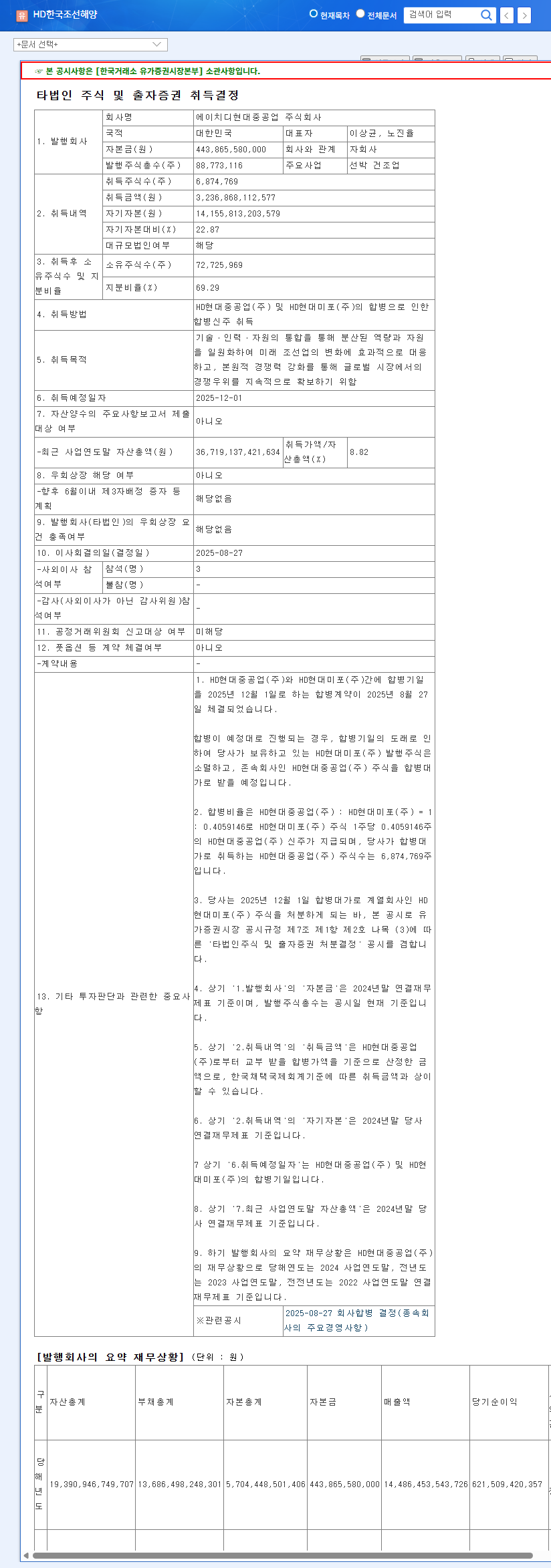

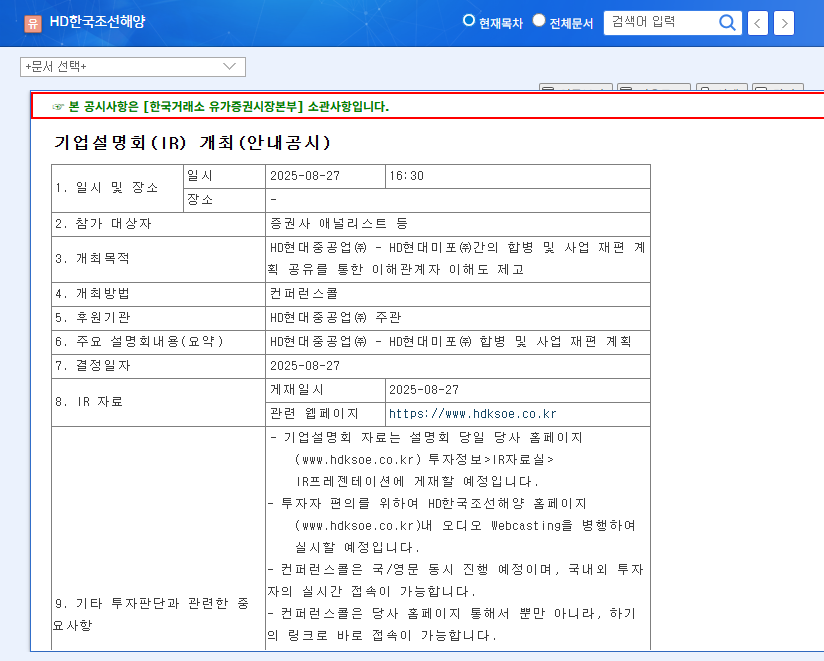

1. What Happened? The HDSK and HD HHI Merger

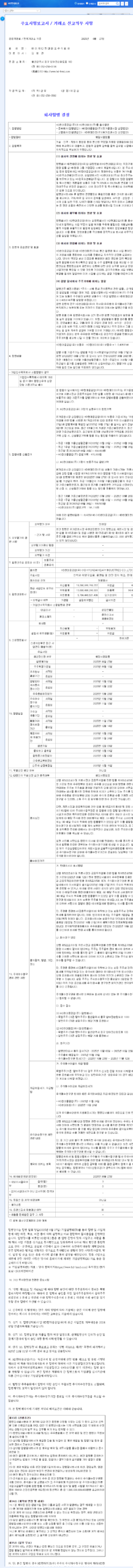

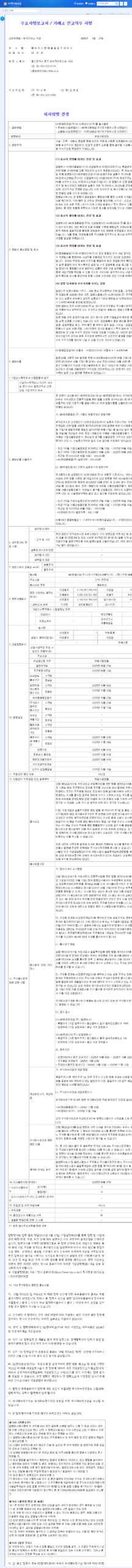

HDSK is set to acquire a 69.29% stake in HD HHI and HD Hyundai Mipo Dockyard through a merger. Scheduled for December 1, 2025, this substantial investment is valued at approximately ₩32 trillion.

2. Why Merge? Synergy and Enhanced Competitiveness

The core objective of this merger is to create synergy by integrating technology, workforce, and resources. By leveraging synergies across shipbuilding, offshore plants, engine machinery, and green energy, the combined entity aims to bolster its global competitiveness and drive overall group growth.

3. What’s Next? Positive Outlook and Potential Risks

- Positive Impacts:

- Enhanced synergy and competitiveness across business segments

- Increased operational efficiency and cost reduction

- Maximized group synergy and new business development

- Improved financial stability and soundness

- Potential Risks:

- Uncertainties in the merger process and potential unforeseen issues

- Integration costs and potential delays in realizing synergy effects

- Financial impact of exchange rate and interest rate fluctuations (KRW/USD exchange rate at 1,395, US interest rate at 4.50%, Korean interest rate at 2.50%)

4. What Should Investors Do? Action Plan

- Maintain a positive outlook from a long-term perspective

- Closely monitor merger progress and the realization of synergy effects

- Pay continuous attention to exchange rate fluctuations and global economic conditions

- Monitor efforts to secure new growth engines, such as green energy and hydrogen businesses

Frequently Asked Questions

What is the outlook for HDSK’s stock price after the merger?

While a positive long-term outlook is expected, volatility may occur due to uncertainties in the merger process and external factors. Continuous monitoring is essential.

When can we expect to see synergy effects from the merger?

Synergy is expected to emerge gradually after the merger’s completion and integration process. Potential short-term financial burdens should also be considered.

What are the key considerations for investors?

Investors should consider various factors, including merger progress, synergy realization, and exchange rate/interest rate fluctuations, before making investment decisions. This report is not investment advice, and investment decisions are the sole responsibility of the investor.