1. Mind AI Wins $7.5M Contract: What Happened?

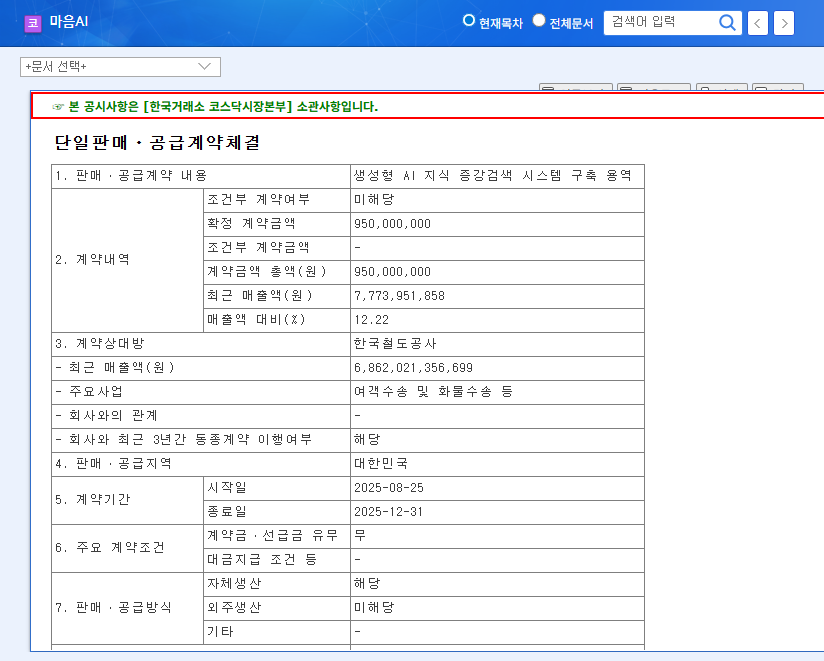

Mind AI has been awarded a contract to build a generative AI-powered knowledge augmentation search system for Korea Railroad. The contract is worth $7.5 million, representing 12.22% of Mind AI’s revenue in the first half of 2023. The contract period is set for four months.

2. Why is This Deal Important? What’s the Impact on Mind AI?

This contract is expected to have several positive impacts on Mind AI:

- • Short-term Revenue Growth: The $7.5 million deal will directly contribute to Mind AI’s short-term revenue growth.

- • Enhanced Credibility: Securing a contract with a public institution like Korea Railroad enhances Mind AI’s credibility and technology validation, potentially leading to future contracts.

- • AI Technology Validation: Winning a large-scale public project serves as a strong example of Mind AI’s capabilities in building AI systems.

However, there are also some caveats to consider:

- • Short Contract Duration: The four-month contract period raises questions about long-term revenue stability.

- • Profitability Concerns: This deal alone may not be enough to address Mind AI’s underlying profitability challenges.

- • Intense Market Competition: Given the increasing competition in the AI market, securing further large-scale contracts is crucial for sustained growth.

3. What Should Investors Do? Action Plan

Investors should consider both the positives of this deal and the challenges faced by Mind AI. Future stock performance will be influenced by factors such as additional contract wins, profitability improvements, and successful commercialization of core technologies. Therefore, it’s crucial to assess Mind AI’s long-term growth potential objectively and make investment decisions accordingly, rather than reacting to short-term stock fluctuations.

Frequently Asked Questions

What is Mind AI?

Mind AI is an artificial intelligence (AI) solutions company developing three foundation models: language, voice, and vision-language-action.

What is the value of this contract?

$7.5 million USD.

Will this contract only have positive impacts on Mind AI?

While there are positive aspects, there are also some potential downsides to consider, such as the short contract duration and profitability concerns.