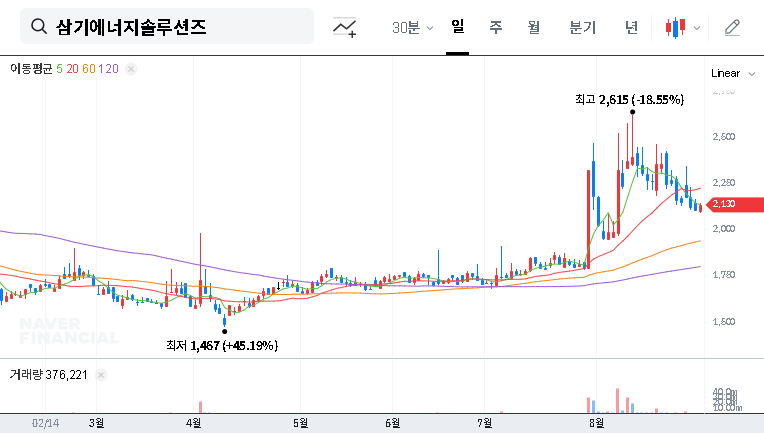

1. What Happened? Samkee Energy Solutions Announces Convertible Bond Offering!

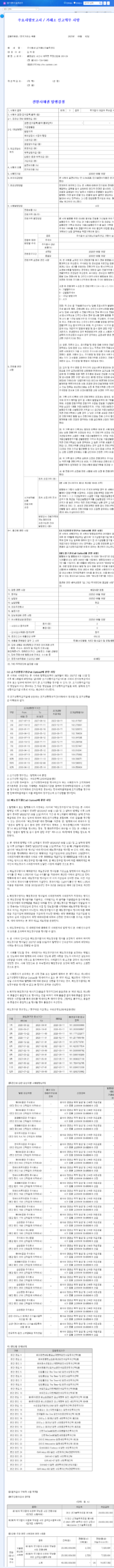

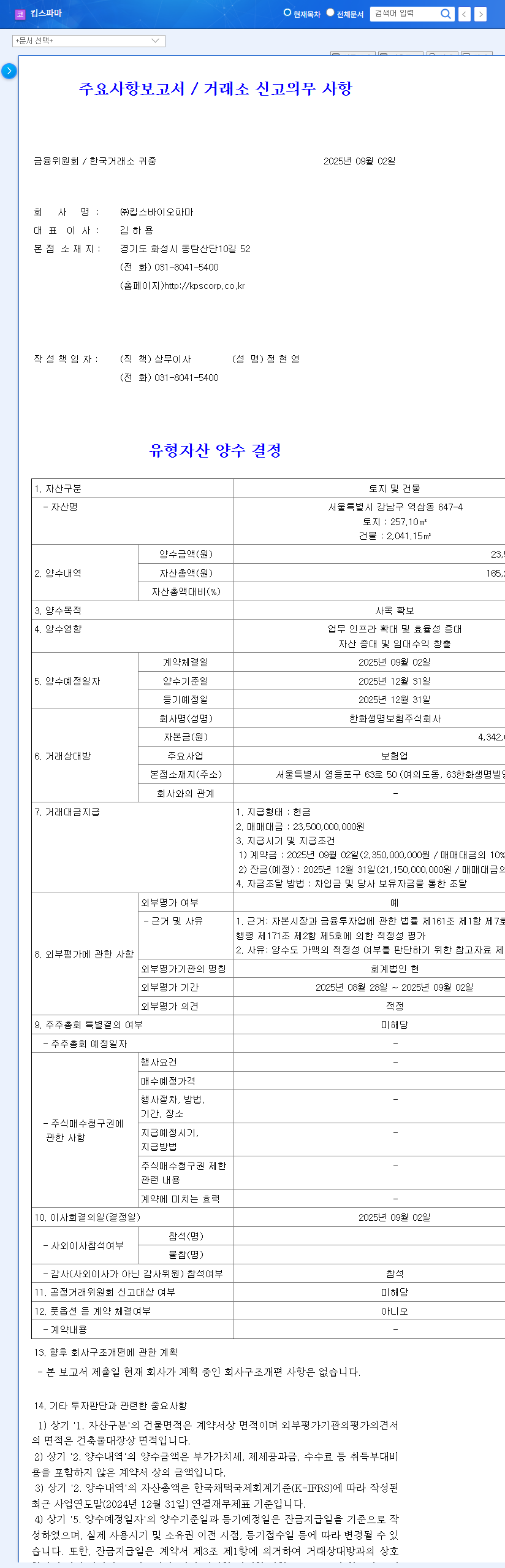

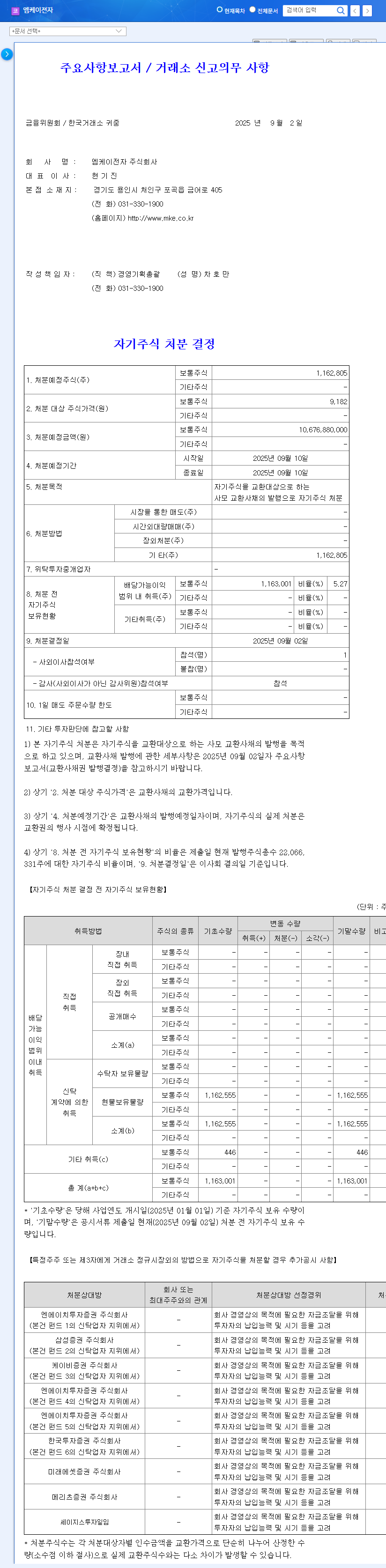

