Yellow Balloon Convertible Bond Exercise Analysis

1. What Happened?

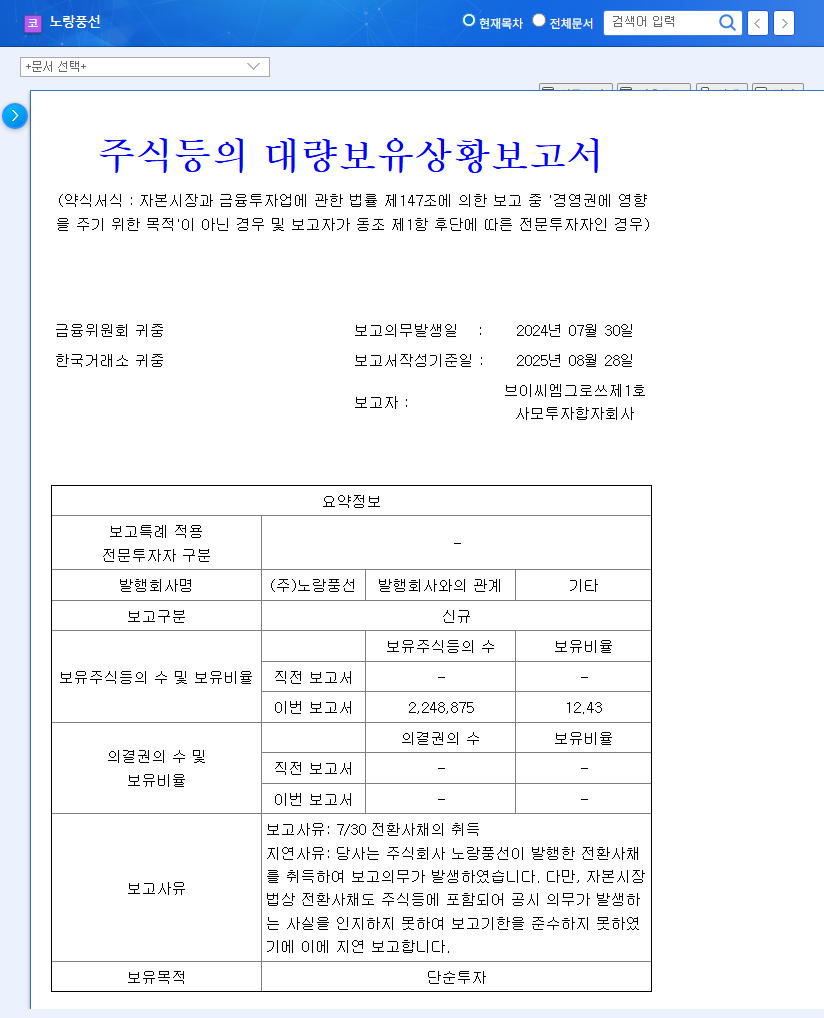

Yellow Balloon exercised its 3rd round of convertible bonds, with 193,685 shares (1.17% of market capitalization) scheduled to be listed on September 18, 2025. The conversion price is ₩5,163, resulting in approximately ₩1 billion in funding.

2. Why Is It Important?

This convertible bond exercise will impact Yellow Balloon’s capital increase and financial structure improvement. The influx of approximately ₩1 billion is expected to improve short-term liquidity and contribute to lowering the debt-to-equity ratio. However, the potential dilution of stock value due to new share issuance and the still high debt-to-equity ratio are important factors to consider when investing.

3. So What?

- Positive Aspects: Capital increase, debt-to-equity ratio improvement, increased liquidity, current stock price higher than conversion price

- Negative Aspects: Potential stock dilution, continued operating losses, high financial leverage, external environment volatility (exchange rates, oil prices, interest rates)

While the convertible bond exercise itself is positive for improving the financial structure, stock price increases may be difficult to expect without fundamental improvements in profitability. Furthermore, macroeconomic uncertainty and intensified competition remain ongoing risk factors.

4. What Should Investors Do?

Before making investment decisions, carefully consider the following:

- Possibility of turning operating profit to black

- Performance and revenue contribution of new businesses

- Additional self-rescue measures to strengthen financial soundness

- Ability to manage external variables (exchange rates, oil prices, interest rates)

- Stock price volatility after conversion

It’s crucial to analyze the company’s fundamentals and growth potential from a long-term perspective rather than focusing on short-term stock fluctuations.

FAQ

What are convertible bonds?

Convertible bonds are issued as debt but give the bondholder the option to convert them into shares of the issuing company’s stock after a certain period.

Why can the exercise of convertible bonds negatively affect the stock price?

When new shares are issued due to the exercise of convertible bonds, the value of existing shares can be diluted. This means that the value per share may decrease as the number of shares increases.

What are the investment risks for Yellow Balloon?

Key investment risks for Yellow Balloon include continued operating losses, high debt-to-equity ratio, exchange rate and oil price volatility, and rising interest rates.