What Happened? The Samdasu Distribution Rights Renewal

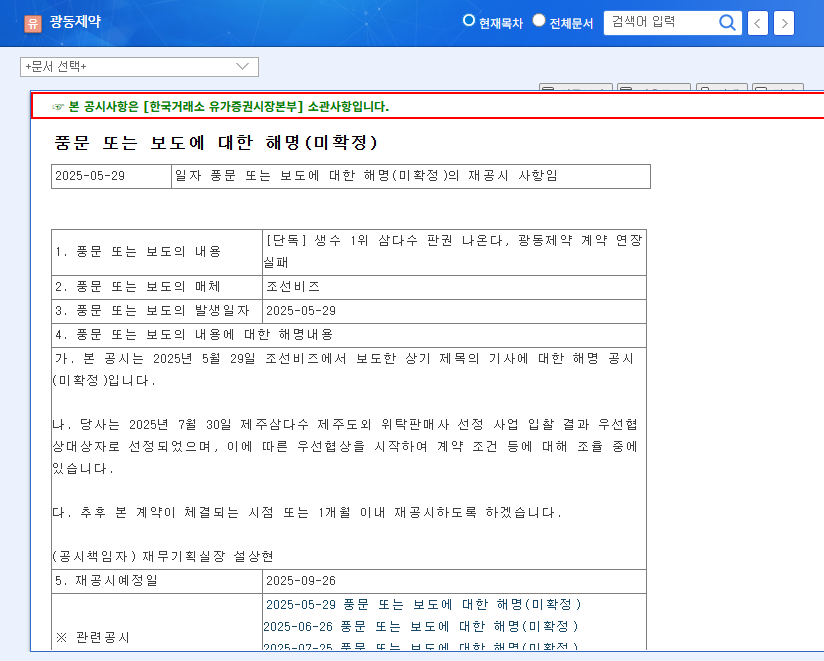

With the expiration of Kwangdong Pharmaceutical’s current contract for Samdasu water distribution rights approaching, uncertainties surrounding the renewal have emerged. Kwangdong has addressed these concerns by announcing its selection as the preferred bidder and its ongoing negotiations. However, the final agreement remains subject to variables, keeping investors on high alert.

Why Does This Matter? The Importance of Samdasu

Samdasu water represents a significant portion of Kwangdong Pharmaceutical’s F&B revenue. Consequently, the renewal of distribution rights has a direct impact on the company’s performance. Successful renewal ensures stable revenue streams, while failure could significantly impact the F&B sector.

What’s Next for Kwangdong Pharmaceutical?

Beyond Samdasu, Kwangdong boasts a robust brand portfolio including Vita500. The company is also focused on strengthening its ethical drug pipeline and venturing into new businesses for long-term growth. However, the recent decline in operating profit requires attention and improvement. Furthermore, macroeconomic uncertainties pose potential risks.

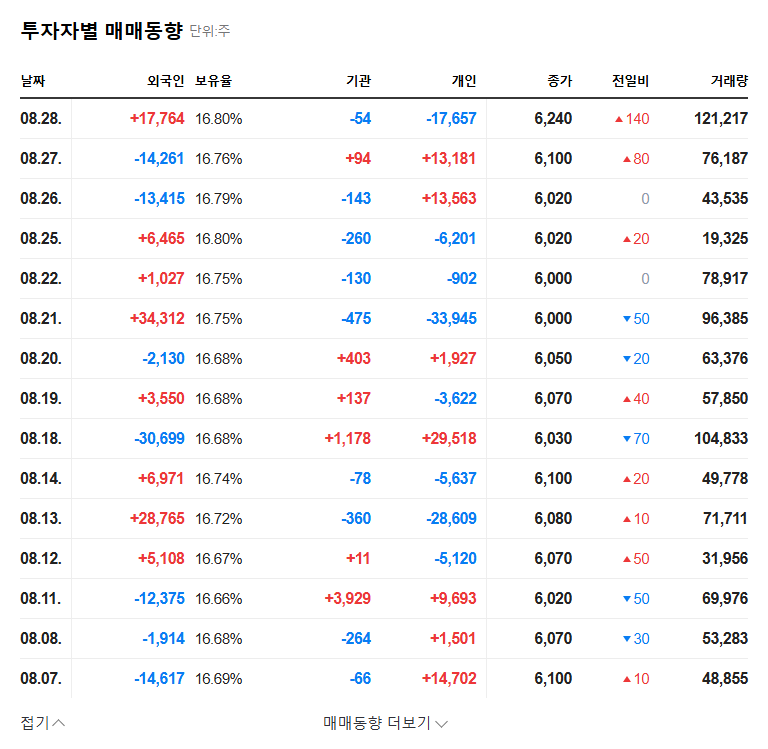

What Should Investors Do?

In the short term, investors should monitor the upcoming official announcements regarding the Samdasu contract renewal and track the trend of operating profit improvement. In the long term, focus should be on Kwangdong’s diversification strategy to reduce reliance on Samdasu and the performance of its new pipelines. Investment decisions should be made carefully, considering all these factors.

What are Kwangdong Pharmaceutical’s main businesses?

Kwangdong Pharmaceutical’s core businesses are F&B (Food and Beverage), including beverages and food products, and pharmaceuticals. Beverage sales, particularly Samdasu water, contribute significantly to the company’s overall revenue.

Why is the Samdasu distribution rights contract so important?

Samdasu water is a key product in Kwangdong’s F&B segment. The renewal of the distribution contract significantly impacts the company’s financial performance. Successful renewal secures stable revenue, while failure could lead to a decline in sales.

What is the outlook for Kwangdong Pharmaceutical?

The renewal of the Samdasu contract, operating profit improvement, and the success of new business ventures will influence Kwangdong Pharmaceutical’s future outlook. Investors should closely monitor relevant information and make informed investment decisions.