What Happened?

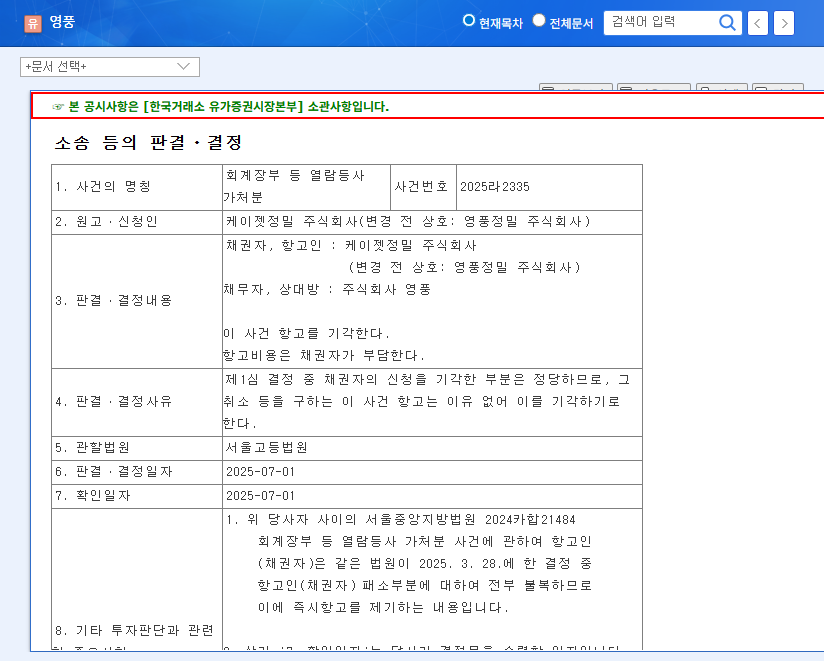

On September 2, 2025, the Seoul High Court dismissed Youngpoong’s appeal against the injunction filed by KZ Precision (formerly Youngpoong Precision) regarding the inspection of its accounting books. This upholds the original court’s decision.

Why Does It Matter?

This ruling is significant due to the ongoing dispute between Youngpoong and KZ Precision regarding stake ownership or management control. The dismissal provides short-term certainty for Youngpoong’s operations and can be seen as a positive sign for investors. However, the possibility of further legal action by KZ Precision remains.

What’s Next?

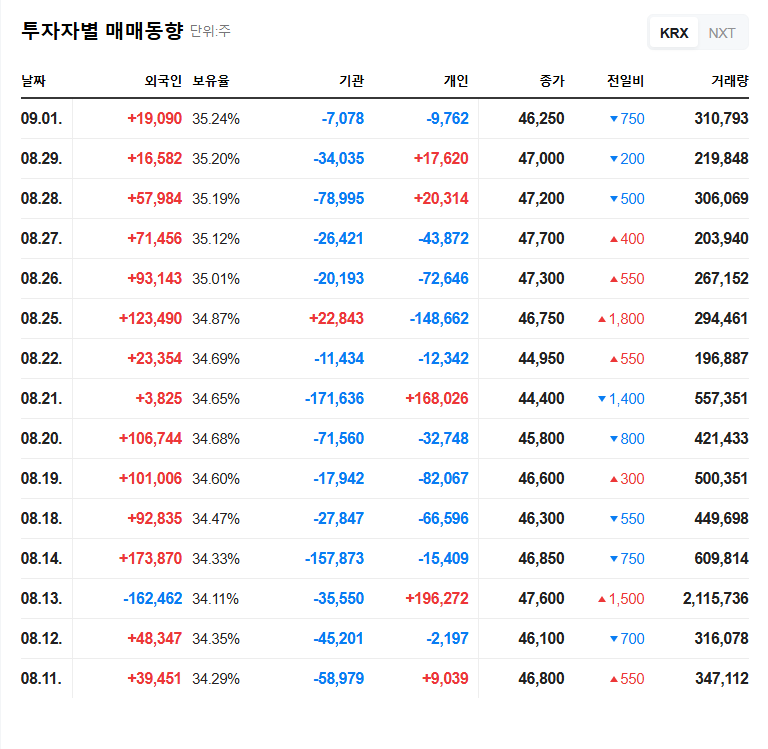

- Stock Impact: A positive short-term impact is possible, but Youngpoong’s financial performance (declining sales and operating loss) will be key to its stock price trajectory.

- Company Operations: Direct restrictions on accounting practices and management are unlikely. However, further actions by KZ Precision could change this.

- Long-Term Outlook: Strengthening core businesses (non-ferrous metal smelting, electronic components) and addressing environmental concerns related to the Seokpo smelter will determine Youngpoong’s long-term growth.

What Should Investors Do?

Instead of reacting to short-term fluctuations, investors should consider Youngpoong’s financial recovery, potential responses from KZ Precision, and strategies to strengthen its core businesses when formulating a long-term investment strategy.

FAQ

Will this ruling positively impact Youngpoong’s stock price?

A positive short-term impact is anticipated, but Youngpoong’s earnings improvement is crucial.

How is KZ Precision expected to respond?

Further legal action is possible, and the situation warrants close monitoring.

What is the long-term investment outlook for Youngpoong?

It depends on strengthening core businesses and addressing environmental concerns.