, increasing short-term stock volatility.

- Low Possibility of Management Change: As CEO Shin Seung-gon still maintains a high ownership stake, the possibility of a short-term management change is low.

Mid- to Long-term Impact:

- The emergence of new shareholders could lead to future changes in management strategies.

- If the gifted shares are sold, it could put downward pressure on the stock price.

What Should Investors Do?

Shinstill is currently facing difficulties due to the global economic slowdown and sluggishness in related industries. There are many challenges to overcome, such as declining sales, deteriorating profitability, and the burden of foreign exchange and financial costs. While this stock gift may cause short-term stock price fluctuations, it doesn’t solve the company’s fundamental problems. Therefore, investors should focus on whether the company’s fundamentals improve and its long-term growth potential rather than short-term price fluctuations. Careful investment decisions should be made by closely monitoring future earnings announcements and changes in management strategies.

Frequently Asked Questions

How will this stock gift affect Shinstill’s stock price?

It could increase stock volatility in the short term, but the long-term impact depends on Shinstill’s fundamental improvement.

What is Shinstill’s current financial status?

Due to the global economic slowdown and a sluggish related industry, Shinstill is experiencing difficulties, including declining sales and deteriorating profitability. However, the high ownership stake of major shareholders can contribute to management stability.

Should I invest in Shinstill?

Currently, there is high uncertainty, so it is recommended to approach with a conservative perspective. Careful investment decisions should be made by closely monitoring future earnings improvements, normalization of overseas businesses, and cost management strategies.