What Happened? TLB Designated as Investment Warning Stock

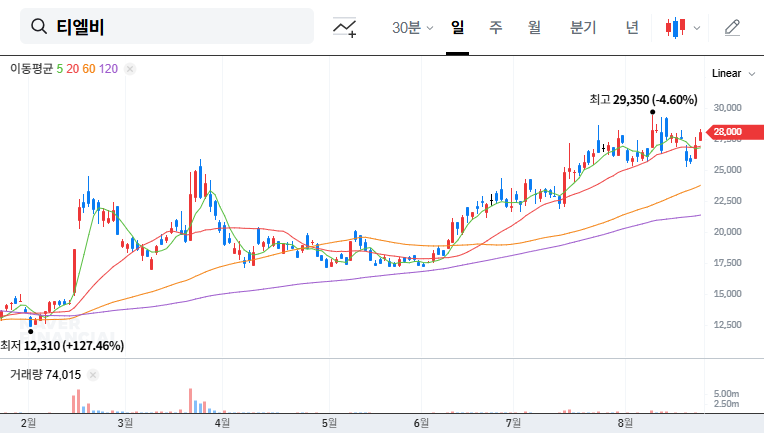

On September 16, 2025, TLB (356860) was designated as an investment warning stock by the Korea Exchange. The recent surge in stock price is the background, and investors’ caution is required.

Why is TLB attracting attention? Fundamental Analysis

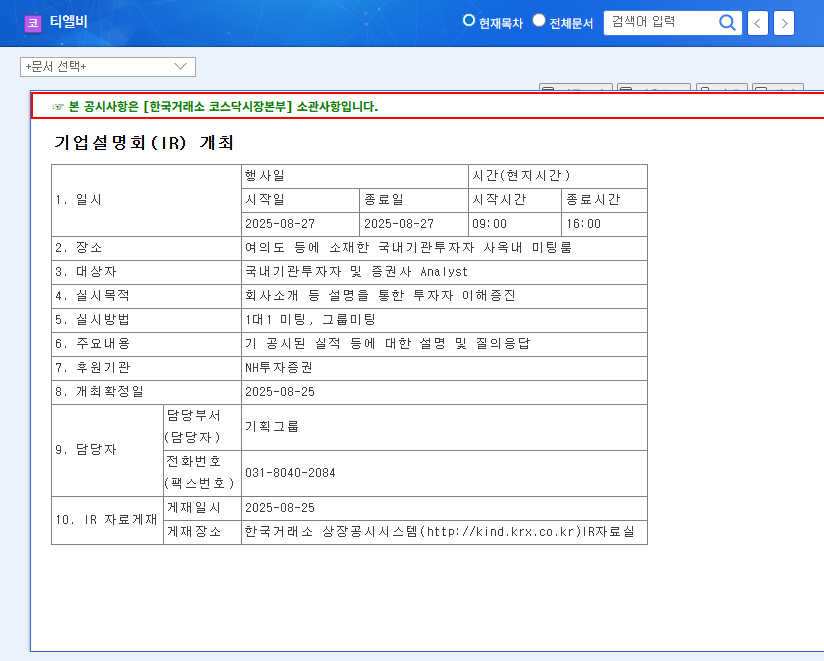

TLB showed remarkable improvement in earnings in the first half of 2025. The growth of the memory semiconductor market, the increase in the operation rate of the Vietnam plant, and the strengthening of technological competitiveness are the main reasons. Sales increased by 19.5% year-on-year to KRW 117 billion, and both operating profit and net profit turned to black. In particular, continuous R&D investment in next-generation memory technologies such as CXL and SOCAMM is attracting attention as a future growth engine.

Investment warning, What’s the Impact?

The designation of an investment warning stock can increase stock price volatility in the short term and lead to profit-taking by investors. However, the key is whether TLB’s solid fundamentals and growth momentum can offset these short-term negative factors.

What’s the future of TLB? Investment Strategy

While the investment warning designation is a short-term risk factor, TLB’s mid-to-long-term growth potential remains valid. Considering positive factors such as the growth of the memory semiconductor market, development of next-generation technologies, and securing a production base in Vietnam, investment can be considered from a long-term perspective. However, it is important to continuously monitor the stock price trend after the investment warning is lifted, the progress of new businesses, and macroeconomic indicators.

Frequently Asked Questions (FAQ)

What is TLB’s main business?

TLB is a semiconductor-related company that develops PCBs for semiconductor post-processing inspection equipment, SSD PCBs, and stacked via technology.

What does the investment warning designation mean?

It is designated by the Korea Exchange to alert investors when the stock price rises sharply in a short period.

What should I be aware of when investing in TLB?

Consider the possibility of short-term stock price volatility, global macroeconomic uncertainty, and financial soundness.

What is the future outlook for TLB?

Volatility is expected in the short term, but in the mid-to-long term, it is expected to continue its growth based on positive fundamentals.