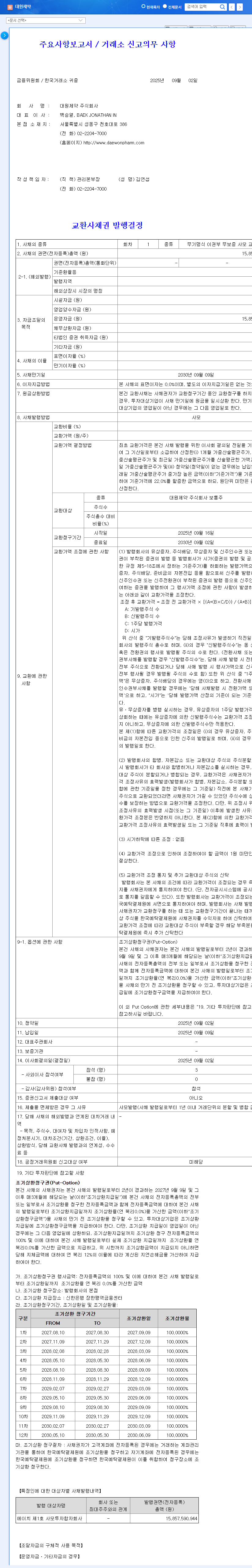

Samkee Energy Solutions announced a convertible bond offering on September 2, 2024. This decision aims to raise capital, which can be used for various purposes such as securing operating funds, investing in R&D, or expanding into new businesses.

