HB Investment IR Key Analysis

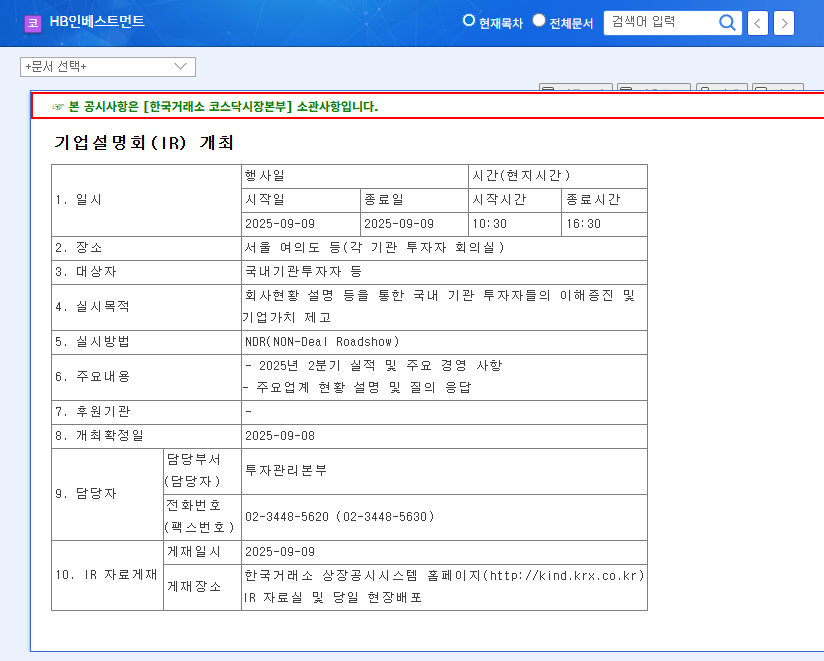

HB Investment presented its Q2 2025 earnings, key management updates, and industry overview at its IR meeting on September 9th. This IR garnered significant attention due to the company’s strong performance.

Q2 Earnings Surge: What Drove the Growth?

- Operating Revenue up 29.31%: Driven by increased management and performance fees from funds.

- Operating Profit up 125.89%: Attributable to higher operating revenue and the reversal of equity method losses.

- Net Income up 99.95%

This positive performance demonstrates the recovery of the venture capital market and the company’s strong fund management capabilities.

HB Investment’s Investment Strategy and Future Outlook

The IR also outlined strategies for future growth. HB Investment plans to leverage its consistent fundraising capabilities to focus on identifying promising investment opportunities. The company is expected to pursue continuous growth through diversification of its revenue streams.

Key Takeaways for Investors

- Core Competencies: Strong fundraising capabilities, robust financial health, differentiated investment strategy.

- Potential Risks: Market volatility, foreign exchange fluctuations.

- Future Outlook: Mid- to long-term growth targets and vision.

Before making investment decisions, thoroughly review the IR materials and disclosed information, while remaining mindful of changing market conditions.

Frequently Asked Questions

What are HB Investment’s main investment sectors?

HB Investment primarily invests in venture companies, focusing on high-growth potential sectors such as IT, biotechnology, and consumer goods.

What were HB Investment’s key financial results for Q2 2025?

HB Investment reported operating revenue of KRW 8.947 billion, operating profit of KRW 4.292 billion, and net income of KRW 3.688 billion for Q2 2025. These represent year-over-year increases of 29.31%, 125.89%, and 99.95%, respectively.

What is HB Investment’s future investment strategy?

HB Investment plans to focus on identifying promising investments and diversifying its revenue streams to achieve sustainable growth.