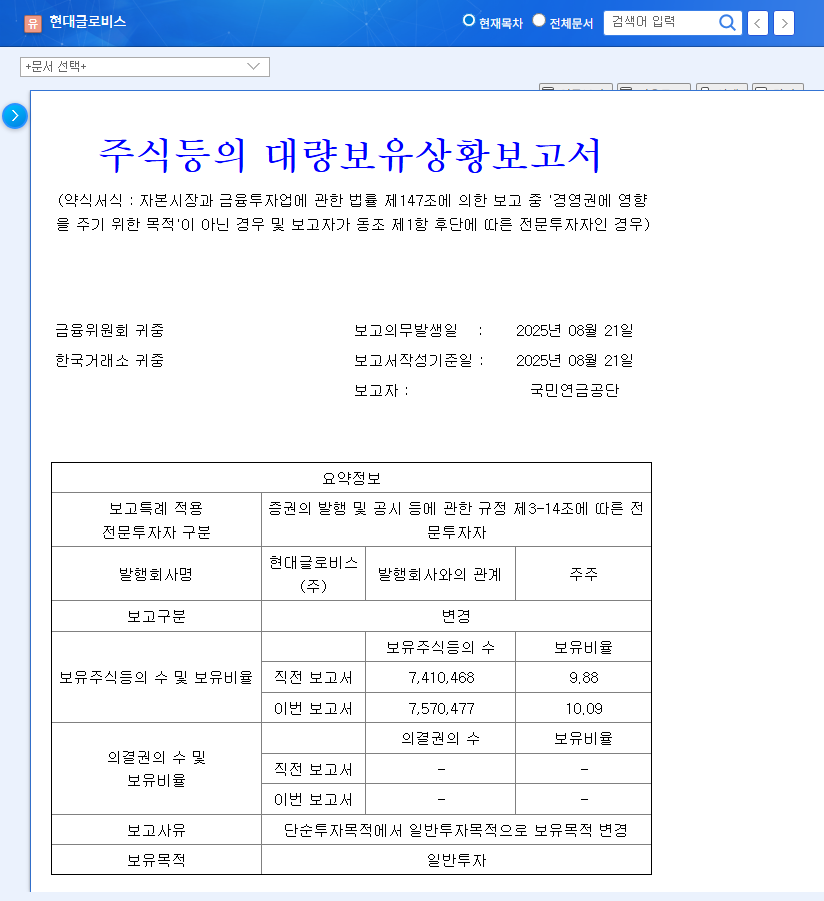

1. What Happened?: NPS Increases Stake in Hyundai Glovis

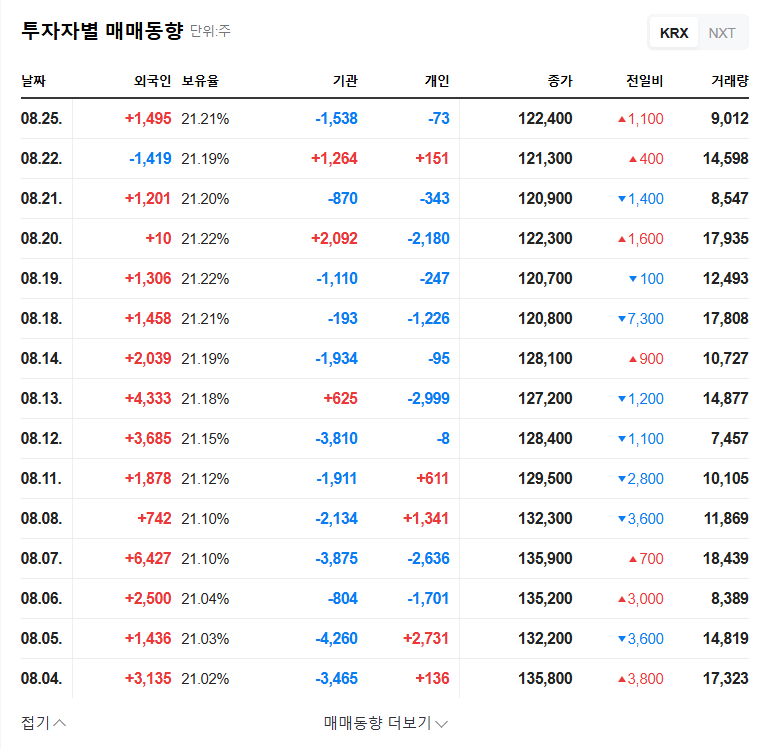

On August 27, 2025, the NPS increased its stake in Hyundai Glovis from 9.88% to 10.09% and changed its holding purpose from ‘simple investment’ to ‘general investment.’ This suggests that the NPS has a higher evaluation of Hyundai Glovis’s growth potential.

2. Why is it Important?: Positive Signal and Fundamental Analysis

The NPS’s stake increase can be a positive signal for the market. It reflects the confidence of institutional investors and could stimulate investment sentiment among other investors. However, it does not directly affect the fundamentals. According to Hyundai Glovis’s semi-annual report for the 25th fiscal year, the company continues to achieve solid earnings growth and is securing future growth engines through investments in new businesses. High cash assets and a stable capital structure are also positive factors. However, the global economic slowdown, exchange rate and interest rate volatility, and raw material price fluctuations are potential risk factors.

3. What’s Next?: Short-Term Upside Potential, Long-Term Perspective is Key

The NPS’s stake increase is likely to act as a short-term upward momentum for the stock price. However, investments should always be approached from a long-term perspective. It is necessary to closely monitor Hyundai Glovis’s continued earnings growth and changes in the macroeconomic environment.

4. What Should Investors Do?: Continuous Monitoring and Prudent Investment

Rather than being swayed by short-term stock price fluctuations, it is crucial to continuously monitor Hyundai Glovis’s fundamentals and future growth potential. Pay close attention to changes in macroeconomic indicators such as US and European interest rates, international oil prices, and exchange rate trends, and make prudent investment decisions.

How will the NPS’s stake increase affect Hyundai Glovis’s stock price?

In the short term, stock prices may rise due to improved investor sentiment, but the long-term stock trend will depend on the company’s fundamentals and macroeconomic conditions.

What is Hyundai Glovis’s investment strategy?

Hyundai Glovis is expanding its investments to secure future growth engines such as EV battery recycling and hydrogen/ammonia transportation, based on its core businesses of integrated logistics, distribution & sales, and shipping.

What should I be aware of when investing in Hyundai Glovis?

Be aware of changes in the macroeconomic environment, such as the global economic slowdown, exchange rate and interest rate volatility, and raw material price fluctuations. Continuous monitoring of the company’s fundamentals and future growth potential is also necessary.