2. Why Does it Matter? The Two Sides of Convertible Bonds: Opportunity and Risk

Convertible bonds offer the advantage of providing funds for company growth, but they also carry the disadvantage of potential stock dilution for existing shareholders upon conversion and increased interest expenses. Investors should carefully review the purpose and conditions of the offering.

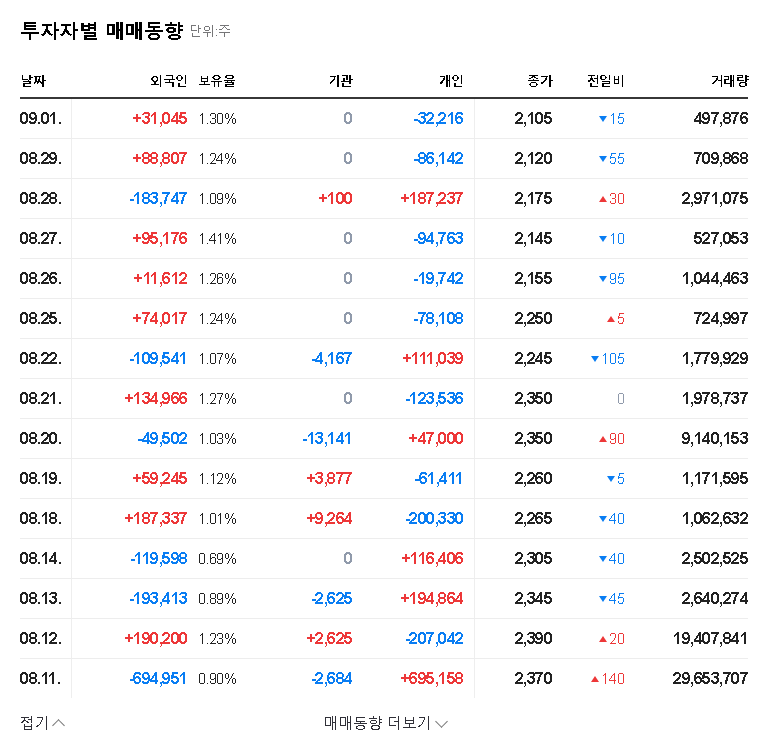

3. So, What Should You Do? Investment Strategies Based on the H1 2025 Report Analysis

According to the H1 2025 report, Samkee Energy Solutions showed positive results, including the ESS BMS cable supply contract with LG Energy Solution. However, it also faces challenges such as sluggish performance and financial burdens. Therefore, investors should consider the following:

- Short-term investment strategy: Carefully review the terms of the convertible bond offering, potential stock dilution, recovery of existing business profitability, and initial performance of the electric vehicle component business, and invest cautiously.

- Mid- to long-term investment strategy: Continuously monitor the performance of the electric vehicle component division, efforts to improve financial structure, and growth of the global electric vehicle market, and consider investments from a long-term perspective.

4. Further Analysis: Macroeconomic Indicators

The rise in the USD/KRW exchange rate is positive for Samkee Energy Solutions as an exporting company, but the decline in the EUR/KRW exchange rate and the possibility of a global economic slowdown are risk factors. The possibility of interest rate cuts can help reduce borrowing costs, but the potential for increased exchange rate volatility should also be considered.

What is Samkee Energy Solutions’ main business?

Samkee Energy Solutions manufactures components for electric vehicle batteries and ESS (Energy Storage Systems).

What are convertible bonds?

Convertible bonds are bonds that give the holder the right to convert them into shares of the issuing company’s stock after a certain period.

How does a convertible bond offering affect stock prices?

Convertible bond offerings can have both positive and negative effects on stock prices in the short term. In the long term, the potential for stock dilution upon conversion should be considered.