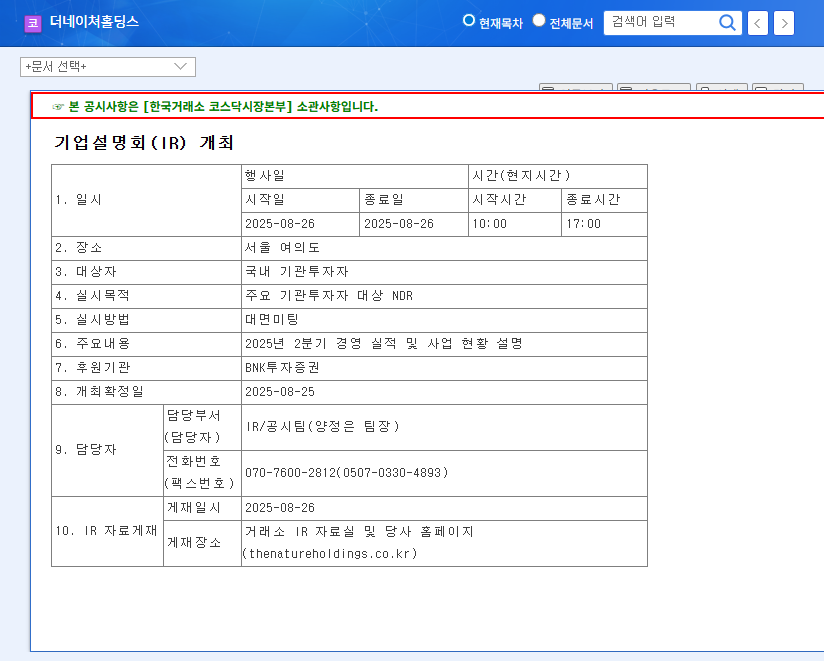

1. What Happened at The Nature Holdings’ Q2 2025 Earnings Call?

The Nature Holdings presented its Q2 2025 earnings and business performance to institutional investors. Key highlights included National Geographic’s expansion in Greater China, Barrel’s strong performance in watersports/athleisure, the acquisition of Deus Ex Machina, and the expansion of the Brompton business. The company also shared its plans for diversification into the financial sector.

2. Why Should Investors Pay Attention?

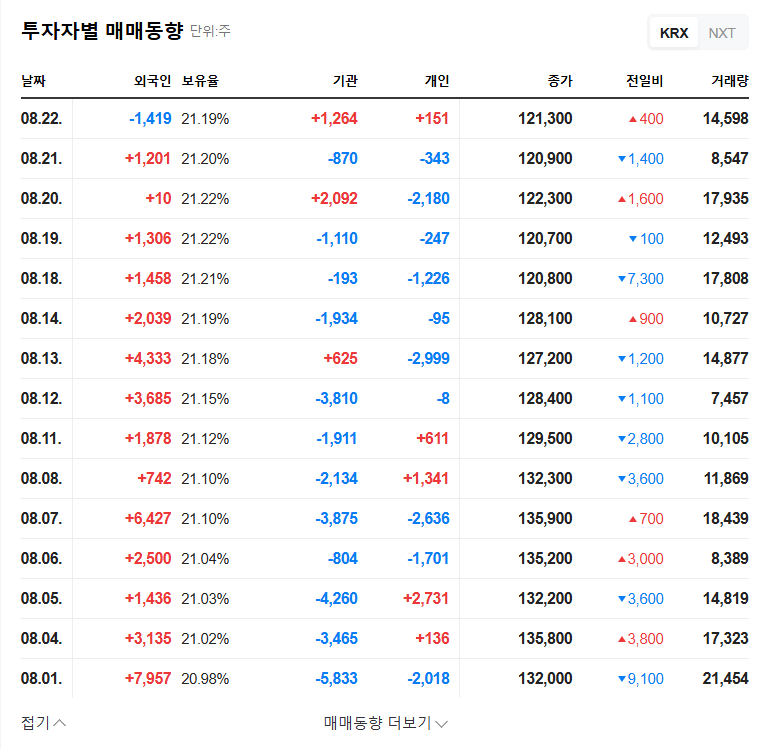

Positive Factors: National Geographic’s global growth, Barrel’s robust earnings, new brand acquisitions and business expansions, entry into the financial sector, solid financials, and shareholder return policy are attractive to investors. However, there are also concerns: Intense competition in the fashion industry, high inventory levels, debt and interest burdens, exchange rate volatility, financial asset/liability valuation volatility, and delays in improving dividend-related articles of incorporation require careful consideration.

3. What Should Investors Do?

Investors should compare the earnings call information with market expectations and carefully examine the feasibility of the growth strategies and financial risk management plans. Changes in the macroeconomic environment (interest rates, exchange rates, commodity prices, etc.) are also important factors for investment decisions.

4. Investor Action Plan

- Be mindful of short-term stock price volatility and make investment decisions from a long-term perspective.

- Continuously monitor the company’s fundamentals by referring to IR materials, related news, and analysis reports.

- Develop an investment strategy considering your investment objectives and risk tolerance.

Frequently Asked Questions

What are The Nature Holdings’ main brands?

National Geographic Apparel, Barrel, Deus Ex Machina, and Brompton.

What were the key highlights of the Q2 2025 earnings?

Barrel achieved record operating profit, and National Geographic expanded into the Greater China market.

What should investors be aware of?

Consider financial risks such as high inventory levels, debt, and exchange rate volatility, as well as intense competition within the fashion industry.