1. MK Electron’s KRW 10.7 Billion Treasury Stock Disposal: What’s Happening?

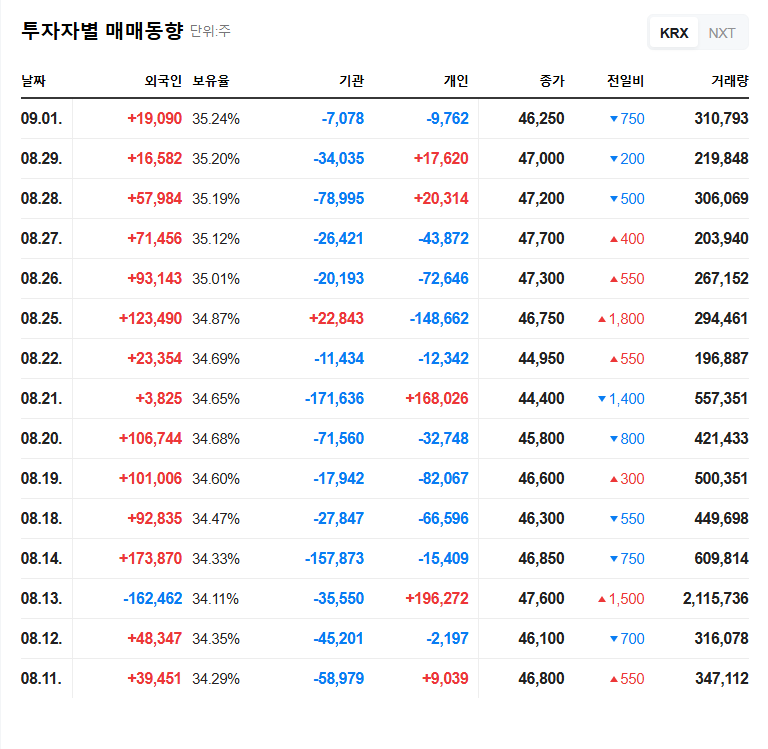

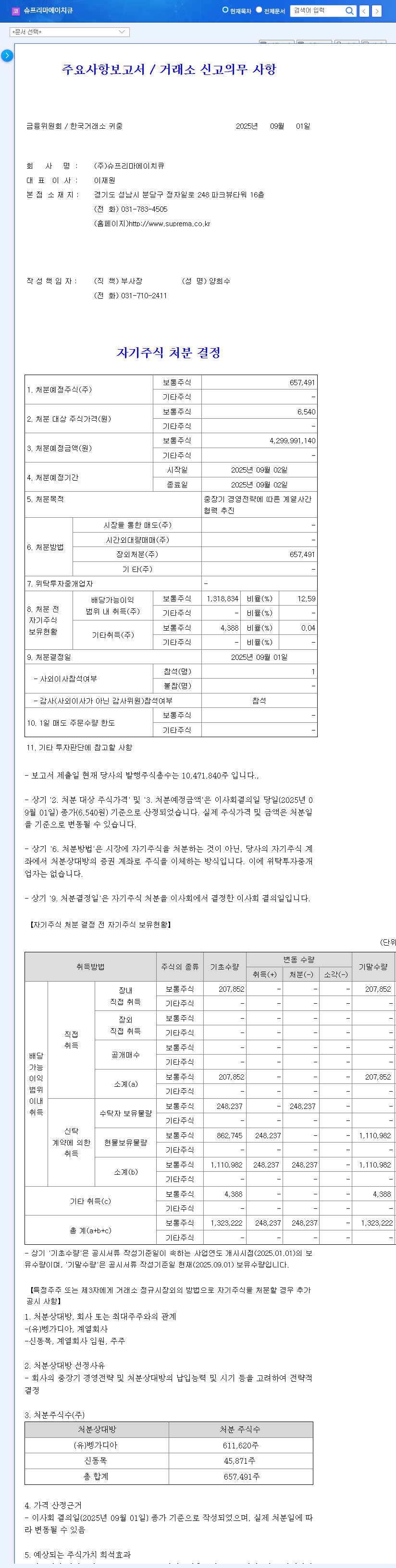

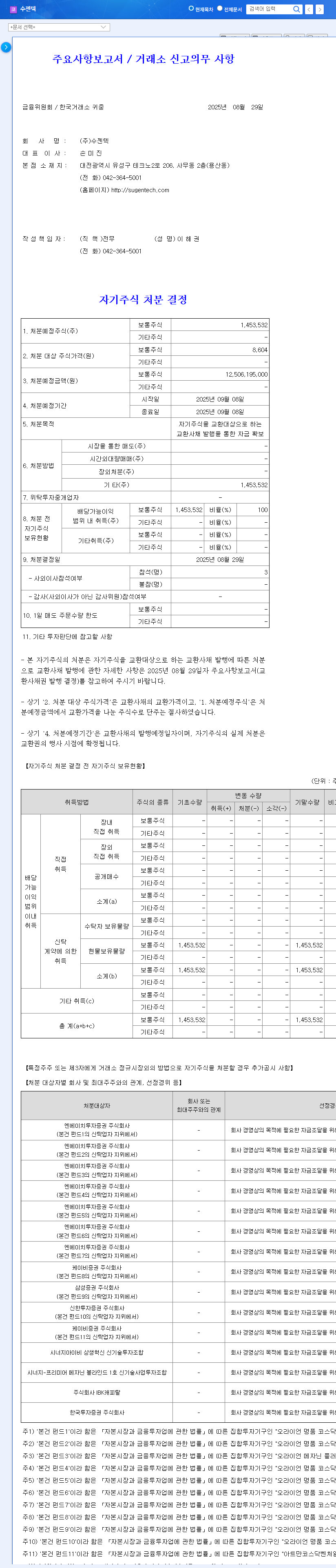

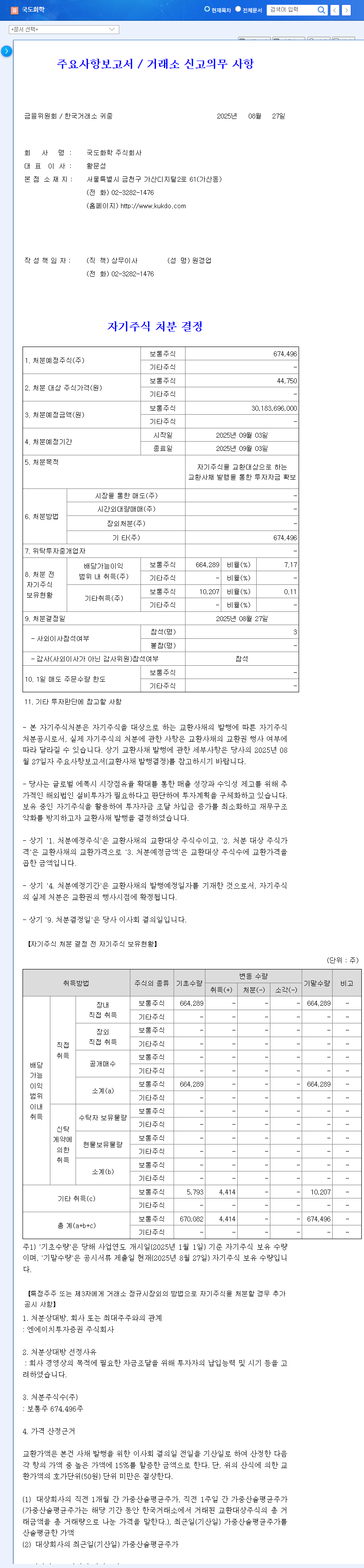

On September 2, 2025, MK Electron announced its decision to dispose of 1,162,805 shares of treasury stock, equivalent to approximately KRW 10.7 billion. The purpose is to raise funds through the issuance of private exchangeable bonds and improve its financial structure.

