1. The $3 Billion Deal: What It Means

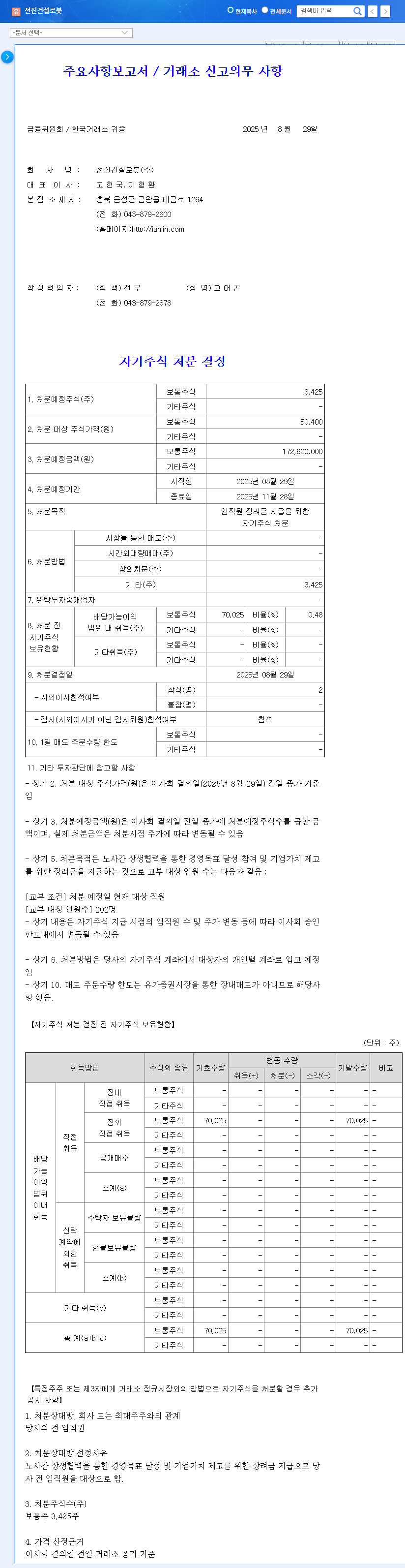

Keangnam Enterprises has signed a contract for a $3 billion public housing project, spanning 4 years and 1 month. Representing 12.55% of Keangnam’s revenue, this substantial contract is expected to play a key role in improving the company’s current financial situation.

2. Positive Impacts: Financial Improvement and Growth Momentum

This contract is anticipated to positively impact Keangnam Enterprises.

- Increased Revenue and Financial Health: The $3 billion contract should boost revenue, leading to improvements in operating and net income, and contributing to financial recovery.

- Stable Business Portfolio: The public-led project offers stable profitability, diversifying and strengthening the company’s business portfolio.

- Potential Stock Price Boost: The large-scale contract could attract market attention and act as a catalyst for stock price appreciation.

3. Risks to Consider: Cost Management and Market Conditions

It’s crucial to acknowledge potential downsides.

- Long-Term Cost Management: Managing costs effectively over the 4-year contract period is critical, as unforeseen factors like rising material prices could impact profitability.

- Project Execution Risks: Construction projects inherently carry unpredictable risks such as design changes and permit delays.

- Macroeconomic Factors: A downturn in the economy, including rising interest rates or a real estate slump, could negatively affect the construction sector.

Investors should carefully consider these factors before making any investment decisions.

4. Action Plan for Investors

This contract presents a positive catalyst for Keangnam, but potential risks exist. Before investing,

- Analyze Contract Details: Examine the projected profit margins and cost management strategies.

- Monitor Project Progress: Keep track of permit approvals, construction timelines, and overall project development.

- Assess Macroeconomic Indicators: Understand the impact of interest rates, real estate market trends, and other relevant indicators on your investment strategy.

A balanced perspective and thorough due diligence are essential for informed investment decisions.

Frequently Asked Questions

How significant is this contract for Keangnam’s performance?

The $3 billion contract represents 12.55% of Keangnam’s revenue, making it a substantial deal with the potential to significantly improve the company’s performance and aid in its financial recovery.

What are the potential risks during the contract period?

Risks include challenges in managing costs over the 4-year period due to factors like rising material prices. Construction projects also face inherent risks such as design changes and permit delays. Macroeconomic factors like rising interest rates and a potential real estate market downturn also pose risks.

What precautions should investors take?

Investors should carefully analyze the contract’s profitability, project execution plans, cost management strategies, and macroeconomic forecasts. Maintain a balanced perspective, conduct thorough research, and make informed investment decisions based on a comprehensive assessment of the situation and potential market changes.