2. Why the Treasury Stock Disposal?

The aim is to raise capital and improve financial health through the issuance of private exchangeable bonds. The funds are expected to be utilized for securing new growth engines, strengthening financial soundness, and expanding R&D investments.

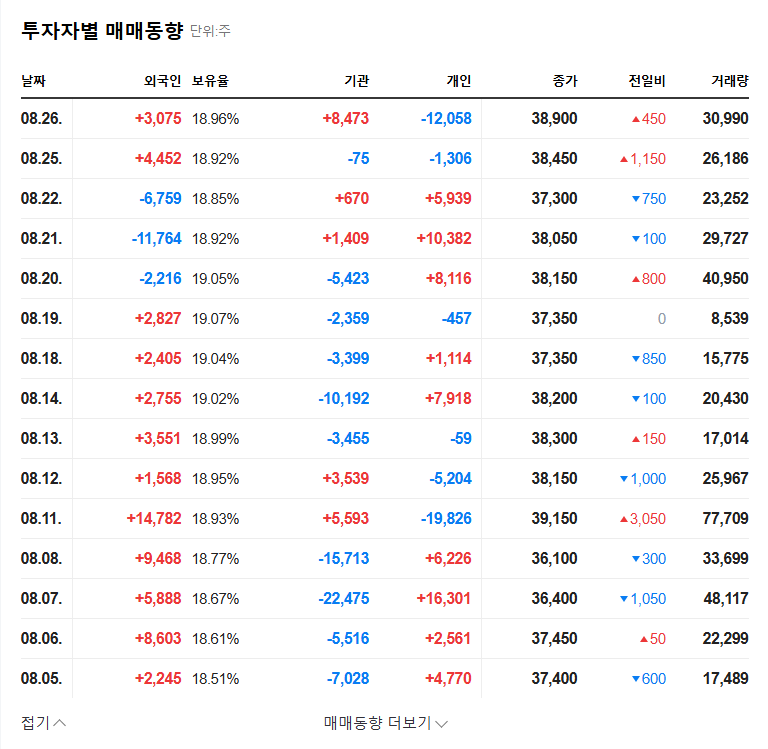

3. What’s the Impact on Stock Price? Investor Action Plan

- Short-term impact: Dilution effects due to increased outstanding shares are possible, but the clear fundraising purpose suggests limited volatility.

- Long-term impact: Efficient use of the funds can contribute to increased corporate value.

- Investor action plan: Carefully consider the planned use of funds, dilution effects, and market conditions before making investment decisions. Closely monitor the performance of their new business, especially secondary battery materials, and the improvement of their financial soundness.

4. Assessing MK Electron’s Fundamentals

- Positive factors: No. 1 global market share in bonding wire, securing new growth engines (secondary battery materials, etc.), technological competitiveness, strengthened ESG management.

- Considerations: Fluctuations in sales and profitability, high debt-to-equity ratio, negative operating cash flow, macroeconomic uncertainty.

5. Market and Economic Outlook

While the outlook for the semiconductor and secondary battery markets is positive, volatility in interest rates, exchange rates, and raw material prices pose risks.

Frequently Asked Questions (FAQ)

What is the purpose of MK Electron’s treasury stock disposal?

The purpose is to raise funds through the issuance of private exchangeable bonds and improve the company’s financial structure.

How will the treasury stock disposal affect the stock price?

In the short term, there may be dilution effects due to the increase in outstanding shares. However, the long-term impact will depend on how the raised funds are utilized, which could positively or negatively affect the stock price.

What are the key investment points for MK Electron?

Key investment points include their leading global market share in bonding wire and securing new growth engines like secondary battery materials. However, investors should also consider the risks related to financial soundness and macroeconomic changes.